This article delves into the seven best crypto exchanges in the United States for Bitcoin trading, renowned for their low-spread trading, high market liquidity, and transparent fees. We’ve handpicked these platforms based on trading volume, exchange reputation, and the breadth of trading pairs they offer. Each exchange stands out for its commitment to providing tight spreads, efficient order execution, and a seamless user experience. Explore our curated list to find the best crypto exchange in the U.S. that aligns with your trading strategies and goals.

Methodology

In our quest to spotlight the best crypto exchanges in the U.S.A. for Bitcoin trading, we meticulously evaluated a range of platforms, ultimately selecting Coinbase, Uphold, Kraken, eToro, iTrustCapital, BYDFi, and Bitget for their standout features. All platforms were tested by BeInCrypto’s product testing teams for six months.

Coinbase earned its place for its exceptionally user-friendly interface, making it a go-to for beginners diving into cryptocurrency. Uphold distinguished itself with its unique ability to trade between cryptocurrencies, fiat currencies, and precious metals, offering a versatile trading experience.

Kraken’s reputation for security and its comprehensive suite of trading options set it apart as a reliable choice for traders of all levels. eToro was highlighted for its innovative social trading feature, allowing users to copy the trades of experienced investors, thereby democratizing access to cryptocurrency investments.

iTrustCapital stood out for offering cryptocurrency trading within tax-advantaged retirement accounts, bridging the gap between traditional finance and the crypto ecosystem. BYDFi made the list for its solid security measures and a user-friendly platform catering to a global audience.

Finally, Bitget was recognized for its competitive fee structure and a wide range of trading options, including futures and spot trading, catering to both novice and experienced traders looking for depth in market offerings.

To ;earn more about BeInCrypto’s verification methodology, click here.

- The best crypto exchanges in the U.S.

- 1. Coinbase

- 2. Uphold

- 3. Kraken

- 4. eToro

- 5. iTrustCapital

- 6. BYDFi

- 7. Bitget

- Understanding cryptocurrency exchange operations

- Types of crypto exchange

- Potential risks associated with crypto exchanges

- Understanding crypto exchange fees

- Selecting the right cryptocurrency exchange

- Registering for a cryptocurrency exchange account

- What’s the best crypto exchange in the USA for you?

- Frequently asked questions

The best crypto exchanges in the U.S.

1. Coinbase

BeInCrypto chose Coinbase as one of the best crypto exchanges in the U.S.A. for trading Bitcoin for a number of compelling reasons. The platform offers a diverse range of cryptocurrencies, which includes popular cryptos but also digital assets that only seasoned investors may be looking for. Coinbase is also one of the cryptocurrency exchanges with the most user-friendly interface, which makes it ideal for beginners.

Coinbase is renowned for its enhanced security measures, advanced trading options, regulatory compliance, and educational resources. Despite its higher exchange fees, Coinbase has high trading volumes, which is essential for any cryptocurrency trader.

- User-friendly interface and easy purchase process

- Great user reviews and security features

- Crypto staking for passive income

- Higher trading fees compared to competitors

- Not available in all 50 states

Over 200 tradable cryptocurrencies

User-friendly interface

Advanced trade product

Strong security record

Regulatory compliance

Custodial and non-custodial wallet options

Support for multiple cryptocurrencies

Multiple payment methods

2. Uphold

We chose Uphold because it offers the unique capability to directly exchange between cryptocurrencies, fiat currencies, and precious metals without the intermediary step of converting to a common asset such as U.S. dollars. This innovative feature means you can seamlessly trade from Ether (ETH) to Japanese yen or gold-backed tokens, enhancing your crypto trading strategies with diversified trading pairs and tapping into the crypto market liquidity.

However, remember that all transaction involving U.S. dollars are subject to taxation. This highlights the importance of considering market volatility, exchange fees, and the bid-ask spread when planning trades. Uphold’s transparent fees and low spread trading contribute to a cost-effective trading environment, making it one of the best exchanges for low spreads.

- Offers over 200 cryptos, traditional currencies and other assets

- Available in 184+ countries

- Regulated by FinCEN and it is licensed in most states

- Not available in all U.S. states

- Some assets have a high spread fee compared to other platforms

Offers a mobile app, enabling easy account management on-the-go

Complex security measures (KYC, two-factor authentication (2FA), cold storage, security audits, encryption for customer’s private keys, 24/7 monitoring for suspicious activities)

Regulated by the U.S. Treasury Department’s FinCEN and registered with the UK’s Financial Conduct Authority (FCA) for anti-money laundering (AML) and counter-terrorist financing (CFT)

No history of hacks since its operation began in 2015

Good customer support

3. Kraken

Among our top choices for popular crypto exchanges in the U.S. is Kraken. We chose it because it has low-spread trading. For experienced traders seeking advanced trading capabilities, Kraken Pro delivers with its comprehensive range of order types, including, but not limited to, market, limit, and stop-loss orders.

This facilitates sophisticated crypto trading strategies, allowing traders to navigate and capitalize on market volatility effectively. Additionally, Kraken Pro distinguishes itself by supporting margin and futures trading, thereby providing traders with the leverage and flexibility to pursue aggressive or conservative strategies based on their risk tolerance and market outlook.

Kraken’s reputation for security makes it a trusted platform in the crypto market. Its transparent fees, coupled with real-time spread visibility, ensure traders have all the necessary information for effective decision-making.

While we consider Kraken one of the best crypto exchanges in the U.S.A., we note that Kraken does not serve residents of New York or Washington due to regulatory constraints.

- Offers over 200 cryptocurrencies

- Low trading fees on Kraken Pro

- Highly liquidity for trading pairs

- Not available in all U.S. states

- Limited account funding options compared to competitors

Low trading fees, of up to 0.26% which are among the lowest in the industry (Fees decrease for higher trading volumes)

24/7 live customer support chat

More than 200 tradable cryptocurrencies

Educational resources

Kraken’s platform and mobile app available on Apple App Store and Google Play Store, suitable for traders of all experience levels

$1 deposit minimum for ACH deposits in the U.S., with trade minimums varying by cryptocurrency.

Advanced trading options, which support a variety of order types for sophisticated trading strategies.

Implements strict KYC and 2FA, holds 90% of digital assets in cold storage, and undergoes regular security audits.

Regulated by FinCEN in the US and registered with the FCA in the UK for AML and CFT compliance.

Instant buy feature

4. eToro

eToro is one of the best crypto platforms in the U.S. for trading Bitcoin because its appeal lies in its simplicity and robust support for newcomers. BeInCrypto chose this platform because excels in offering instant Bitcoin purchases. Its straightforward buying process makes it the ideal choice for those new to crypto trading but also suitable for more advanced users.

With a focus on education, eToro provides an array of short, informative tutorials on key topics like Bitcoin basics and simplified financial concepts, enhancing its reputation for low-cost trading and transparent fees.

The CopyTrader function allows beginners to leverage the crypto market liquidity by mirroring the trades of experienced traders, combining low-spread trading with educational growth.

- Features a social media feed that helps traders connect with the community

- CopyTrader function allows new traders to copy the trading strategies of more experienced traders

- Provides educational resources

- Trade crypto, stocks and ETFs on the same platform

- Registered as a Money Services Business (MSB) with FinCEN and licensed in most states

- Crypto fees and spreads can be higher than on other crypto exchanges

- Limited range of cryptocurrencies available

- Crypto withdrawals take a few days

- Lacks crypto-to-crypto trading pairs

Offers stocks, cryptocurrencies, ETFs, and options trading with competitive pricing.

No commission for stocks and ETFs, and no base commission or per-contract fee for options trading.

CopyTrader feature allows users to automatically copy the trades of popular crypto traders, enhancing social trading experiences.

Virtual trading account ($100,000 virtual money account for beginners to practice trading)

eToro club membership offers benefits like analyst newsletters, webinars, and digital subscriptions based on the user’s investment level.

Features a social media feed for traders to connect and share insights.

Allows investment in thematic portfolios, such as AI or renewable energy, with a $500 minimum investment.

Enables buying fractional shares with a minimum of $10 per trade.

A minimum deposit of $10 makes it accessible for beginners.

Offers an easy-to-use interface with quick access to trading and social features.

5. iTrustCapital

iTrustCapital is one of the best platforms for trading Bitcoin due to its unique offerings that cater especially to U.S. citizens interested in leveraging cryptocurrency within their retirement planning.

We chose it because the platform specializes in integrating cryptocurrencies like Bitcoin and Ethereum into IRAs, providing tax-free trading and potential tax-deferred or tax-free gains, unlike traditional exchanges where profits are taxable.

iTrustCapital supports various IRA types and facilitates rollovers from existing retirement accounts, making it versatile for different investment strategies. It partners with trusted entities like Fortress Trust, BitGo, and Fireblocks for asset custody, ensuring institutional-grade security. Additionally, the platform is regulated in the U.S., further enhancing its credibility.

Since 2018, iTrustCapital has seen significant growth, managing approximately $2 billion across 27,000 accounts by early 2022.

- Good customer support

- Institutional grade security of assets

- Tax-free for holding crypto

- User-friendly interface

- Platform 24/7 open for trading

- Multiple IRA options

- Limited number or cryptocurrencies

- High trading fees compared to other crypto platforms

- Limited trading and deposit options

Specializes in cryptocurrency investments within Individual Retirement Accounts (IRAs), offering tax-deferred or tax-free gains.

Offers trading in 20+ cryptocurrencies, including Bitcoin and Ethereum, but also precious metals like gold and silver.

Partners with Fortress Trust, BitGo, and Fireblocks for secure asset custody, employing advanced security measures like offline cold storage and MPC technology.

Compliant with U.S. regulations, catering exclusively to U.S. residents and employing IP address blocking to restrict access from outside the U.S.

24/7 Market Access

Supports various types of IRAs and facilitates account rollovers from existing retirement plans such as 401(k)s and 403(b)s.

Offers a mobile application

Utilizes an FDIC-insured bank for USD deposits, providing an additional layer of financial security.

6. BYDFi

0.3% /taker

BYDFi has quickly become a top platform for trading Bitcoin in the U.S. Despite its recent entry, it offers a strong suite of features comparable to established competitors, with potential for further growth. BeInCrypto chose it because it offers over 400 trading pairs, including Bitcoin, and supports various strategies, from basic spot trading to advanced perpetual contracts with up to 100x leverage. Its user-friendly interface, powerful security, and diverse trading options make it a competitive choice for U.S. traders.

The platform focuses on transparency, low trading fees, and tight spreads, making it a preferred exchange for novice and experienced traders in the dynamic crypto market.

- It’s available in all 50 states

- Low trading fees

- Accepts more than 50 fiat currencies

- Offers both an online wallet and cold storage

- Not many advanced trading features

- Doesn’t offer staking and lending

- Deposited funds are not insured

Serves users in 150+ countries with a significant presence in the crypto space.

Manages a 24-hour trading volume of almost $300 million, indicating robust market liquidity.

Offers tiered spot trading options from classical to advanced interfaces, catering to all trader levels.

Supports trading in perpetual futures with up to 100x leverage for both USDT and coin-margined contracts.

Features leveraged tokens for spot trading, allowing traders to amplify their trades without manual margin settings.

Enables users to copy the trades of experienced traders, fostering a learning environment for new traders.

Adheres to regulatory standards with advanced security measures in place to protect users.

7. Bitget

We selected Bitget as one of the best exchanges to trade Bitcoin in the U.S. for its impressive combination of features tailored to both novice and experienced traders.

The platform ensures the safety of exchange and wallet through multiple security protocols, securing users’ investments. Licensed to operate in several countries, Bitget’s adherence to regulatory standards across Lithuania, Italy, Canada, and Australia bolsters its credibility.

Bitget offers a competitive fee structure, a web3 wallet, a large user base, and comprehensive trading options. These attributes underscore Bitget’s position as a leading crypto exchange in the U.S., making it a preferred platform for trading Bitcoin and other cryptocurrencies.

- Diverse trading options, including spot and futures trading

- Bitget Earn

- Web3-focused wallet

- Competitive fee structure

- Robust security measures

- Copy trading feature

- Limited fiat support

- Complexity for beginners

- Withdrawal limits for unverified users

Spot and futures trading

Offers leverage up to 125x on certain trading pairs

Copy trading

Bitget Wallet

Bitget Earn

Extensive cryptocurrency support

Trading bots

| Platform | Trading fees | Cryptocurrencies | Payment method | Minimum deposit |

|---|---|---|---|---|

| Coinbase | 0.0%-0.6% | 241 | Bank transfer, card, PayPal | $2 |

| Uphold | 0.25%-1.25% | 250+ | Bank transfer, card | $10 |

| Kraken | 0.00%-0.26% | 249 | Bank transfer, card | $1 |

| eToro | 1% | 70+ | Bank transfer, card, PayPal | $100 |

| iTrustCapital | 1% | 20+ | IRA, and ACH | $1,000 |

| BYDFI | 0.1% (maker)/0.3%(taker) | 279 | Bank transfer, card | $50 |

| Bitget | 0.1% | 692 | Card | $2 |

Understanding cryptocurrency exchange operations

Cryptocurrency exchanges are digital platforms that facilitate the buying, selling, and trading of crypto. They operate as intermediaries between buyers and sellers, providing a marketplace where users can exchange cryptocurrencies for other digital currencies or fiat money (such as USD, EUR, etc.). The core functionality of a cryptocurrency exchange involves matching orders from users who want to sell cryptocurrencies with orders from users who want to buy them.

When a user wants to trade, they must first create an account on the exchange and deposit funds (either fiat currency or cryptocurrencies) into their exchange wallet. More experienced traders often opt for pro accounts for crypto trading.

Once the account is funded, the user can place buy or sell orders on the exchange. These orders are listed in the exchange’s order book, a real-time ledger that records all pending transactions.

Buy orders specify the amount of cryptocurrency the buyer wants to purchase and the price they are willing to pay. Sell orders specify the amount of cryptocurrency the seller offers and the minimum price they are willing to accept.

When a buy order matches a sell order in price, the exchange automatically executes the trade, transferring the sold cryptocurrency to the buyer’s wallet and the purchase amount to the seller’s wallet. Exchanges make money by charging fees for their services. These fees can include trading fees (a percentage of the trade amount), withdrawal fees, and deposit fees.

Some exchanges also offer additional services like margin trading, futures trading, and access to initial coin offerings (ICOs) or token sales, often with their own set of fees. Security is a critical concern for cryptocurrency exchanges, as these platforms are prime targets for hacking and fraud.

Types of crypto exchange

Cryptocurrency exchanges are broadly categorized into two main types — centralized exchanges (CEXs) and decentralized exchanges (DEXs). Centralized exchanges (CEXs) are platforms managed by a centralized entity that facilitates the trading of cryptocurrencies.

They act as intermediaries between buyers and sellers, offering services like fiat-to-crypto transactions, enhanced liquidity, and advanced trading features, such as AI crypto trading bots.

CEXs are known for their user-friendly interfaces, customer support, and implementation of strict security measures. However, they require users to trust the platform with their funds and personal information.

Decentralized exchanges (DEXs) operate without a central authority, enabling direct peer-to-peer transactions. DEXs offer a higher degree of privacy and security, as trades are executed directly between users through smart contracts on a blockchain.

They promote anonymity and reduce the risk of hacking and centralized control. However, DEXs might have lower liquidity, fewer trading features, deal with slippage issues, and be less user-friendly for newcomers compared to CEXs.

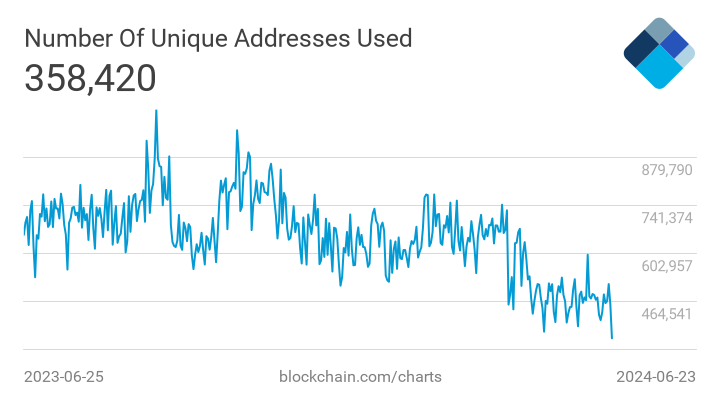

When dealing with a DEX, you will have a unique address for your BTC wallet. According to the Bitcoin blockchain explorer Blockchain.com, over 300,000 unique blockchain addresses are used daily. Note that this doesn’t count the many other wallets created in centralized platforms.

Each type of exchange offers unique advantages and considerations, catering to different user preferences regarding security, privacy, ease of use, and regulatory compliance.

Potential risks associated with crypto exchanges

Using cryptocurrency exchanges, whether centralized (CEXs) or decentralized (DEXs), involves various risks. Understanding these risks is crucial for users to make informed decisions and take appropriate measures to mitigate them. Here’s a breakdown of the key risks involved in using crypto exchanges:

Security vulnerabilities

- Hacking and theft: Exchanges can be prime targets for hackers. Successful attacks may lead to the loss of users’ funds stored on the platform. Even with advanced security measures, no exchange is entirely immune to breaches.

- Phishing attacks: Users may fall victim to phishing scams, where fraudulent websites or communications mimic legitimate exchanges to steal login credentials and funds.

Operational risks

- Technical failures: Glitches, downtime, or technical malfunctions can affect an exchange’s ability to execute orders, leading to potential losses, especially in volatile market conditions.

- Liquidity issues: Some exchanges, particularly smaller or newer ones, may suffer from low liquidity, making it difficult to execute large orders without significantly impacting the market price.

Regulatory and legal risks

- Regulatory changes: The regulatory sector for cryptocurrencies can affect exchanges’ operations, potentially leading to sudden restrictions or the closure of services in certain jurisdictions.

- Legal actions: Exchanges facing legal challenges or regulatory scrutiny may halt operations or freeze assets, impacting users’ ability to access their funds.

Market risks

- Price volatility: The crypto market is known for its high volatility. Rapid price movements can lead to significant losses, especially for leveraged positions.

- Market manipulation: Some exchanges may have less stringent measures to prevent market manipulation, exposing users to pump-and-dump schemes and other manipulative practices.

Counterparty risks

- Trust and custody: On CEXs, users’ funds are typically held by the exchange, creating a risk if the exchange becomes insolvent or acts maliciously.

- Smart contract vulnerabilities: Trades on DEXs are executed through smart contracts. Bugs or vulnerabilities in smart contract code can lead to fund loss.

Personal security risks

- Loss of access: Losing access to your account due to forgotten passwords, lost two-factor authentication devices, or death without sharing access information can result in the permanent loss of funds.

- Privacy concerns: Personal information provided to CEXs might be exposed in the event of a data breach, leading to privacy issues and potential identity theft.

Strategies to avoid these risks

To mitigate these risks, users should:

- Use exchanges with strong security measures and a good track record.

- Enable two-factor authentication and use hardware wallets to store cryptocurrencies.

- Stay informed about regulatory changes in their jurisdiction.

- Be cautious with market orders on platforms with low liquidity.

- Regularly withdraw funds not needed for trading to a secure wallet.

- Educate themselves on the signs of market manipulation and phishing attempts.

Understanding crypto exchange fees

Crypto exchange fees are charges that platforms impose for services, such as trading, withdrawing, and depositing cryptocurrencies. These fees vary across different exchanges and are crucial for users to understand before engaging in crypto transactions. Here are the crypto exchange fees any beginner should be aware of:

Trading fees

- Maker and taker fees: Most exchanges differentiate between “maker” orders that provide liquidity to the market by creating a new order on the book and “taker” orders that remove liquidity by matching with an existing order. Makers typically pay lower fees than takers.

- Percentage-based fees. Many exchanges charge a percentage of the trade amount. This fee can decrease as a user’s trading volume increases over a specified period.

Withdrawal and deposit fees

- Withdrawal fees: When you withdraw cryptocurrencies to an external wallet, the exchange may charge a fee. This fee often reflects the network fee required to process the transaction on the blockchain and can vary by cryptocurrency.

- Deposit fees: Depositing funds into an exchange can also incur fees, especially for fiat deposits through methods like bank transfers or credit cards. Some exchanges offer free deposits for cryptocurrencies.

Other fees

- Conversion fees: Exchanging one cryptocurrency for another directly on the platform may involve conversion fees in addition to trading fees.

- Network fees: Separate from the exchange’s withdrawal fees, network fees are paid to blockchain miners or validators to process transactions. These fees fluctuate based on network congestion.

Tips for minimizing fees

- Compare exchanges: Fees vary widely among platforms, so compare to find the most favorable rates.

- Use limit orders: Opting for maker orders can lower trading costs compared to taker orders. Learn more about stop loss vs stop limit orders to increase your trading efficiency.

- Leverage fee discounts: Some exchanges offer lower fees for using their native tokens or for users with high monthly trading volumes.

- Withdraw wisely: Consolidate withdrawals to minimize network and withdrawal fees.

Selecting the right cryptocurrency exchange

Choosing a cryptocurrency exchange is a critical decision for anyone looking to trade or invest in cryptocurrencies. Here are key factors to consider before selecting an exchange that suits your needs:

- Security measures: Opt for exchanges with robust security features like two-factor authentication (2FA), cold storage for funds, encryption, and regular security audits to protect your assets.

- Fee structure: Understand the exchange’s fee structure for trading, deposits, and withdrawals. Look for transparent fees that align with your cryptocurrency trading patterns.

- Supported cryptocurrencies: Check the range of supported cryptocurrencies. Whether you’re interested in popular coins or exploring altcoins, ensure the exchange caters to your investment interests.

- User interface and experience: Choose an exchange with an intuitive and user-friendly interface. Ease of use is crucial for both beginners and experienced traders.

- Liquidity: High liquidity ensures you can execute trades quickly and at desired prices. Check the exchange’s trading volume to gauge its liquidity.

- Regulatory compliance: Select exchanges that comply with regulatory requirements in your jurisdiction. This compliance indicates a level of reliability and security.

- Customer support: Good customer service is essential for resolving issues. Look for exchanges with responsive support through multiple channels.

- Additional features: Consider extra features like margin trading, staking, or earning opportunities if these are important to your trading strategy.

Taking the time to assess these factors will help you choose a cryptocurrency exchange that meets your trading needs and security expectations.

Registering for a cryptocurrency exchange account

Signing up for a cryptocurrency exchange account involves a straightforward process.

Here’s how to get started:

- Choose an exchange: Select a cryptocurrency exchange that fits your needs based on security, fees, supported cryptocurrencies, and other factors discussed previously.

- Visit the exchange’s website or app: Go to the official website or download the exchange’s official app to ensure security.

- Signup: Look for a “Sign Up” or “Register” button. Click on it to start the registration process.

- Provide Your Details: Enter your personal information, such as email address, phone number, and a strong password. Some exchanges may ask for additional details upfront or during the verification process.

- Verify your email or phone number: You’ll likely receive a verification link via email or a code via SMS. Follow the instructions to verify your contact details.

- Complete identity verification (KYC): Many exchanges require Know Your Customer (KYC) verification for security and regulatory compliance. You’ll need to upload documents like a government-issued ID, passport, or driver’s license, and sometimes a selfie for facial recognition.

- Secure your account: Enable two-factor authentication (2FA) for an added layer of security on your account.

- Deposit funds: Once your account is set up and verified, you can deposit funds using the methods available on the exchange, such as bank transfer, credit card, or cryptocurrency transfer from another wallet.

- Start trading: With funds in your account, you’re ready to start trading cryptocurrencies.

Each exchange may have slight variations in this process, so follow any additional instructions the exchange provides carefully.

What’s the best crypto exchange in the USA for you?

Navigating cryptocurrency trading requires choosing the right platform that aligns with your trading needs and goals. The best crypto exchanges in the U.S.A. offer low-spread trading, a wide array of pairs, and robust crypto market liquidity. These platforms ensure tight spreads, transparent fees, and efficient order execution, which are crucial for optimizing trading strategies amidst market volatility.

When selecting a cryptocurrency exchange, prioritize those with a strong reputation, high trading volume, and a user-friendly experience. This approach will help you engage in low-cost trading on popular crypto exchanges, benefiting from real-time spreads and a comprehensive trading fee comparison. Ultimately, the right exchange combines all these features to provide a secure, cost-effective, and seamless trading environment.

Frequently asked questions

Frequently asked questions

Coinbase stands out for its user-friendly interface, powerful security measures, and wide selection of cryptocurrencies. It offers low-spread trading and is renowned for its transparent fees. Its popularity and regulatory compliance make it a top choice among U.S. traders.

Bitcoin remains the most popular cryptocurrency in the U.S., known for its high market liquidity and extensive trading pairs. Ethereum follows closely, favored for its utility and involvement in decentralized finance (DeFi). Both are widely supported across cryptocurrency exchanges for their proven track record and investor interest.

Using a reputable cryptocurrency exchange with a strong user experience and transparent fees is advisable. Platforms like Coinbase and Kraken offer secure, straightforward purchasing options for beginners and experienced traders alike. They provide various payment methods, including bank transfers and credit cards, facilitating easy access to the crypto market.

Kraken is recognized for its extensive security features, including two-factor authentication and cold storage of assets. It has maintained a strong exchange reputation with minimal incidents over its operational history. Its commitment to security and regulatory compliance makes it one of the safest choices for crypto trading.

Earning USDT for free typically involves participating in airdrops, referral programs, or crypto faucets offered by some platforms. Many exchanges and wallets run promotional campaigns rewarding users with USDT for completing specific tasks. However, always exercise caution and research to avoid scams.

Joining Bitcoin faucets, participating in affiliate marketing programs, and completing website micro-tasks can earn you free Bitcoin. Some platforms offer Bitcoin rewards for viewing ads or answering surveys. Remember, the amounts earned are usually small and should be approached as a way to accumulate Bitcoin gradually. If something looks too good to be true, it probably is.

No investment, including USDT, is entirely risk-free. This is despite USDT’s stablecoin status and its aim to maintain a 1:1 value with the USD. Market volatility and regulatory changes can pose risks. Conducting thorough research and considering diversification to mitigate potential losses is essential.

Yes, cryptocurrency exchanges are legal in the U.S. and operate under regulatory scrutiny to ensure compliance with financial laws. They must register with the Financial Crimes Enforcement Network (FinCEN) and adhere to anti-money laundering (AML) and Know Your Customer (KYC) regulations. Users should choose exchanges that comply with these regulations for secure and lawful trading experiences.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.