Activity in the meme coin market has gained momentum in the last week, leading to an uptick in demand for the frog-themed token Pepe (PEPE).

Exchanging hands at $0.000012, the meme coin’s value has increased by 5% in the past seven days.

Pepe Sellers May Take Action

Pepe’s (PEPE) Chaikin Money Flown (CMF) confirms the rise in the altcoin’s demand. This indicator, assessed on a one-day chart, is in an uptrend at 0.08 at press time.

This indicator measures the money flow into or out of an asset over a specified period of time. When its value is positive, it indicates the presence of significant buying pressure behind an asset’s price rally.

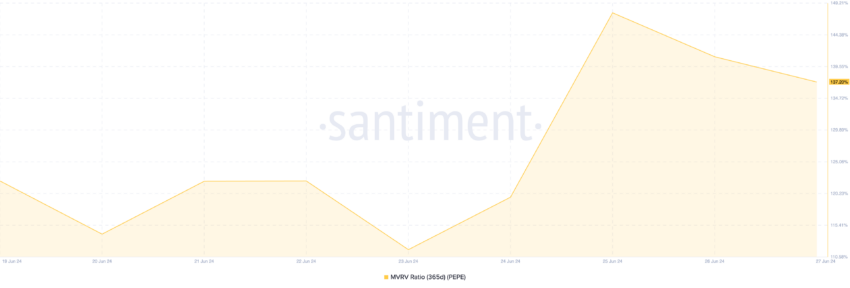

However, PEPE’s Market Value to Realized Value (MVRV) ratio hints at the possibility of a price reversal. At press time, the metric’s value is 137.20%.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

Pepe MVRV Ratio. Source: Santiment

The MVRV ratio assesses whether an asset is overvalued or undervalued. It does this by comparing the current market value of an asset to the average price at which all units were last moved on the blockchain.

When it returns a value above one, it suggests that an asset’s current market value is significantly higher than the price at which most investors acquired their holdings.

When an asset’s MVRV is above one, profit-taking activity is common. This is because it suggests that the asset has appreciated in value compared to the price at which it was acquired. Investors who hold above their cost basis interpret this as an opportunity to lock in their profits by selling their holdings.

PEPE Price Prediction: The Bulls Wield Control

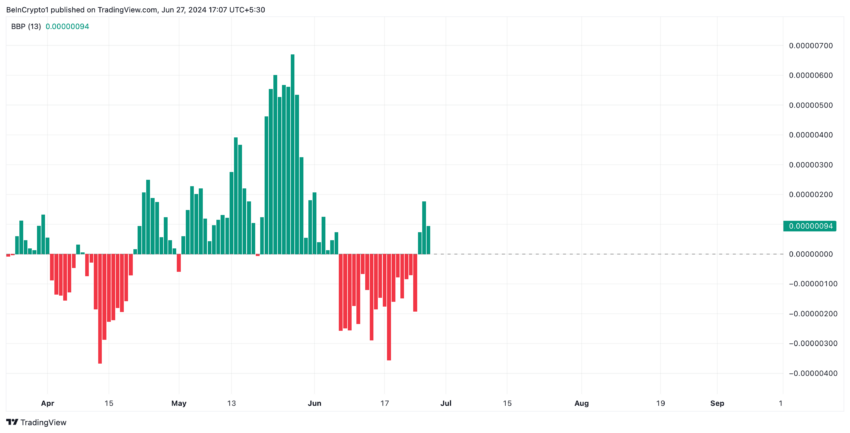

Although it remains at risk of significant selloffs, the bullish bias toward PEPE remains high. The meme coin’s Elder-Ray Index confirms this. At press time, this indicator’s value is above zero at 0.00000094.

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is positive, bull power is dominant in the market.

Further, PEPE’s rising open interest shows the surge in the demand for the meme coin. At $132 million at press time, PEPE’s open interest has risen by 20% in the past seven days.

Open interest measures the total number of outstanding futures or options contracts that have not been settled or closed. When it climbs, it suggests an influx of traders opening new positions.

If the bullish bias toward PEPE remains, the meme coin’s price will rally to $0.000013.

However, if profit-taking activity commences, it puts downward pressure on the token’s price, invalidating the above projection. PEPE’s price may then fall to $0.000012.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.