Hashrate is an important aspect of crypto projects that use the Proof-of-Work (PoW) consensus mechanism. While Bitcoin (BTC) heads this regime, the hashrate of its 2017 hard fork, Bitcoin Cash (BCH), surged dramatically on July 3.

Questions arose about the cause of the spike. However, BeInCrypto could lay hands on the rationale as the price moved in the opposite direction.

New Miner Scoops Bitcoin Cash New Supply

According to CoinWarz, the hashrate jumped to 8.54 ExaHash per second (EH/s). The last time the reading was close to this region was November 2018, when it reached 7.79 EH/s. Therefore, the new value means it has hit a new All-Time High (ATH).

Hashrate represents the computational power miners use to generate new hashes while trying to solve new blocks on the Bitcoin Cash network. The higher the hashrate, the more secure the network and the more averse the blockchain is to attacks.

Therefore, the recent spike implies that Bitcoin Cash has become healthier. According to The Bitcoin Cash Podcast, a certain miner called “Pheonix” was responsible for the hike in hashrate.

The podcast mentioned via X, that this miner has been accumulating all the BCH fresh supply and, in turn, adding to the hashrate. Throwing more light on the situation, the handle noted that:

“A miner receiving a large chunk of coins (or knowing of others who were) could be bullish on swaps to BCH (150+:1 BCH: BTC is bullish for OGs reallocating to BCH) and want to grab an extra supply.”

Read More: 7 Best Bitcoin Cash (BCH) Wallets in 2024

Despite the rise, BCH’s price went the other way. As of this writing, BCH trades at $357.74. This is a 5.23% decrease in the last 24 hours and the lowest the coin has reached since March 14.

BCH Price Prediction: It All Depends on Bitcoin

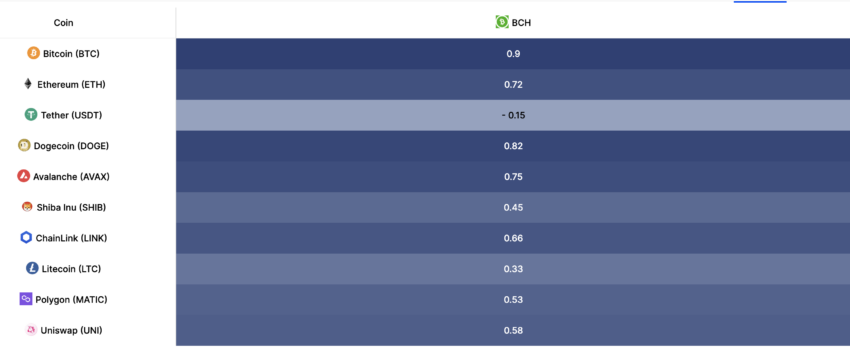

BCH’s price decline can be attributed to Bitcoin’s plunge within the same period. This is because of the correlation between both cryptocurrencies.

According to IntoTheBlock, the correlation matrix between BTC and BCH is 0.90. Typically, the correlation matrix ranges from -1 to +1. Values closer to -1 indicate a strong divergence in prices.

However, when the correlation is close to +1, it means that the cryptos move in the same direction in many instances. This is the case with Bitcoin and its hard fork.

On June 10, the daily chart shows that BCH retested the 476.35 resistance. However, it was at this point that a bearish crossover happened. A bearish crossover, also known as a death cross, occurs when the longer EMA rises above the shorter EMA.

EMA stands for Exponential Moving Average, and it measures trend direction over a period of time. This was the case with BCH on the said date, as the 50 EMA (yellow) crossed above the 20 EMA (blue).

Consequently, Bitcoin Cash bulls could not defend the support at $423.30. In addition, the price trades below both EMAs, indicating a further decline could be in the works.

Read More: Bitcoin Vs Bitcoin Cash: Which Is a Better Investment in 2024?

If this happens, the price of BCH could drop to $317.19, especially as most miners remain unprofitable. However, this will be invalidated if Bitcoin’s price recovers or rises above $60,000 for a start. Should this be the case, BCH may rise toward $415.19.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.