Bitcoin price has formed a new all-time high, crossing into the $71,000 zone. The rally, however, is still ongoing at the time of writing.

In six days, the world’s biggest cryptocurrency has gained over 40% to trade at $71,000 at the time of writing. BTC is now close to breaching the $72,000 level.

Bitcoin Defies Bearishness

Bitcoin price noted a pullback about a week ago, but BTC holders’ optimism about the cryptocurrency has prevented any considerable decline. BTC price topped $69,000 in March and corrected the next day to fall back to $63,724.

This induced panic among the investors, who immediately jumped to sell their holdings to secure profits. This led to the crucial investors – the whales- selling their BTC.

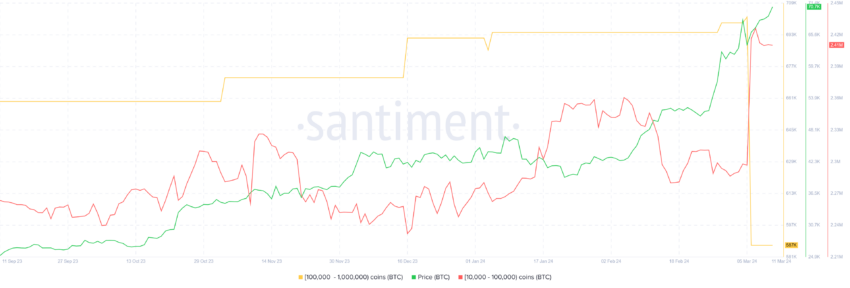

In the span of a day, over 115,000 BTC worth more than $8.13 billion were sold by the addresses holding between 100,000 to 1 million BTC, which were picked up by retail investors right after.

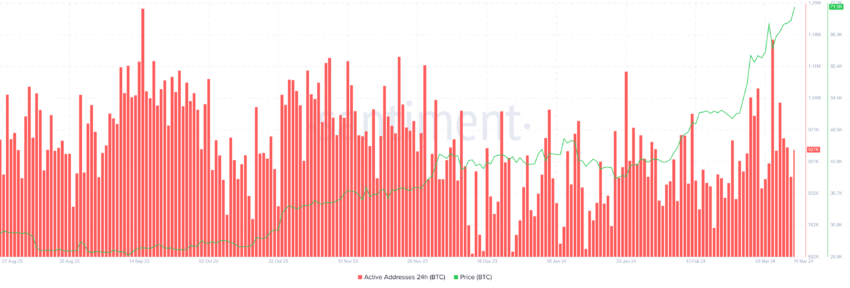

This support from investors was short-lived, however, as these investors’ optimism scaled back soon after. The decline in the active addresses can observe the same. Addresses conducting a transaction have 953,000 to 921,000.

Nevertheless, Bitcoin marched undeterred over the past few days to reclaim an important price level as a support floor. However, the cryptocurrency might soon witness some correction given the recent surge, which caused a saturation in the bullishness.

BTC Price Prediction: Market-Wide Selling Could Erase Gains

Bitcoin price is presently holding on to optimism, but once selling occurs, this cryptocurrency will witness correction. The peak of the MVRV Ratio evinces this.

The Market Value to Realized Value (MVRV) ratio indicates the average profit or loss of investors who have acquired an asset. Specifically, the 30-day MVRV ratio assesses the average profit or loss of investors who obtained an asset within the previous month.

In the case of Bitcoin, the 30-day MVRV currently stands at 16.26%, indicating that investors who purchased BTC in the last month are experiencing a 16.26% profit. This situation often prompts these investors to consider selling their holdings to capitalize on their gains, potentially leading to a sell-off.

Historical data illustrates that when the MVRV reaches the range of 11% to 21%, Bitcoin tends to undergo significant corrections. Hence, this range is often termed as a “danger zone.”

Thus, selling is highly likely right now, which could naturally impact Bitcoin’s price. Testing the $72,000 resistance level, BTC is attempting to breach it at the time of writing. However, a failed breach combined with selling will likely result in BTC falling back down.

The cryptocurrency could slide back down $70,000, losing, sending it to $63,724.

However, if the investors show resilience and the $72,000 price level is successfully breached and flipped into support, BTC could continue to rise, invalidating the bearish thesis.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.