Concerns about Bitcoin mining centralization have resurfaced following a notable event involving AntPool, the second-largest BTC mining pool

On May 17, AntPool mined seven consecutive blocks between block heights 843,893 and 843,904 in one hour and thirty-eight minutes.

AntPool Mines 7 Consecutive Blocks

During this period, the mining pool confirmed over 20,000 transactions and earned 23 BTC—21.875 BTC in mining rewards and 1.283 BTC in fees.

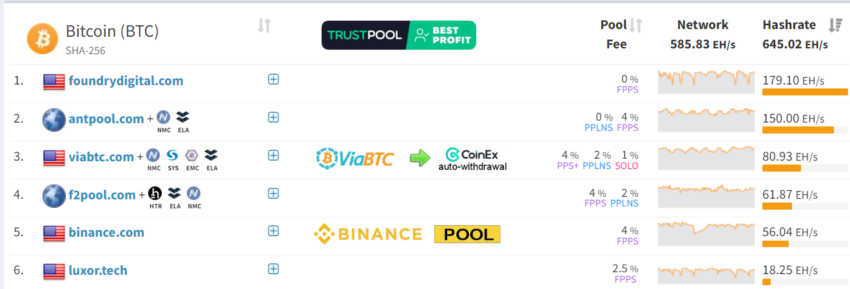

This impressive streak caught the crypto community’s attention, highlighting the prevalence of dominant pools like AntPool and Foundry USA. These two mining pools control over 50% of Bitcoin’s hashrate, raising centralization concerns.

For context, Foundry USA mined the block before AntPool’s streak and the two blocks immediately after, resulting in ten consecutive blocks mined by these two pools in one day.

Read more: Top Cryptocurrency Mining Pools To Join 2024

Bitcoin developer Luke Dashjr has previously warned about the risks posed by the dominance of large mining pools. He argues that such centralization threatens Bitcoin’s decentralized nature, potentially leading to censorship and control issues. Crypto analyst TOBTC also shared similar concerns.

“This centralization trend, driven by economies of scale, allows these pools to censor transactions, as seen with F2Pool’s compliance with OFAC sanctions. Such power concentration poses an existential threat to Bitcoin’s decentralized nature and its foundational principle of trustlessness,” TOBTC remarked.

These pools’ dominance is considerably unsurprising, as the current economic realities make it challenging for smaller miners to compete. Banking giant JPMorgan reportedly stated that the current hashrate and power consumption on the BTC network had pushed the average mining cost to about $45,000.

Moreover, the recent regulatory scrutiny will likely intensify the pressure on Bitcoin miners. Bitcoin mining is now viewed as a national security issue in the US. President Joe Biden recently ordered Chinese-backed MineOne Partners Ltd. to halt construction of a crypto mine in Wyoming and sell the property.

Read more: Making Passive Income From Crypto Mining: How to Get Started

Other countries are also concerned about energy consumption. Venezuelan authorities recently announced plans to disconnect all crypto-mining farms from their energy grid. Similarly, The Norwegian government is also focused on regulating data centers and curbing its energy use for Bitcoin mining.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.