Bitcoin has had plenty of people feeling bullish over the past week — but was that sentiment premature?

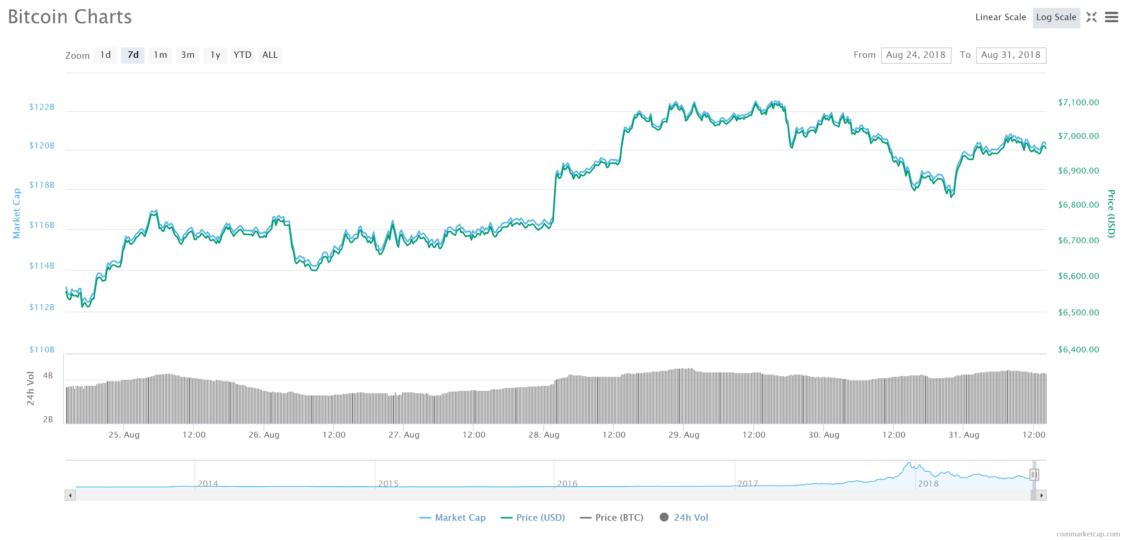

Bitcoin (BTC) has been on a nice little run, seeing green daily candles on five out of six days — until sellers put the brakes on Wednesday and Thursday.

After topping out at roughly $7140, two days of selling has the market leader trading at $6,985 — at the time of this writing.

Some experts have offered up a reminder that sellers are still in control of the market.

Indeed, many short positions have been closed. The problem is, there wasn’t much of a squeeze. When short positions are closed during two days of selling, that may be interpreted as a bearish sign.

Some experts have offered up a reminder that sellers are still in control of the market.

Indeed, many short positions have been closed. The problem is, there wasn’t much of a squeeze. When short positions are closed during two days of selling, that may be interpreted as a bearish sign.

Support at $6,600

Sweeting also told MarketWatch that the $6,500 level should provide support — and our analysis tends to agree. Without drawing any fancy lines or taking a look at in-depth levels or support and resistance, we can gauge Bitcoin’s general trend. Taking a look at the 4-hourly chart, we can clearly see that Bitcoin is trending upwards in a gently-sloping channel. The top of the channel should provide some resistance, while the bottom — around $6,600 — should provide some support. A breakdown of the channel’s lower support may signal a sharp sell-off. Likewise, a break to the upside may signal that the market leader is looking to go higher. What do you think about Bitcoin’s current price action? Do you believe the bears are still in control of the market? Is the bottom in for Bitcoin this year? Let us know your thoughts in the comments below!

[Disclaimer: This article is not intended as financial advice. Neither BeInCrypto nor the author should be held responsible for any financial gains or losses. Readers are always encouraged to do their own research, never invest more than they can afford to lose, and to consult with a licensed financial professional before making any major investment decisions. Trading in cryptocurrencies carries risk.]

[Full Disclosure: The author of this article holds Bitcoin (BTC).]

What do you think about Bitcoin’s current price action? Do you believe the bears are still in control of the market? Is the bottom in for Bitcoin this year? Let us know your thoughts in the comments below!

[Disclaimer: This article is not intended as financial advice. Neither BeInCrypto nor the author should be held responsible for any financial gains or losses. Readers are always encouraged to do their own research, never invest more than they can afford to lose, and to consult with a licensed financial professional before making any major investment decisions. Trading in cryptocurrencies carries risk.]

[Full Disclosure: The author of this article holds Bitcoin (BTC).]

Top crypto platforms | July 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored