A Bitcoin wallet that has been numb for years has resurfaced, moving 8,000 BTC, worth about $535.64 million, after almost six years of latency.

The wallet, dating back to mid-2018, transferred the holdings to multiple addresses, including a Binance deposit, when BTC crashed.

Dormant Bitcoin Wallet From 2018 Moves $535 Million

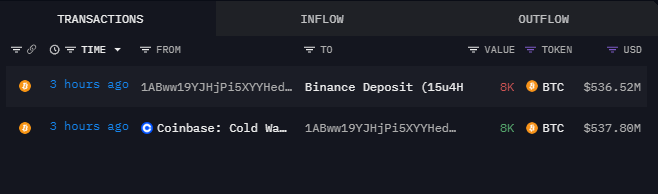

On June 11, during the early hours of the US session, a dormant wallet moved its first transaction after 5.5 years of inactivity. The wallet address transferred 8,000 BTC from Coinbase cold storage, Akrham data shows. The value of the moved assets was $535.64 million as of press time.

Dormant Bitcoin wallets, which are addresses showing no activity for long periods, can cause a stir when they suddenly become active, especially with large transfers. Analysts often see these movements as bearish indicators, suggesting that large holders, or whales, are cashing in their holdings.

More intriguingly, the dormant wallet became active amid an ongoing BTC price crash, now down nearly 5%. This market turbulence led to liquidations totaling over $255 million across the crypto market, with $235 million being long positions.

Read more: Who Owns the Most Bitcoin in 2024?

CryptoQuant data reveals that on June 10, the Bitcoin average dormancy was 9.3098. This metric shows the average number of destroyed days of moved coins, increasing when long-term holders move or sell their coins, which can signal a potential price drop.

On May 21, a dormant Bitcoin wallet from 2013 was reactivated, transferring $7.6 million in BTC after nearly 11 years of inactivity. As shown in the chart, this transaction coincided with a subsequent Bitcoin price drop, moving from the $70,000 to $67,000 range. It is evident that large holders moving their holdings to exchanges often cause price fluctuations, typically favoring the bears.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, some experts, including Javier Bastardo, the Bitcoin Ambassador at Bitfinex, challenge this assumption. He recently expressed that dormant Bitcoin whales’ activities would not significantly impact the market.

“I don’t think this is a significant movement that will affect or influence BTC price. However, it’s important for users to understand that there are a significant number of long-term investors who are ready to hold their BTC positions for years,” Bastardo told BeInCrypto.

At the time of writing, Bitcoin is trading at $66,449, down almost 5% in the past 24 hours.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.