German authorities declared in an official statement the seizure of 50,000 Bitcoins acquired through copyright law violations and money laundering.

The enforcement regulators explained that two individuals have been charged along with the seizure, and a piracy portal is being investigated.

Staggering Amount of Bitcoin Seized in Germany

According to a recent statement, three enforcement agencies were involved in investigating this case: the Public Prosecutor’s Office in Dresden, the State Criminal Police of Saxony, and the Tax Investigation Unit of the Leipzig II Tax Office.

“This marks the most extensive seizure of bitcoins by law enforcement authorities in the Federal Republic of Germany to date.”

It further explained that the two men engaged in violating copyright laws. Furthermore, the “unauthorized commercial exploitation” of copyright works through a piracy website.

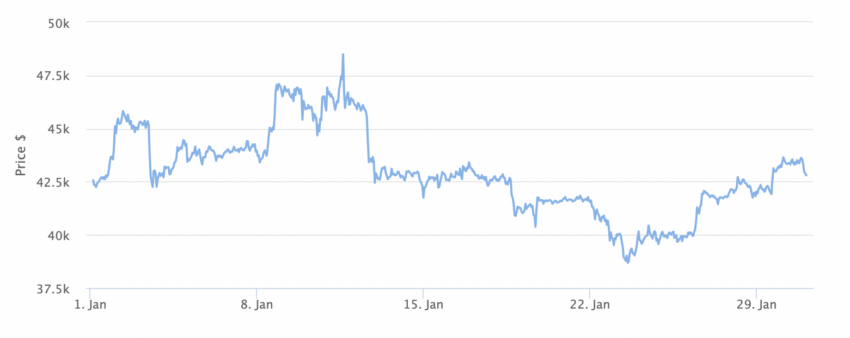

At the time of publication, Bitcoin’s price is $42,705. Therefore, the value of the 50,000 Bitcoins is approximately $2.13 billion.

Read more: Bitcoin Price Prediction 2024/2025/2030

Speculation over What Will Happen to Seized Bitcoin

However, the German government’s intentions for the substantial Bitcoin holdings remain uncertain, causing apprehension and speculation among Bitcoin holders. Concerns arise, particularly if the German authorities opt to sell, potentially impacting Bitcoin’s price.

The price of Bitcoin has already dropped approximately 10% in the past two weeks. This follows the news on January 10 that the United States Securities and Exchange Commission (SEC) had approved 11 spot Bitcoin ETF applications.

Meanwhile, BeInCrypto recently reported that some market commentators have expressed concern about the US government’s plans to sell Bitcoin seized from the Silk Road saga.

Read more: What Is A Bitcoin ETF?

This comes after the US government said it would sell around $130 million worth of BTC from sentenced Silk Road drug traffickers. Fears of massive sell pressure ensued from Bitcoin investors.

Meanwhile, the demand for Bitcoin in Germany is growing significantly.

In November 2023, BeInCrypto reported that German bank Commerzbank received a green light to offer crypto custody services after the German regulator approved its expanded license.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.