Bitcoin mining might not be the great evil we have been led to believe it is, says Daniel Batten.

Since the China-ban, the Bitcoin Mining council reports a significant rise in the use of renewable energy. In some quarters, they have been questioned due to the fact it relies on self-reported data.

To avoid this criticism, I decided to do an independent analysis based on publicly available information, statistics and news reports to confirm the impact on the amount of the Bitcoin network using renewable energy.

Where there is uncertainty, I assumed a worst-case scenario (ie: I assumed in the direction of greater fossil fuel use). This means the finding of a 10.9% increase in renewable energy usage throughout the Bitcoin network is a minimum increase.

Bitcoin mining: Flawed reporting

Before we dig into the weeds, how did reports that it had got less green (widely reported in NY Times among other places) get it so wrong?

In summary: they relied on a single study, which contained serious flaws, the main ones being

1. Incorrect analysis of both the net hashpower change and the renewable-energy mix pre and post-ban in China

2. Failure to factor in the 47x reduction of mining in Iran (98% non-renewable grid) combined with the 4x growth of mining in Canada (67% renewable grid)

The study also relied heavily on one piece of information that was accurate at the time, but has since changed:

3. Miner migration to Kazakhstan

Bitcoin Mining: Analysis

1. The China mining “ban” was effectively only a fossil-fuel power ban

As a nation, China is now the world’s biggest contributor to green Bitcoin mining.

How do we know that?

Firstly:

Global hashrate from China is still over 20% according to 2 separate sources (China’s own cybersecurity Qihoo360 and Cambridge University which estimates 21.1% of mining still happens in China as of Jan 2022.

One source who wished to remain unnamed, an owner of a China-based Bitcoin mining operation, confirmed:

“Bitcoin mining in China using hydro and solar is widespread. But if you try to mine Bitcoin using coal, you’ll be crushed because of the Central Govt’s emission targets. What the ban in China has done is eliminate all coal-based Bitcoin mining in China which was happening for 9 months of the year.”

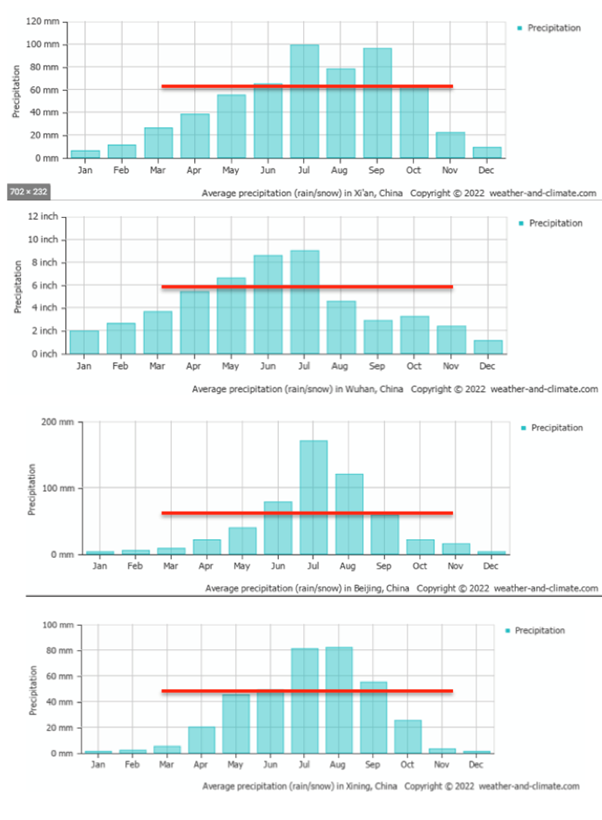

Secondly: 9 months of the year? Yes that’s right. 9 months.

Many people assume that mining companies in China used to use hydro for 6 months of the year, coal for the other 6 months.

However, this is not accurate. Cheap hydro energy was only used by Bitcoin mining companies during the wet summer months: a period where sudden large rainfall causes more generation capacity than hydro-stations can find customers for, causing them to curtail energy. Bitcoin miners would use this energy only when it would otherwise have been curtailed (wasted).

Here are the charts where we see that across various regions of China, a consistent pattern of very high rainfall for a period of around 3 months.

Because China had almost half of the Bitcoin network by hashpower pre-ban, that coal-based energy was making the entire Bitcoin network >30% more fossil-fuel based.

The displacement of that massive amount of coal-based Bitcoin mining, chiefly to the US and Canada, has decarbonized the Bitcoin network by a non-trivial amount.

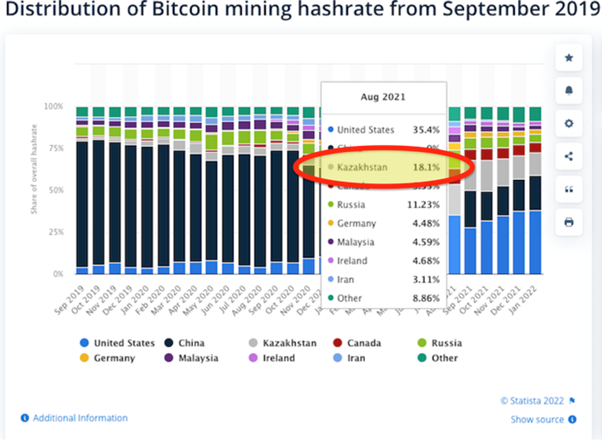

But didn’t a lot of it go to Kazakhstan too? Yes initially, but it didn’t stay there. That brings us to our next point.

2. Kazakhstan has not ended up being the big factor most people imagine

It’s important to calculate Kazakh hashrate, because 99% of their grid is fossil fuel based. So a permanent mass-relocation to Kazakhstan would indeed have had a non-trivial impact on how green Bitcoin mining was.

However, as of Aug 2022, Kazakhstan’s contribution to global hashrate is fast reducing to the level it was pre-ban.

Here’s why:

In March ’21, Kazakhstan represented 7.4% of global hashrate. It rose briefly to 18.1% in Aug ’21.

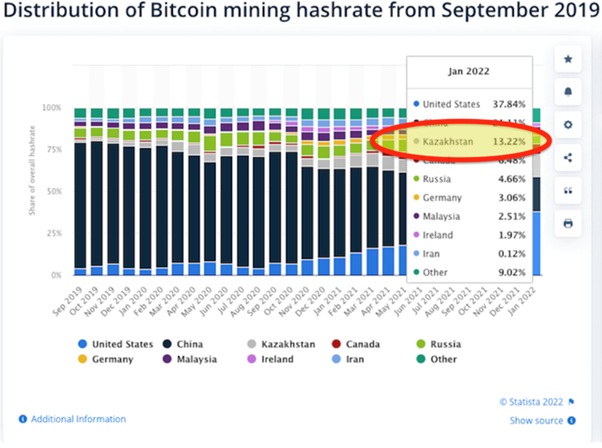

But had already reduced to 13.4% by Jan ’22.

Since then, I estimate that Kazakhstan hashrate has dropped another 3.8% minimum.

Here’s the logic behind that estimate:

Since Jan ’22, Kazakhstan has endured blackouts, a 1-2.5c/KWh tax on crypto-mining (enough to make many operations unprofitable), the seizing of 67,000 illegally mining machines, and the loss of 202 MW power in a single raid of 13 mining sites, followed by a second raid of 106 mining sites.

The first raid alone on 13 sites (202 MW power) would have reduced Kazakh hashrate by ~5.4 EH (2.5% of global hashrate) assuming 80% of the machines were the S19Pros.

Assuming that the second raid of 106 mining companies was in total only half the size of the initial 13 mining companies because they were targeting the “long tail,” then the total hashrate loss in these 2 raids would have been 3.8%, reducing the current Khazak hashrate to 9.6%, slightly more than the pre China-ban level.

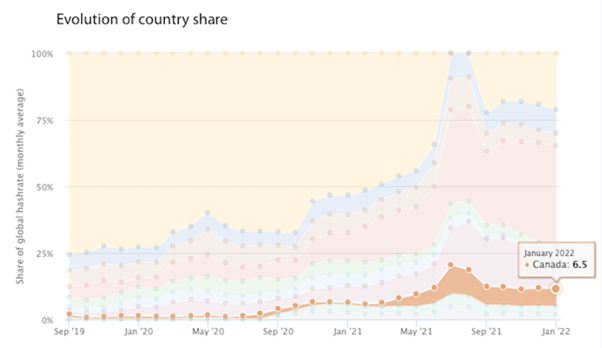

3. The explosion of Bitcoin mining in Canada; it’s decimation in Iran

Iran has a 98% fossil-fuel based grid. According to Cambridge University, almost all mining has now stopped. (Dropping from 4.7% in March ’21 to 0.1% by Jan ’22).

The loss of Bitcoin mining to Iran alone removes 4.5% of fossil fuel use from the Bitcoin network.

By contrast, over the same timeframe, Canada has significantly increased its contribution to global hashrate. From 1.6% in March ’21 to 6.5% by Jan ’22.

This is significant, because Canada uses 67% renewable energy. This increase of Bitcoin mining in Canada alone makes the Bitcoin network 3.3% more renewable.

Net greening due to changes in hashpower of Iran and Canada: +8.3%

When we factor in these plus the migration to the US and recalculate the overall renewable-energy mix, allowing for the fact that international, grid-based electricity is currently greening at a rate of approx. 0.7% per year globally, and the fact that there is more renewable-based off-grid Bitcoin mining than 18 months ago (Iris, Dame, Green Mining Capital to name a few), the overall Bitcoin network is at least 10.9% more renewable-based than before the China Mining ban.

Bitcoin Mining: Future Trends

The future looks positive for the further greening of the network, for three reasons.

1. Individual companies start pledging to go 100% carbon-neutral

Marathon, which could become the world’s largest Bitcoin mining company by hash rate by mid-2023 based on their current new ASICS purchase agreements, has pledged to move from 70% renewable to 100% renewable by end of 2022. With the volume of EH pledged by mid-2023 (23.3 EH/second), this would represent 10% of the network coming from a 100% renewable source, greening the entire network by a further 2.7%.

Importantly, Marathon has followed up on their pledge with action, ending their contract with their major (non-renewable) power supplier earlier this year.

2. Significant portion of new hashrate is carbon-negative or renewable-based

For example, I’m currently in contact with 20 new Bitcoin mining companies. Of these companies, 90% of them are either carbon-negative or 100% renewable-based (8 are carbon-negative, 10 are renewable-based).

3. Carbon-negative mining is increasing exponentially

We’ve gone from 1 to 12 Bitcoin mining companies that mitigate methane since the start of 2021. This is important because methane is 84x more warming than CO2 over a 20-year period. So removing methane from our atmosphere is the strongest action we can take to immediately curb climate change.

About the author

Daniel Batten is a ClimateTech investor, author, ESG analyst and environmental campaigner who previously founded and led his own tech company.

Got something to say about Bitcoin mining and the environment or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Trusted

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.