Bitcoin (BTC) closed the daily candle with a robust 7.5% gain, signaling strong bullish momentum.

Let’s examine why the $60,000 price has been a crucial entry point for investors and traders.

Bitcoin Price Analysis: Breaking Down Key Technical Indicators

The price is currently navigating within the daily Ichimoku Cloud, a critical technical indicator of market sentiment. A breakout above the cloud’s upper boundary would signify a potential continuation of the upward trend.

Conversely, the cloud’s lower boundary around $62,000 and the 0.618 Fibonacci retracement level at $60,135 provide strong support levels.

The chart shows that the price has tested the $60,000 level multiple times, establishing it as a strong support. Let’s explore the reasons behind this.

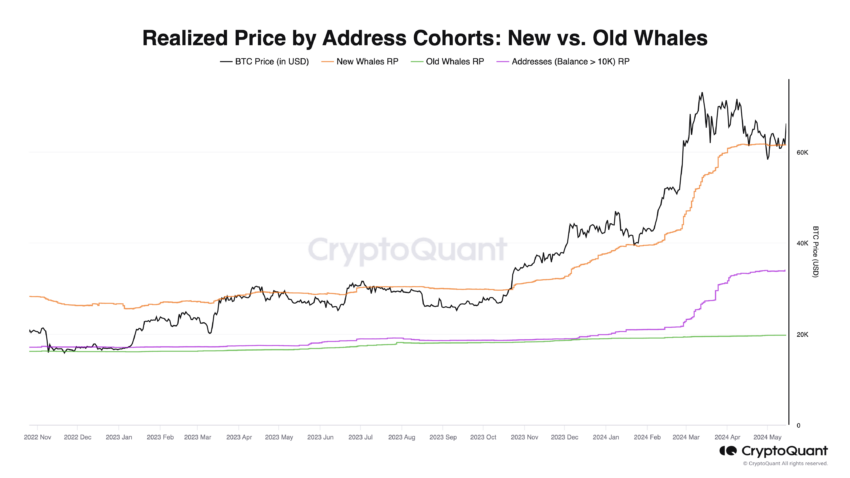

Realized Price by Address Cohorts: New vs. Old Whales:

- New Whales’ Realized Price: New whales—addresses holding over 1,000 BTC with a coin detention time of less than 6 months—have been significantly accumulating Bitcoin around the $60,000 mark. This buying activity is crucial, solidifying $60,000 as a major support level. The continuous accumulation at this price demonstrates strong confidence among new whales, reinforcing the support level for Bitcoin’s price. The average acquisition price, or realized price, of these new whales, indicates that each Bitcoin they have bought was, on average, acquired at $60,000.

- Old Whales’ Realized Price: Long-term whales, holding more than 1,000 BTC for over 6 months, have a stable realized price. This stability reflects their confidence and lower turnover, suggesting a strategic long-term investment approach.

Read More: Who Owns the Most Bitcoin in 2024?

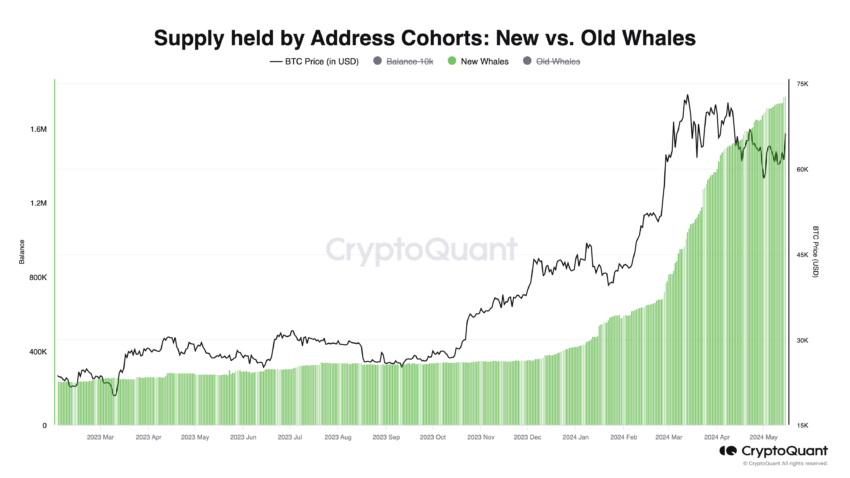

Supply Held by New Bitcoin Whales:

- Accumulation Trend: The graph shows a sustained increase in the supply held by new whales. Indicating their active accumulation over the past month. This trend aligns with significant price increases, suggesting a correlation between their buying activity and upward price momentum.

- Market Confidence: New whales consistently accumulate, even during price corrections. This underscores their bullish outlook and reinforces $60,000 as a critical support level. This behavior indicates that new whales view current levels as attractive entry points, contributing to market stability and potential upward movement.

Bitcoin’s upward momentum is strongly supported by the aggressive rise in supply held by new whales. A cohort of large holders who have significantly increased their accumulation. This trend is evident as the realized price for these new whales is a major support level.

Bitcoin consistently marks $60,000 as a critical threshold. Each time Bitcoin hits this price, new whales step in to accumulate, reinforcing $60,000 as a robust support level and underpinning Bitcoin’s continued rise.

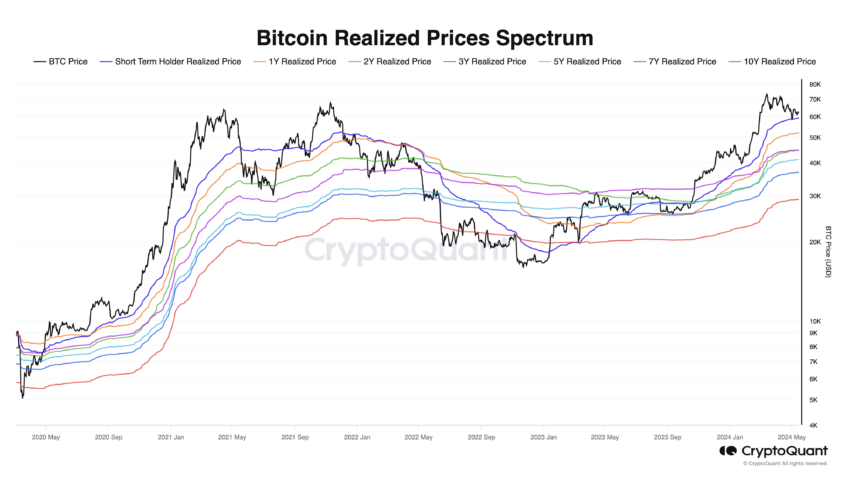

Bitcoin Realized Prices Spectrum

The realized price spectrum is a crucial tool for navigating bull markets. Providing insights into average acquisition prices across different holder cohorts. The short-term holders’ realized price, representing the average acquisition price for short-term holders, is acting as a support level, effectively timing market lows during this bull market.

The realized price spectrum helps monitor Bitcoin’s risk during market cycles. Currently, Bitcoin’s price is trading above all realized prices in the spectrum, which is a bullish signal indicative of a strong upward trend.

This positioning highlights market confidence and potential for further gains.

Read more: Bitcoin Price Prediction 2024/2025/2030

Strategic Recommendations Amid Bitcoin’s Influence

- Bullish Outlook: The outlook for Bitcoin remains bullish. This assessment is based on recent price movements and the underlying support levels formed by new whale accumulations.

- Conditional Support at $60,000: Bitcoin has strong conditional support at the $60,000 level. This support is primarily due to new whales, who have been consistently accumulating Bitcoin at this price point, reinforcing it as a significant threshold.

- Price Projections and Recommendations: If Bitcoin breaks above the daily Ichimoku Cloud, we could see prices reach the $78,000 to $80,000 range in the mid-term. However, this bullish projection is contingent upon several factors: – Continued accumulation of new whales.

– Miners refrain from selling off their holdings, as they are currently profitable.

– Absence of adverse macroeconomic or geopolitical events that could disrupt the bullish momentum.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.