Bitcoin mining operations reached unprecedented daily revenue levels immediately following the halving, dispelling concerns over their viability.

According to available data, miners collectively earned around $107 million from block rewards and transaction fees. This figure significantly surpasses the previous record of $77 million established in April 2021.

Why Bitcoin Miners’ Revenue Soared

The lion’s share of this earning, approximately 75% or $80 million, stemmed from transaction fees. The remaining $27 million originated from the block subsidy. Notably, Bitcoin miners earn compensation for validating transactions and solving blocks.

A striking trend emerges when examining Bitcoin’s top 10 most valuable blocks in terms of US dollar value – the majority were mined post-halving. The first halving block alone raked in $2.6 million in fees and block rewards, nearly clinching the top spot. Subsequent blocks boasted values ranging from $1.3 million to $2 million.

“The first 77 blocks of epoch 5 have generated $75 million in miner revenue. For reference, the final 77 blocks of epoch 4 generated just $35 million. The halving? More like the doubling,” Baylor Landing, a director at Bitcoin miner Core Scientific said.

Read more: What Are Mining Algorithms and What Purpose Do They Serve?

The surge in revenue can be attributed to the heightened minting activity of the newly launched Runes protocol. This protocol introduces meme coins into the Bitcoin blockchain and deviates from the BRC-20 token standard using an Unspent Transaction Output (UTXO) model. It facilitates altcoin creation through an “etching” process directly on the network.

Data indicates that Runes’ introduction spurred a spike in Bitcoin network activity, leading to congestion and increased fees. A Dune analytics reveals that Runes transactions accounted for 57% of all transactions, totaling over 12,200 BTC post-halving.

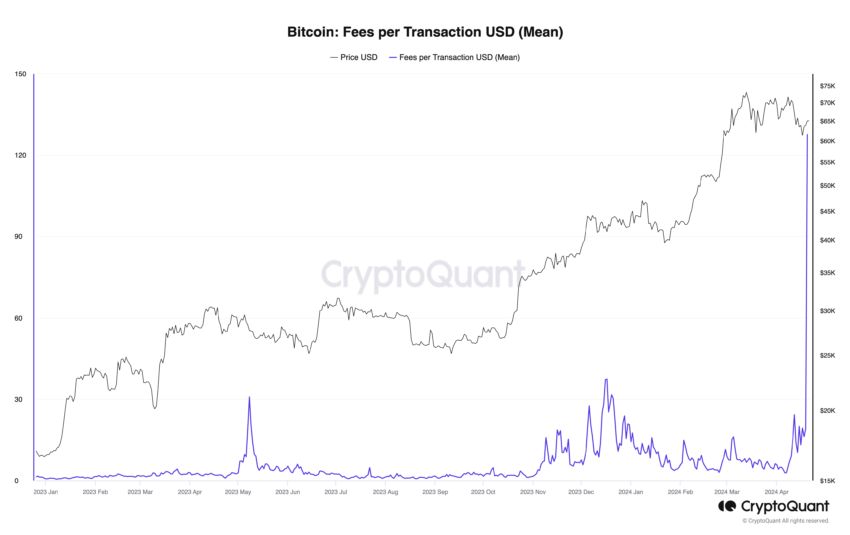

Despite the surge in transaction fees, experts note a decline in average fees compared to 2017 and 2018. Julio Moreno, CryptoQuant’s Head of Research, underscores this point, emphasizing that average transaction fees remain lower even amid heightened Rune activity than in previous years.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.