Have you ever wondered, what is blockchain tokenization? Tokenization has been around for a long time. To give a very broad definition; a token is a representation of something within its particular ecosystem. For example, a poker chip would have no value other than in the casino where it was issued.

Methodology

Our process for selecting the top platforms to purchase tokenized assets was conducted over a period of six months. The requirements for selecting each platform mainly revolved around the support for tokenized assets, in addition to any other features.

INX for purchasing security tokens

INX is an exchange that stands out, as it is one of few exchanges that has gotten SEC approval for security tokens. In addition to offering security tokens, it is also a launchpad for companies that wish to launch tokenized assets. INX also doubles as a spot trading exchange where you can purchase a dozen assets.

- SEC approved

- 0.3%/0.4% maker/taker fee

- 12 cryptos and 7 security tokens

Angelo for buying tokenized art

Angelo is a platform that tokenizes art and creates a marketplace for buyers and sellers of art. It was chosen because it creates an approach for creators to fractionalize ownership of their artwork to sell to interested parties.

- Fractionalized NFTs

- 1% trading fee

- Mint tokens right on the platform

Ark7 for investing in real estate

Ark7 is one of few platforms that have created a successful model for investing in shared real estate without the complex financial structures of a REIT or equivalent investment vehicles. Users have a lower barrier to entry when using fractionalized real estate investing.

- Fractional real estate

- One-time 3% fee

- SEC-approved

The aforementioned options for purchasing tokenized assets reflect the top choices. This process was peer-reviewed and fact-checked for accuracy. To learn more about BeInCrypto’s Verification Methodology, please navigate here.

What is tokenization in the world of asset management?

In asset management; tokenization offers us an entirely new way of thinking. Until the idea of asset tokenization came along, the only way to manage money involved several elements, third parties, legal agreements, all of which can be time-consuming and lacking in both security and transparency.

The boom of modern, decentralized digital tokens began in 2009 with the creation of Bitcoin. This became the very first digital asset of value that you could send via the internet without the need for a specific third party approving the transaction.

A token, in general, is a representation of a specific asset or utility. You may encounter “tokens” in your everyday life. Examples of tokens are car titles, the deed to a house, or even the tokens that you receive at an arcade.

Top platforms for buying tokenized assets

Tokenized assets are still a niche asset class offered by companies. You may not know where to start if you want to gain exposure to these types of products. However, here are a few companies making these revolutionary products available to everyday people.

INX is a fully regulated financial marketplace that makes trading security tokens and other cryptocurrencies easier. You can trade a number of security tokens on INX.One, such as MSTO, BCAP, SPICE, PRTS, and others. As per regulatory requirements, only USD pairs for the same are supported at this time.

Angelo

Angelo is an NFT platform leveraging blockchain technology to transform the art acquisition and viewing experience. It’s designed to democratize access to modern art, enabling artists and galleries to connect directly with enthusiasts and collectors.

Ark7 is a tech-enabled, SEC-qualified fractional real estate investing platform. With it, investors can enter the real estate market without having to purchase a real estate investment vehicle (REIT) or exchange-traded fund (ETF). It exposes people to real estate through fractional NFTs.

How does blockchain tokenization work?

Tokenization was developed across industries as a way to pay without transferring any sensitive data. This is achieved by the data receiver issuing a sequence of characters that represents the data sent and then returning that sequence to the provider. These references or ‘tokens’ only hold value in their given context, and that’s what gives them their secure properties.

The introduction of Ethereum in 2015 brought with it new ways to use tokens. They enabled developers the ability to build their own tokens and meant that blockchain could be used for so much more than just cryptocurrency. People could develop their own projects and decentralized applications (DAPPS) through smart contracts.

Tokenization, in the context of blockchain technology, is the process of converting something of value into a digital token that can be used on a blockchain application. In doing so, users are able to transfer real world assets onto the blockchain.

What are the main uses of tokenization?

Property investment

- Real estate has a vast market size; in a tokenized market, everyone can buy a stake in a property. This may look like REITs, also known as real estate investment trust or fractionalized NFTs.

Asset management

- Tokenization allows you to break up assets so that people can own fractional parts of a share.

Contracts

- We can track, store and share information, tokenizing the terms and conditions that are associated with a contract.

Applications and games

- Gamers feel like they’re working towards a goal, tokenization offers an entertaining way to fulfil this while increasing user engagement as players get rewarded with virtual assets.

Categorizing tokens:

As new tokens are being developed all the time, it is essential to make some distinctions between utility tokens and a tokenization security —the most common types of tokens. To continue, the main difference is the intended use of the token:

Utility tokens represent the future right to a service or product provided by the token issuer. They are not created as an investment but intended to be used more like a coupon for a developing product. An example of a utility token is Filecoin: They raised $257 million by selling tokens to enable future users to access their cloud storage platform.

Security tokens represent a claim on an external asset or cashflow and so are used as investments. These sorts of tokens are subject to federal laws and regulations, which, if not complied with could result in the whole project being stopped. However, if all the rules are adhered to, security tokens have the potential to be used for so many applications.

- Token holders get shares in the company, every time profits in the market are made, they will receive more coins.

- Some investors are even able to have a say on the company’s development through functions offered by blockchain.

Blockchain tokenization frameworks

Tokens are assets in the blockchain ecosystem that allow information and value to be transferred, stored, and verified in an efficient and secure manner. Furthermore, these crypto tokens can come in a variety of shapes and sizes. All can be programmed with unique characteristics that expand their use cases.

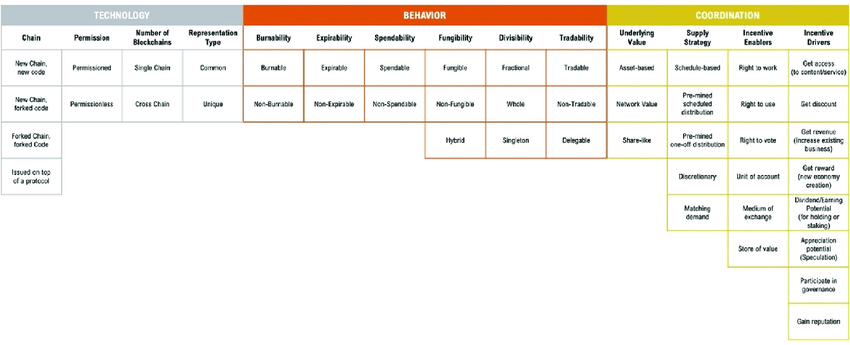

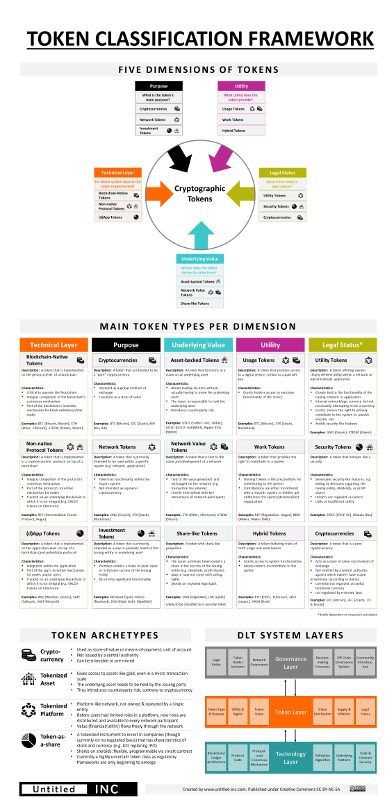

Blockchain tokenization is a field that constantly innovates. As a result, there are few frameworks for understanding tokenization. However, there are some like the Token Classification Framework or the Morphological Token Classification Framework . These frameworks help to cultivate a better understanding of blockchain tokenization.

Comparatively, the key difference between the two is that the Token Classification Framework takes into account the legal status of the token, whereas the Morphological Token Classification Framework does not. Ironically, both classify tokens as well as coins.

What does the future of blockchain tokenization look like?

Undeniably, as more developments are being made and issues resolved, people are opening up to the idea of tokenized assets and services. It’s clear that this is only the beginning of the potential uses of tokenization.

Frequently Asked Questions

What are tokens on the blockchain?

What are examples of tokens in the real world?

What are the most common types of tokens?

What are the different token frameworks?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.