Crypto profitability isn’t only about timing the market. Instead, the blockchain arena and related cryptocurrencies rely on using on-chain data. There is a lot of cryptic data on blockchains, which, if interpreted correctly, can make life easier for traders and holders alike. This is exactly why you should know how to use platforms like Arkham Intelligence.

As an on-chain analytics platform, Arkham is different from the likes of Cipher Trace, Chainalysis, and Elliptic. While every analytics platform has its use, Arkham offers deeper investigative insights, helping users make money, provided they can read the insights correctly. Let us now focus on learning how to use Arkham Intelligence to maximize your chances of making money.

In case you simply want to get hold of the ARKM token, here are some exchanges to consider

Best for mobile app

Best for altcoins

Best spot trading fees

What is Arkham Intel?

Arkham Intelligence offers blockchain intelligence, helping you make better sense of what’s happening deep within the ecosystems. The platform itself is powered by the concepts of artificial intelligence, machine learning, and data science, making it possible for it to extract relevant data, refine it, and present the same in a readable format.

Arkham Intel can come in handy to researchers, traders, investors, and even blockchain security personnel as it supports detailed asset and chain tracking. Arkham’s proprietary AI engine — ULTRA — matches pseudonymous chain addresses with real-world scenarios, giving accurate insights. Thanks to the Intel-to-Earn economy, Arkham also works as a data-exchanging marketplace, primarily led by ARKM — the platform’s native token.

Did you know? Arkham Intelligence has raised over $12 million from esteemed investors like OpenAI and Palantir. Influential individuals including Geoff Lewis and Tim Draper are also associated with Arkham Intelligence as investors.

To reiterate, Arkham Intel is a one-stop solution to digital asset data, comprising exchange-specific insights, advances made by notable names in the crypto space, forensic chain data, and more. It is useful for tracking misappropriated or hacked funds, verifying counterparties, investigating hacks, getting ahead of the price action, and auditing transactions, among other things.

The Intel-specific earning opportunity can also be identified as pay-to-snitch, an approach where insights lead to rewards.

Unpacking Arkham’s Intel-to-Earn model

Before we delve deeper into Arkham’s Intel-to-Earn model, it is important to understand the concept better. The idea here is to leverage the collective intelligence of the crypto community, enhancing transparency. The contributors are adequately incentivized with native ARKM tokens in the case of Arkham Intel.

Mechanics and use cases driving the Intel-to-Earn model

At its heart, any Intel-to-Earn plan is about sharing services and deanonymizing the blockchain to present true insights to the users. Arkham’s Intel-to-Earn model extends its service set from deanonymizing the blockchain to transaction pattern analysis, network analysis, address clustering, web scraping, and more. And all of that contributes to research insights, law enforcement improvement, and regulatory compliance.

Imagine this: a blockchain or a protocol experienced a high-profile ecosystem hack with an unscrupulous party trying to move funds across ecosystems. Any user who can track and report the same to Arkham Intelligence receives ARKM tokens and ends up thwarting the hacker’s attempt.

Another use-case of the Intel-to-Earn model is extensive chain analysis, precisely for investment purposes. Investors looking for the next 100x asset can use Arkham’s chain intelligence to analyze asset flow, activity, and other burgeoning trends. In this discussion, we will primarily focus on the money-making use cases of Arkham Intelligence.

Now that the Intel-to-Earn model is clear, let us understand how Arkham empowers the crypto space.

The role of Arkham in the crypto space

As mentioned earlier, Arkham intelligence aids with data democratization and offers advanced tools to interested parties. Plus, it also makes room for community-driven insights, all while helping gauge the impacts created by prominent figures like Elon Musk and more. Here is a simple explanation of how it works.

Imagine Elon Musk tweeting something pro-dogecoin, resulting in a surge in market movements. Arkham Intelligence helps give context to this surge by analyzing the same in terms of transaction flows, traders, activity, and more.

Arkham and a crypto use-case

In case you are still unsure about the capabilities of Arkham Intelligence, here is a hypothetical use case where the focus is on preempting the meltdown of the Do Kwon-led Terra ecosystem. Here is how you could have used Arkham Intelligence to flag this event.

Here is what happened:

The Terra ecosystem, led by its algorithmic stablecoin UST or TerraUSD, imploded, leading to massive capital erosion. However, Arkham could have predicted this via the following strides:

- Early warning via on-chain analysis, with a focus on heightened transaction volumes.

- Deanonymized wallet addresses courtesy of the revealed wallet holdings of the major stakeholders, including Do Kwon.

- Monitoring the balance history of key LUNA whales

- Setting high-transaction or exchange inflow alerts

And more. Overall, Arkham Intelligence, as a comprehensive blockchain analytics ecosystem, could and still can play a role in identifying key financial implosions and meltdowns.

“Firmly believe on-chain analytics helped a lot of folks get through the “mini-bear” market over summer.

Makes me really feel like continuing to push out content through all the scrutiny/doubt was worthwhile.”

Will Clemente, Co-Founder of Reflexivity Research: X

How to earn via Arkham Intelligence

Before we delve into the details, let us enlist the tools while Arkham-led earning is possible. These include the following:

- Monitoring on-chain activity using Arkham

- Using the AI-powered ULTRA engine to read analytics better

- Using ARKM tokens to earn more

- Be a part of Arkham’s Intelligence Exchange

Throughout the subsequent sections, we shall discuss each tool in detail.

Using Arkham’s on-chain analyzing capabilities

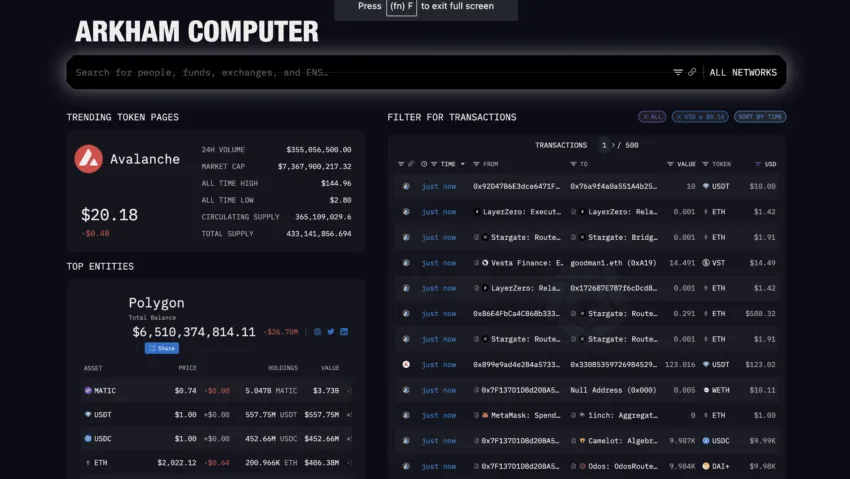

Once you head over to Arkham, you can use the dashboard to track and look for insights specific to a given entity. For instance, imagine us tracking Polygon using Arkham. You can check the portfolio of the entire Polygon ecosystem, chain-specific holdings, the profit and loss exposure of users, and more.

You can utilize these insights to make trading-related decisions and make money. Also, you can customize the look for a dashboard to prep it towards capturing specific insights. Plus, while accessing the dashboard, you can head over to the transactions section, zero in on a specific address, and learn more about its holdings and other insights to amplify your trading capabilities.

Another element that you can leverage is the Arkham Tracer. If you have recently come across a new address or an address that has been moving funds at a clip, you can feed this information into the tracer to know about it. This way, you can preempt movements for trading or gain necessary insights for fulfilling the bounties — which we will discuss in the next section.

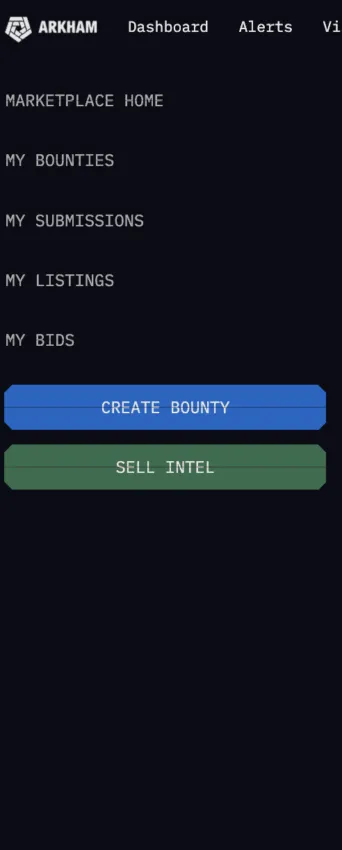

Earning through the Arkham Intel Exchange

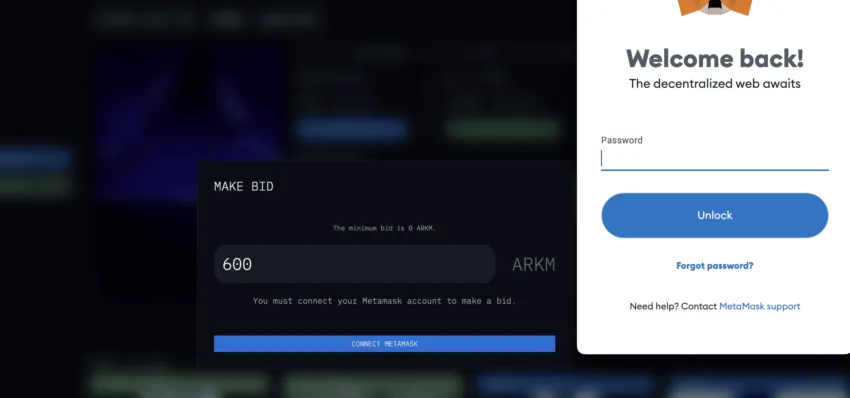

Arkham’s Intel Exchange is probably the most rewarding aspect of Arkham’s Intel-to-Earn model. To get started, you simply need to create an account and connect your wallet. You can pick pre-cooked or available data or participate in bounties, thereby taking part in challenge-based analysis and intelligence activities.

Here is what a bounty looks like:

Once you have successfully fulfilled the bounty-related activities, you can submit findings and stand a chance to get a reward. You can even create bounties or sell intel to start earning directly.

Leveraging the Arkham AI as an earning opportunity

While the mentioned strategies can help you earn, you can even use Arkham’s extensive list of AI capabilities to further your chances of being profitable. Arkham offers address matching to understand the real-world individuals behind specific transactions, access to APIs for setting up independent analytics solutions, and tools for fulfilling bounty requests.

Besides the mentioned traits, Arkham also lets you access a visual tool in the Visualizer, which offers a graphical representation of the on-chain activities related to a given token. The Visualizer helps with Network analysis, works with volume and time-based displays, and even allows filter-based customizations.

Another element of Arkham AI is the Oracle section. This is where the Arkham chatbot resides, helping you get any type of data you seek via prompts. You can ask about token unlocks, airdrops, and other instances that can impact the price of a token if studied and comprehended correctly.

Setting up Arkham alerts to maximize earning potential

Another cool feature associated with Arkham Intelligence is the ability to set up customizable alerts. While there are pre-set alerts that you can customize and build on, creating a new alert by setting up wallet IDs, USD value of the transaction, token value, concerned chain, and more allows you to set up whale transactions. These alerts can help you track smart money movements, giving you that trading edge.

What is Arkham token?

While we have discussed most of the Arkham-led earning strategies, the native ARKM token can also make a compelling case. Whenever you fulfill bounties or other challenges, you are incentivized with ARKM tokens.

Plus, the native token of the blockchain intelligence platform is tradable and also allows you to earn if and when the price appreciates. And the Arkham token can also help you gain an edge with the ecosystem governance,

In case you simply want to get hold of the ARKM token, here are some exchanges to consider:

Binance

KuCoin

Getting started with Arkham Intelligence

Now that you know how to use different elements and components of Arkham Intelligence to make money, the next thing you need to do is set up an account. To get started, you simply need to verify your email ID, connect a MetaMask wallet, and start using the analytics-specific services. In case you only want to track tokens and certain basic insights, such as profit-loss statements, the free account seems more than adequate.

However, professionals can opt for the $299/month plan with access to customer research and alerts. A quick starter plan is also priced at $99/month. It offers access to entity identification, visualization, address clustering, and other features, all of which can help you get started with analysis.

If you wish to make money using Arkham Intelligence’s Intel-to-Earn model, opting for a paid plan makes more sense. This is precisely to get access to more actionable info.

Make the most of Arkham Intelligence

As analytics tools go, Arkham Intelligence packs a punch. We urge you to try out the token-specific dashboards, Oracles, or rather the Arkham-bot, Tracer, or the Intelligence exchange. A hands-on look at all these Arkham-specific features will help you make money with Arkham Intelligence. Of course, profit is never guaranteed. However, this top-of-the-line blockchain intelligence firm offers valuable insights for the wily investor and can certainly give you a leg up in the information stakes.

Frequently asked questions

What is the Arkham platform?

How do I connect Arkham to MetaMask?

Where is Arkham Intelligence located?

When was Arkham Intelligence founded?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.