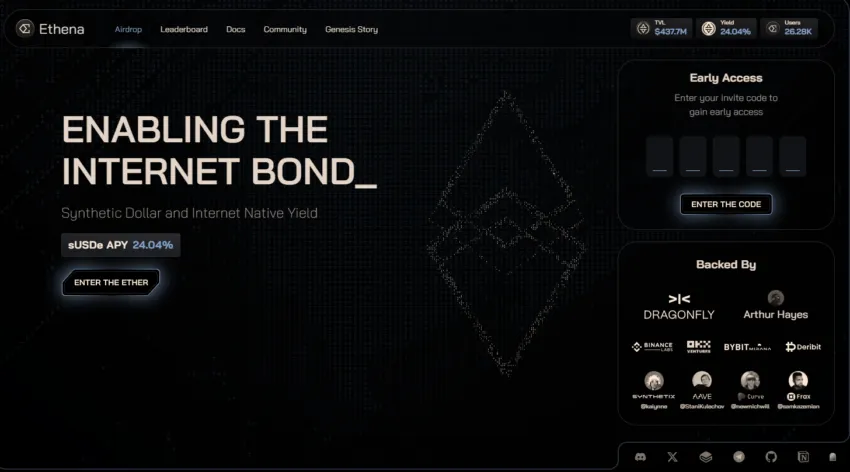

The Ethena Protocol by Ethena Labs has pioneered the concept of synthetic dollar — USDe. However, the USDe token isn’t only intended to function as a stablecoin. Instead, if you hold USDe, you can stake the asset on Ethena Finance, the DApp side of the protocol, to earn yields. But how do you use the Ethena platform to stake USDe, and how eventually do you unstake and redeem? This guide explains everything you need to know.

Methodology

Our process for selecting exchanges to purchase crypto is exhaustive and conducted over a six month period. We extensively conducted a test of the Coinbase platform which assessed its products and features, fees, security, and a multitude of other factors.

In the case of security, Coinbase is a publicly regulated company, has acquired multiple licenses, and is therefore one of the safest exchanges on the market.

BeInCrypto conducted thorough evaluations of the platform’s user interface, its user-friendliness, and how well it functions across various devices. We looked into several aspects, including the process for setting up an account, the methods available for deposits and withdrawals, and the presence of customer support services.

In our assessment, Coinbase emerged as the top choice for a dependable and secure centralized exchange that offers support for USDe. The platform focuses on ensuring a smooth user experience and offers a wealth of educational materials for those new to the field.

To learn more about BeInCrypto’s Verification Method, navigate here.

Buy USDe on Coinbase

- Buy USDe on Coinbase

- A quick USDe token refresher

- How to mint USDe on Ethena Finance?

- How to stake USDe on Ethena Finance?

- How to redeem USDe on Ethena Finance?

- Calculating the yield

- Risks associated with USDe staking on Ethena Finance

- Is the Ethena Finance yield promise sustainable?

- Frequently asked questions

A quick USDe token refresher

Even though the USDe token, a synthetic dollar, is at the heart of this Ethena Labs-powered protocol, it is driven by several innovative technologies. Delta hedging is one of these. A quick way of understanding Delta Hedging is that it works by taking the ETH collateral (staked ETH, to be precise) as the initial backing for USDe and then shorting Ether (the collateral version) on an exchange at 1:1 or 1x.

Shorting Ether derivatives, leverage-free (as 1x), gives the price of ETH a buffer if the price goes down, helping stabilize the USDe peg further. However, the short ETH position also allows the Ethena Protocol to generate APY or yield, as derivatives are still high-earning propositions. Therefore, Ethena Finance facilitates yield generation by using the liquid staking ETH component and then entering this into a derivative contract to offset price volatility.

But to get this yield, simply having USDe isn’t enough. You need to an internet bond with Ethena Finance by staking the USDe and getting a receipt-like sUSDe in return. This sUSDe accrues the yield while the technologies maintain the USDe peg — a double-pronged approach.

Also, USDe, or the existing Ethena token, aims to work as a decentralized, scalable, and secure alternative to the traditional banking system. As an ERC-20 cryptocurrency at heart, the project focuses on democratizing finance, especially the DeFi space, as a resource for yield farming, liquidity pooling, and more. All while being transparent about the approach, technology, and yield.

How to mint USDe on Ethena Finance?

Before you stake USDe using Ethena Finance, you must first mint USDe. Here is a step-by-step breakdown of the process.

Step 1: Review the terms

Before you mint, it is necessary to identify the nature of the collateral you want to use and review the minting terms. At this point, you also find out the gas fees (as it is also an Ethereum blockchain or mainnet transaction), total assets receivable, and more.

Step 2: Accessing the minting dashboard

Once you agree with the terms, choose the amount of USDe you want to mint.

Step 3: Initiate the minting process

Then, choose the asset type — the liquid staking token you want to deposit in exchange for USDe. The Ethena Finance DApp screen displays the amount you need to get from the wallet to mint the selected amount of USDe.

Step 4: Wallet interaction

To enter the Ethena Finance dashboard, you first need to connect your wallet — MetaMask in our case. You need to interact with your wallet again when you hit “Mint.” The digital interface pops up, and you must follow the steps described on the screen to give Ethena Finance access to the assets stored in your wallet.

Did you know? Liquid staking tokens like stETH from Lido, rETH from Rocketpool, and even other LSTs are compatible with the MetaMask wallet. You simply need to use the “Add token” feature, input the contract address of the LST, and store the token directly within the wallet. These tokens can, therefore, be used on the Ethena platform for minting USDe.

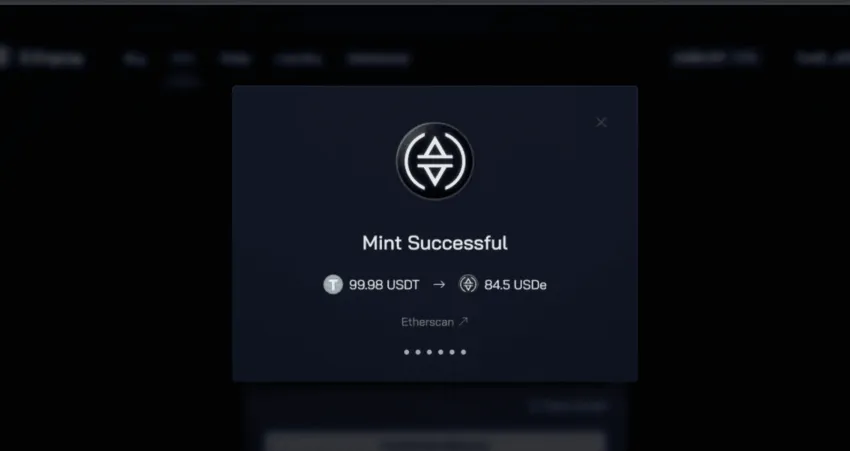

Step 5: Signing the transaction

The last wallet-specific step is signing the transaction using the EIP712 style signature. This cryptographic go-ahead can be initiated with the wallet open and hitting the “Sign” option. This way, you can approve transactions on the mainnet.

Step 6: Approving the mint

Signing the transaction is akin to approving it. After that, the minting will be approved, and after a couple of seconds, your transaction should go through. You can then view the USDe in your wallet.

Things to consider

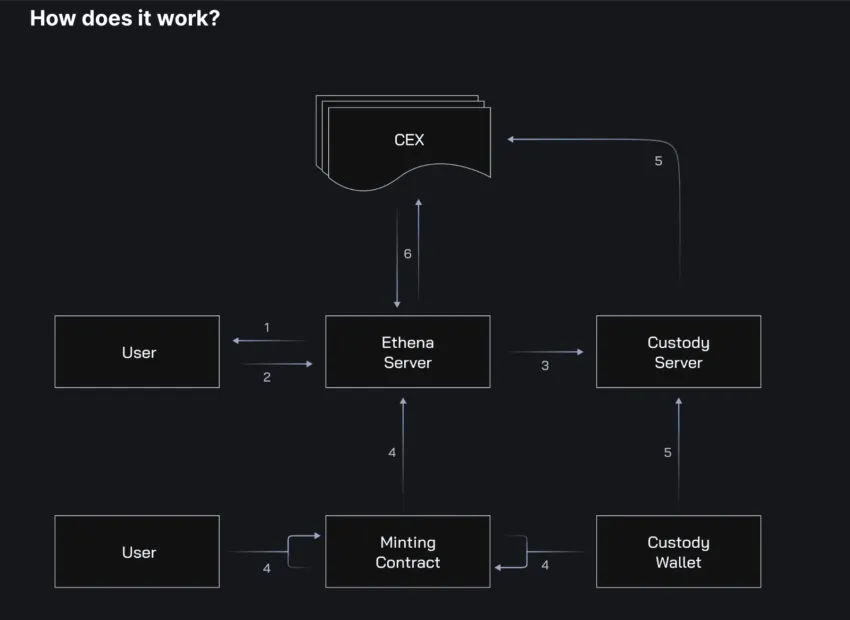

Do note that a minting contract — a set of smart contracts — is in play, which is more like a triparty agreement between the Ethena server, the user, and the custody options where the staked ETH resides.

In case the mint option isn’t visible, which might happen due to restrictions imposed by Ethena itself or due to geographical constraints, you can also use a host of stablecoins — USDT, DAI, and more to purchase USDe.

How to stake USDe on Ethena Finance?

Now that you have USDe — either bought or minted — you can focus on the next step of getting access to the Internet bond — staking USDe to get sUSDe. Here are the standard steps:

Step 1: Head over to Ethena.fi as it is the only trusted non-phishing link to stake USDe

Step 2: Connect your MetaMask wallet

Your USDe gets sent to the wallet with the count being shown on Ethena Finance. To get and stake these USDe tokens, you need to connect the wallet first.

Step 3: Head over to the staking section and stake

You can find the “Stake” tab at the top of the page. You need to click that, assign the amount of USDe you want to stake, and approve. Do note that the platform clearly defines the gas fees required for the transaction to go through and also the fact whether the process is Shard-eligible or not.

Note: Ethena Shards are like reward points, possibly meant for amplifying airdrop eligibility. These shards are credited to users when they complete specific activities within the Ethena Labs-powered DApp.

Step 4: Confirm and monitor

Use the wallet to sign the transaction and confirm the same. In most cases, the amount of sUSDe received will be lower than the staked USDe, but there is nothing to worry about as the asset-to-asset value will remain the same. Once confirmed and staked, you will receive the corresponding sUSDe tokens in your wallet.

The appreciation, courtesy of the generated high yield, can be monitored using the Ethena Finance DApp interface.

“Ethena has seen a staggering rise in its USDe token market cap, increasing almost fourfold from $91 million to $352 million since the start of 2024. The inflows can partly be attributed to USDe’s whopping 27.6% staking yield.”

Laura Shin, crypto journalist: X

Things to consider

Do note that the yield isn’t paid out directly but reflects as increased sUSDe value over time. If you have sUSDe tokens, you can further lock them up across liquidity pools to generate additional APY.

Ethena Finance even lists some pools where you can stake standalone USDe without having to acquire sUSDe first.

Ethena Protocol promises positive or zero yields as the minimum.

Per the protocol, there will never be an instance of negative yield, courtesy of the Insurance Fund.

How to redeem USDe on Ethena Finance?

Redemption on Ethena Finance can be done in one of two ways. You can redeem your USDe by unstaking the sUSDe position, and then you can give away or burn the USDe to get back the staked ETH collateral.

Let us discuss the second option first, where you can get back the staked ETH by burning USDe:

To redeem the staked ETH, you need to locate the “Redeem” option, which should be there alongside the “Mint” option. You must select the amount of USDe you wish to eliminate, sign the transaction using the wallet, and hit enter. Before making a decision, you can also view the Mint and Redemption fees on the interface.

Now, if you want to unstake sUSDe positions, you need to revisit the “Stake” option, select Unstake, enter the amount of sUSDe you want to get rid of, and hit Unstake. You need to sign the transaction again, and post-approval, the equivalent amount of USDe should be reflected in your account.

Do note that redemption isn’t the same as claiming. Every USDe token you have redeemed needs to be claimed separately after a seven-day buffer period.

Another unstaking and redemption aspect has to be related to the Ethena-based liquidity pools. Each liquidity pool you provide to, either USDe or sUSDe, might have different claiming timelines for the LP tokens, with 21 days being the most common.

Calculating the yield

Ethena kicked off with a promise of 27% APY as yield for staking USDe to get sUSDe. Let us explore and look at how this is calculated via a sophisticated blend of innovative strategies:

More on yield calculation:

Staked ETH and perpetual contracts

The staked ETH yield remains outside Ethena’s control and is controlled by the liquid staking providers.

However, this kind of yield keeps accruing inside the wallet, whereas Ethena opens short perpetual contracts on the existing staked ETH to leverage funding rate dynamics to generate yield.

Ethena uses the concept of basis spread — which is more like guessing the future price against the spot price — to further amplify yield opportunities. All these elements combine to promise high yields, which might vary depending on market conditions.

Risks associated with USDe staking on Ethena Finance

Each phase, minting, staking, and redeeming on Ethena Finance for high yields, comes with a host of risks. Let us explore each one in detail:

Minting USDe risks

- Smart contract risks

- Collateral fluctuation risks

- Liquidation risks

- Regulatory risks

Staking USDe risks

- Issues related to lock-up periods

- Yield variability

- Counterparty risks (even though Ethena mentions that staked USDe isn’t reinvested)

- Platform risks

Redeeming staked ETH or USDe risks

- High fees and withdrawal limits

- Market impact

- Slippage

- Redemption delays

Besides the mentioned risks, there are other concerns related to the high-yield promise made by Ethena Finance. These include the following:

- Yield inversion risks where the cost of managing the staking platform exceeds the rewards

- Historical concerns with Terra’s Anchor Protocol promising similar yields

- Yield management risks, especially when the funding rates concerning ETH remain negative for a long time

The sustainability concerns are normal, especially due to Terra/Luna’s implosion in 2022. However, it is important to know that unlike the algorithmic stablecoin UST, which relied on LUNA’s price to maintain the peg, USDe is backed by real collateral stored with off-chain custody service providers.

Is the Ethena Finance yield promise sustainable?

While we have discussed how to use Ethena Finance to mint, stake, and redeem USDe, the most important question remains — is the high-yield promise sustainable? With the bull market approaching in 2024 and funding rates expected to remain positive for the most part, Ethena Protocol’s delta-neutral stablecoin might be able to churn decent yields in days and months to come, especially with delta-hedging peg-maintaining strategy serving as a reliable way to generate profits for users.

Frequently asked questions

How does Ethena generate yields for USDe stakers?

What are the risks involved in staking USDe on Ethena?

Can I unstake my USDe at any time?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.