TRON founder Justin Sun announced that his team is developing a stablecoin solution to increase institutional adoption of such assets.

On July 6, Sun revealed that a gas-free stablecoin solution will launch on the TRON network in the fourth quarter of this year.

Gas-Free Stablecoin Solution

Sun explained that this innovation means users will not need to pay a gas fee for stablecoin transactions. Instead, the stablecoins will cover the fees themselves. This solution will initially be available on the TRON Network before expanding to Ethereum and other Ethereum Virtual Machine (EVM)-compatible public chains.

“Our team is developing a new solution that enables gas-free stablecoin transfers. In other words, transfers can be made without paying any gas tokens, with the fees being entirely covered by the stablecoins themselves,” Sun stated.

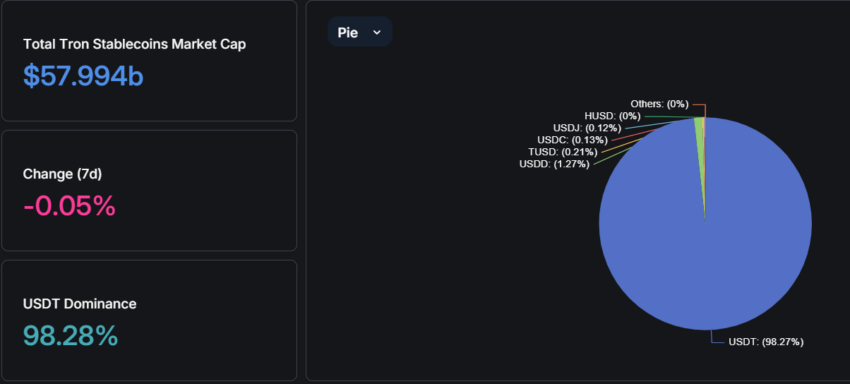

Sun added that this development could help TRON become the first blockchain to surpass one billion addresses. TRON gained prominence by offering affordable stablecoin access, making it the second-largest network for such assets after Ethereum. TRON controls around 36% of the stablecoin market, with Tether dominating 99% of its $58 billion stablecoin supply.

Read more: A Guide to the Best Stablecoins in 2024

Despite facing regulatory challenges and allegations of misuse by fraudsters, Sun believes this solution will further drive institutional stablecoin adoption. Over the years, stablecoins have become one of the most successful real-world applications in the emerging industry, especially after payment giants like PayPal launched theirs.

Stablecoins, typically pegged to the US dollar, offer a stable alternative to volatile digital assets like Bitcoin. In emerging markets, crypto users use these assets to hedge against depreciating national currencies and as a payment method for goods and services.

Read more: 10 Platforms That Provide the Best Interest Rate on Stablecoins

Market experts predict that demand for these assets will continue to grow. Visa notes that this growth is helping it catch up with established settlement networks. Due to this, regulatory efforts in various countries, including the United States, aim to bring these assets into compliance due to their high adoption rate.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.