Are you wondering how to start with NFT staking? As blockchain-based ecosystems continue to evolve, staking has emerged as a popular way to earn passive income through digital assets. While staking crypto has been around for a while, staking NFTs (sometimes called digital collectibles) is a relatively new concept gaining traction.

By staking NFTs, users can earn rewards and benefits while still maintaining ownership of their digital assets. This guide explores the basics of staking NFTs for passive income, the various available projects, and what to consider before getting started.

BeInCrypto Trading Community in Telegram: read reviews on the best NFT projects, get technical analysis on coins & answers to all your questions from PRO traders & experts!

What is NFT staking?

Staking NFTs involves depositing these digital collectibles into a platform or system within the crypto community, particularly in the DeFi space, to gain rewards and additional benefits. This process allows NFT owners to leverage their idle assets for passive income, while maintaining ownership.

Unlike the proof-of-work model used in traditional cryptocurrencies, staking an NFT follows a procedure akin to proof-of-stake (PoS) digital currencies and necessitates the use of a web3 wallet. This integration of NFTs into staking mechanisms reflects the evolving landscape of digital asset management and income generation within the broader crypto community.

Did you know that you can get $10 cashback for inviting friends to ZenGo wallet?

However, not all NFTs are eligible for staking. Before buying any digital collectibles for staking purposes, carefully research and verify that your chosen platform accepts that specific NFT for staking.

What are some NFT staking platforms?

We’ve compiled a quick list of the most popular platforms supporting staking for NFTs. Note that each has unique features and can access different ranges of NFTS.

Most popular NFT staking platforms

- Binance NFT PowerStation

- NFTX

- Doge Capital

- Splinterlands

- Polychain Monsters

- BAND NFTs

- Mobox (MBOX)

- KIRA

- FootballCoin

- WhenStaking (Onessus)

Note that NFT staking is still new. Many of these projects and platforms are dedicated to NFT-based play-to-earn games, such as Polychain Monsters and Splinterlands. These platforms will only allow you to stake a specific type of NFT (for example, in-game assets)

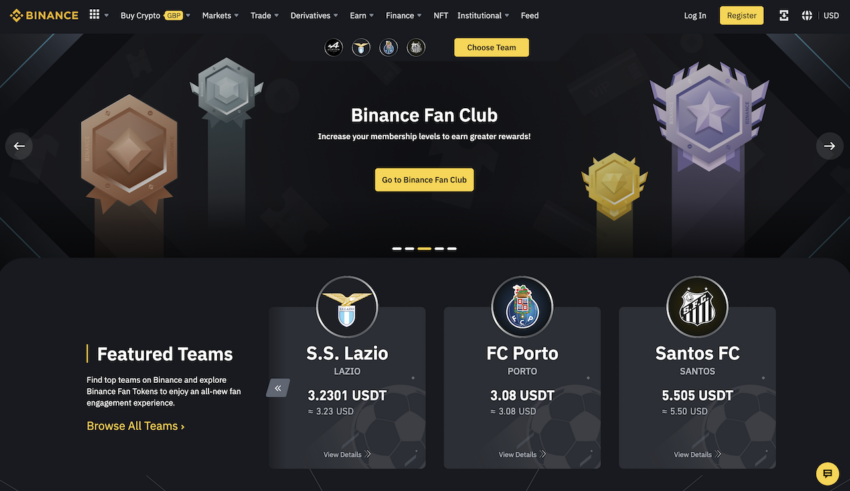

Binance NFT PowerStation

One of the most popular and accessible platforms on this list is Binance NFT PowerStation. Unlike the other platforms, Binance is a centralized crypto exchange servicing millions of users worldwide. Users can earn passive income from holding Binance Fan Tokens.

Binance Fan Tokens are utility tokens linked to specific sports teams. Token holders can enjoy various benefits, such as priority ticket sales or influence over key decisions within the sports club. These tokens are popular among sports club enthusiasts and can also be utilized by artists or celebrities with large followings.

MOBOX (MBOX)

An example of a platform featuring a blockchain-based game, the MOBOX metaverse — the MOMOverse — contains various NFTs. Users can trade these NFTs on MOBOX’s marketplace or stake them to generate passive income. Each MOMO has distinct attributes with randomly generated hashing power.

Staking MOMO rewards users with MOBOX’s governance token. The reward quantity depends on the number of staked MOMOs. Since each MOMO has varying rarity, hashing power also differs, affecting staking rewards. Other well-known NFT games, such as Splinterlands and Axie Infinity, also provide similar services to NFT holders.

How does NFT staking work?

Staking can be compared to depositing money into a savings account at a bank. While your funds are locked for a specified duration, you earn interest on your NFT investment. While the mechanism behind this technology is different, the results are similar. Although NFTs don’t function identically, the core idea is similar.

By staking a digital collectible, you secure your non-fungible tokens on an exchange platform, receiving staking rewards or other advantages in return. Similar to cryptocurrency staking, NFT staking contributes to the security and functionality of a blockchain.

Remember that staking rewards depend on the platform and the specific collection. Various digital collectibles provide different staking rewards, and some cannot be staked at all. The project team determines these factors when minting the NFT on the blockchain. Sometimes, you’ll also have to mint the NFT at the moment of purchase. This may incur additional costs.

Remember that unlike cryptocurrencies, which are fungible digital assets (meaning one unit can be exchanged for another and have the same value), NFTs are more specialized assets. One particular unit cannot be traded for another, as each holds a different value (hence the term non-fungible). This is just one of the many differences between crypto staking and NFT staking.

Since each particular NFT collection has its own particularities, partnerships, and staking capabilities, investors are responsible for researching each specific NFT and understanding its respective capabilities.

What are the pros and cons of staking my NFTs?

Consider the following aspects as you determine whether staking your NFTs is an appropriate decision:

Advantages

- Earn passive income. If you possess an NFT that you don’t intend to sell in the near future, staking offers an excellent opportunity to utilize your idle digital assets. Similarly to staking crypto, by locking your NFT on a staking platform, you can enjoy the rewards without relinquishing ownership.

- Interacting with projects and communities. While the specific rewards and incentives for staking an NFT may vary among projects, a shared element is that most projects grant utility tokens to users who stake their NFTs. These tokens can provide additional perks, such as voting and governance rights, enabling users to influence the project’s future direction.

Disadvantages

- Risk of scams. Earning rewards on your NFTs may seem appealing, but be mindful of the risks.

The NFT market is still maturing, making distinguishing between reliable and malicious players challenging. Untrustworthy staking platforms could mismanage users’ funds and abscond with their tokens.

To stay informed about potential NFT scams, practice due diligence. Thoroughly research and scrutinize the staking platform and its team – it’s better to be cautious.

- Price volatility. While staked, your NFT’s value might experience substantial fluctuations due to market developments and the digital art landscape.

Depending on your staking platform’s terms, you might be unable to withdraw an NFT with an extended lock-up period. However, if your NFT strategy is focused on long-term holding, temporary market fluctuations should be less of a concern.

Is staking NFTs worth it?

When seeking passive income opportunities with NFTs, you’ll need to conduct market research prior to any acquisition. That means you have to assess the NFT, its utility, the rewards, and the overall market to make informed decisions. Remember that an NFT’s popularity can increase, potentially leading to earnings from the NFT itself. But it can also lose popularity, making the investment less profitable and potentially leaving you with worthless digital assets.

If you’re interested in gaming and wish to invest in the sector, then NFT staking on a gaming platform like Splinterlands might be appealing. Most of these blockchain games allow you to participate in the game while also earning a passive income. Remember that just like crypto, NFTs can decline dramatically in value. As with all digital assets, there will always be an investment risk.

Frequently asked questions

What is an NFT stake?

What is the risk of staking an NFT?

Does staking an NFT cost gas?

Does staking an NFT cost gas?

What is the purpose of staking?

Does staking pay daily?

How can I start staking?

What is an example of NFT staking?

Are NFTs truly dead?

How does NFT staking work?

Can I stake any NFT on any platform?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.