Ripple’s (XRP) price action has consistently disappointed its investors, with the altcoin noting declines since the beginning of the month

Going forward, the crypto asset could see a period of consolidation as the investors exhibit mixed signals.

Ripple Investors Seem Unsure

XRP price is noting mixed signs as whales try to initiate recovery while retail investors continue to pull back. The addresses holding between 1 million and 10 million XRP have bought over 100 million XRP in the last 48 hours.

This $47 million accumulation is crucial in initiating recovery, given that the XRP price has been trending lower and lower every day.

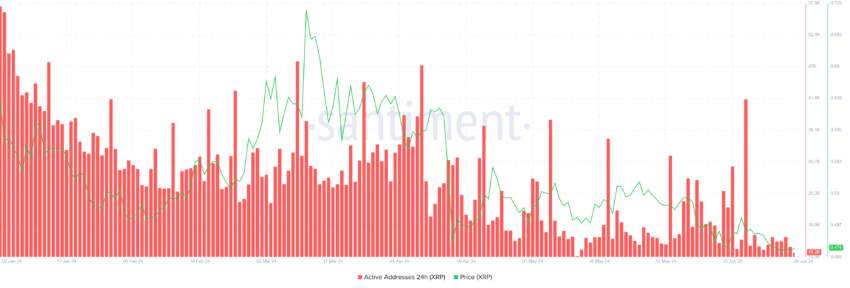

However, retail investors do not seem to share this optimism as they remain bearish. Their participation on the network remains minimal visible in the declining active addresses.

Investors are likely to refrain from conducting transactions on the network because of the lack of profits. This price and daily active addresses (DAA) divergence is flashing a “sell” signal.

If Ripple holders continue to pull back, the altcoin might face considerable resistance in initiating recovery. This could invalidate the attempts made by the whales to pull the price back up.

Read More: How To Buy XRP and Everything You Need To Know

XRP Price Prediction: Consolidation Ahead

XRP price, trading at $0.474 at the time of writing, is around the crucial support at $0.473. Despite massive accumulation by the whales, the aforementioned cues support sideways momentum for the altcoin.

This would keep the crypto asset restricted between $0.473 and $0.516. The latter coincides with the 23.6% Fibonacci Retracement, which is known as a bear market support floor. The chances of reclaiming it are minimal, but if this happens, the XRP price could reinitiate recovery.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

On the other hand, if the $0.473 support is lost, the altcoin could end up testing the critical support at $0.460. Losing this support would invalidate the bullish-neutral thesis, resulting in further drawdown.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.