Polygon’s (MATIC) price is taking the bearish way forward as the altcoin seems to be losing the support of its investors.

From the whales attempting to sell their holdings to the increasing volume of losses, MATIC is not looking too good.

Polygon Investors Lose Confidence

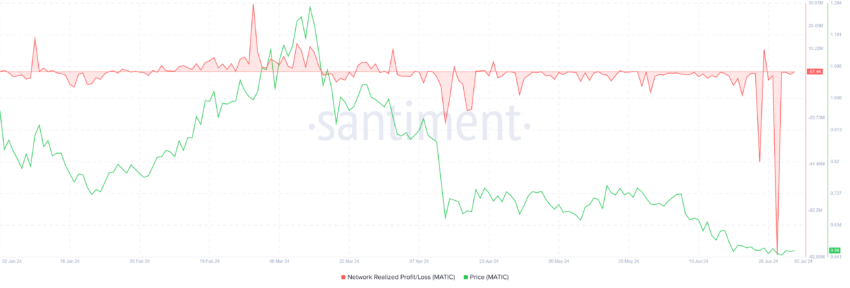

As MATIC price continues to descend it is creating more and more bearish conditions for the investors. Signs of the same can be noted by spikes in Realized losses over the last couple of days. This indicates a significant increase in the number of investors selling their assets at a loss.

This trend suggests that the selling sentiment is prevalent in the market. Many investors are likely reacting to recent market conditions by liquidating their holdings.

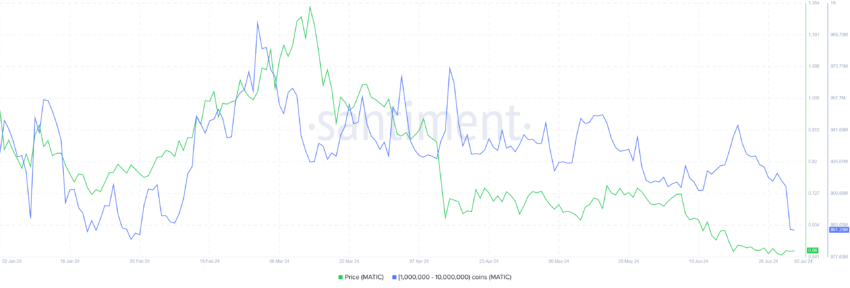

This theory can be practically observed in the way whales are moving their holdings. Over the last four days, whales have sold about 28 million MATIC, worth more than $14 million, to the exchanges.

The addresses holding between 1 million and 10 million MATIC have been offloading their MATIC, bringing it down from 944 million to 891 million at the time of writing. This development is concerning since whale investors tend to have a considerable influence on the price.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

As these whales continue to sell, the price could drop further, extending the losses MATIC holders bear.

MATIC Price Prediction: How Much Farther?

Trading at $0.55, MATIC price is already at an eight-month low. It is currently holding above the crucial support level of $0.53, which has been broken only twice in two years.

Based on the aforementioned factors and increasing bearishness, it appears that MATIC could break below this support again. The likely outcome will be a drop to $0.50, as anything below that could result in overselling.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

Nevertheless, since this level has been tested before, if the MATIC price bounces off of it, it could reclaim $0.60 as support. This would invalidate the bearish thesis, pushing the price further up.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.