The cryptocurrency market has recently witnessed the 2024 Bitcoin halving, an event that significantly reduces the reward for mining BTC by half, aimed at limiting its new supply.

This pivotal event, the fourth since Bitcoin’s creation, has stimulated extensive discussions about its implications for miners, investors, and the broader market landscape.

Bitcoin Miners Upgrade

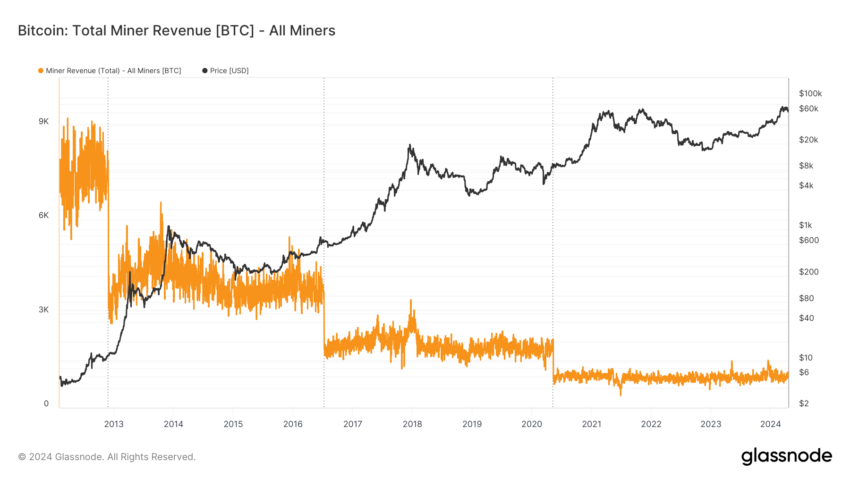

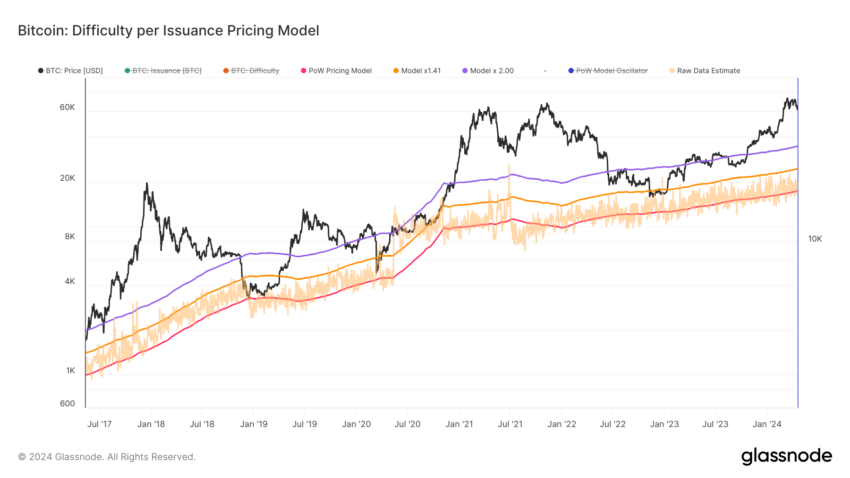

As the block reward halved from 6.25 BTC to 3.12 BTC, miners initially face significant challenges. Omar Lopez, Founder of Cripto It Club, shared with BeInCrypto that a portion of the miners will be compelled to shut down their operations as continuing becomes economically unfeasible. Some will even find themselves operating at a loss.

This scenario embodies a form of game theory, according to Lopez. Initially, if 1,000 miners are profitably mining 6.25 BTC, the profitability equation shifts dramatically post-halving when the reward drops to 3.12 BTC, spread among the same number of miners. This change forces those miners who cannot sustain losses to cease their operations.

Eventually, this attrition might reduce the number to, say, 600 miners. For these remaining miners, the reduced competition for the 3.12 BTC could restore profitability, stabilizing the mining landscape.

“Miners follow the price of Bitcoin, not the other way around. If the price of Bitcoin is low and it’s not profitable to mine, several miners will turn off their machines. Until it becomes profitable for those remaining to compete for the 3.12 BTC. Game theory in all its glory,” Lopez explained.

For this reason, some Bitcoin miners are increasingly investing in state-of-the-art technologies. Hao Yang, Head of Financial Products at Bybit, highlights the strategic shift towards more sophisticated mining solutions.

Many miners upgrade their equipment to newer models that deliver greater mining power with reduced energy consumption. This strategy is typically feasible for the more professionalized Bitcoin miners who possess the necessary capital.

By doing so, they are able to enhance their profitability, particularly during the challenging initial days following the Bitcoin halving.

“Miners are focusing on energy efficiency and diversification by investing in next-generation equipment like three nanometer mining rigs, which can increase hash rate to 3.4 exahash per second, enhancing capacity without a proportional increase in energy consumption,” Yang told BeInCrypto.

This upgrade not only aids in sustaining operations but also contributes to overall efficiency in the mining process. Therefore, it ensures that miners remain competitive post-halving.

Read more: Free Cloud Mining Providers to Mine Bitcoin in 2024

Further emphasizing sustainability, miners are adopting energy-efficient technologies and integrating their operations into broader energy systems. This approach includes exploring renewable energy sources such as solar and wind, and even harvesting energy from waste products.

These are becoming popular options to reduce the environmental impact of mining operations.

Rampant Demand for BTC

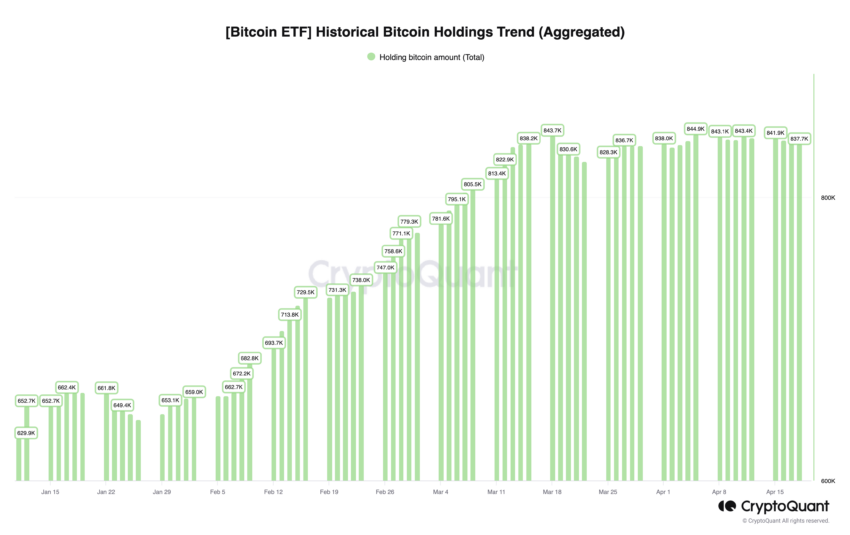

Moreover, Yang notes significant changes in the Bitcoin market’s structure, particularly with the introduction of Bitcoin exchange-traded funds (ETFs). These have played a crucial role in merging Bitcoin with traditional financial markets.

“The ETFs have been an important way that traditional investors can interact with Bitcoin as a portfolio diversifier in a way that is regulated and familiar. In this sense, these financial instruments have proved that Bitcoin is here to stay, that it’s not going to zero, that it can and will play a part in our future financial system,” Yang added.

This integration has not only stabilized price volatility and demonstrated Bitcoin’s enduring presence in the financial ecosystem. It has also opened the floodgates to meet the growing demand from institutional investors. Collectively, spot Bitcoin ETFs now hold over 837,700 BTC, worth $53.61 billion.

Consequently, this has significantly enhanced market liquidity, according to Mauricio Di Bartolomeo, Co-Founder of Ledn.

“This is the first halving where spot Bitcoin ETFs are live in the market, unlocking an avalanche of institutional demand. So far, it looks like the conditions are set for this halving to have a similar impact on price as previous ones have,” Di Bartolomeo told BeInCrypto.

Although immediate price surges post-halving are not always evident, the general consensus is that the halving will positively impact Bitcoin’s value in the long run like it has done historically.

During the initial Bitcoin halving on November 28, 2012, the price stood at $12 and later soared to a high of $1,242, representing an impressive increase of 9,937%. The second halving, which occurred on July 16, 2016, started with Bitcoin priced at $664, and it ultimately climbed to $19,804, reflecting a 2,903% rise. The latest halving, dated May 11, 2020, saw Bitcoin at $8,571, with its peak later reaching $68,997, an increase of 705%.

“Historically, price movement has been fairly muted around the halving itself but there has been a major price run-up 9-12 months afterwards. This seemed to be driven by Bitcoin miners earning less Bitcoin to sell on the market, relative to the demand for Bitcoin. As such, the halving has been a ‘buy after the news’ event,” Andy Fajar Handika, CEO at Loka Mining, told BeInCrypto.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

As Bitcoin evolves post-halving, the introduction of new, more energy-efficient mining technologies and strategies will likely continue to shape the industry. These advancements are crucial for maintaining the stability and long-term sustainability of the Bitcoin network, reinforcing its position as a fundamental component of the future financial system.

With each halving, Bitcoin takes a step closer to its eventual supply limit, underscoring its unique economic model and its potential to continue influencing the global financial system.

Trusted

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.