Once valued at $32 billion and the third-largest crypto exchange by volume, FTX had more than one million users before its rapid implosion in 2022. The astonishing meltdown reverberated across the crypto sector, taking down a handful of debtors and causing a wider market crash. Is any entity in crypto too big to fail? This guide explores the reasons behind the FTX collapse, its longer-term impact, and the current state of affairs in 2024.

Want to learn first about critical events in crypto, move fast and stay safe? Join BeInCrypto Trading Community on Telegram: there we share not only technical analysis and answers to your questions every day, but also flash insights on market movements and alerts! Join now.

- Unraveling one of crypto’s largest failures

- What happened and what is happening with FTX?

- 2022: A year in review

- FTX hackers revealed

- What’s happening in 2024?

- What is (was) FTX way before the collapse?

- What is the FTT token?

- Who is Sam Bankman-Fried?

- Unpacking Alameda Research

- FTX collapse explained

- Who’s been affected by the FTX collapse?

- The impact on the broader crypto industry

- Altruism or meanness?

- Frequently asked questions

Unraveling one of crypto’s largest failures

The FTX collapse was not a one-day event. It unfolded over nearly two weeks, with new developments at every turn. We may still not have seen the end of it. This collapse raises several questions: How did FTX get to this point? What will happen to the customer funds stuck in FTX? When will the market stop feeling the shockwaves from this event?

We aim to answer these questions to help you understand the FTX collapse and its reasons. It’s important to note that the trouble didn’t come out of nowhere. FTX was a ticking time bomb. Why do we say this? Read on as we delve deeper into the details.

What happened and what is happening with FTX?

Well, before we proceed, we have to tell you that this is going to be a long read. So if you are pressed for time, here is a quick rundown of the details.

The buildup (May 2019)

Back in 2019, when FTX came to be, Alameda Research was already around. As per Nansen — a blockchain analytics platform, there never existed a clear demarcation between the two. One man, at the center of two firms — one managing funds and one “using” it (speculative), is not a story that ends well.

Plus, FTX participating in hype advertising might have shown them in an overconfident light. Having an FTX Arena in the Miami area as part of a $135 million deal to bring Larry David in a hubristic ad, FTX and FTX CEO garnered a lot of eyeballs.

The first nail

TerraUSD crashing was the first nail in this coffin. Nansen’s on-chain investigation reveals that during the UST crash, massive FTT outflows from FTX were seen. So, was Sam Bankman-Fried using FTT tokens to bail out companies?

Or, while the market was crashing, user FTT tokens were sent over to Alameda Research using a backdoor to take short positions? Many questions, muddled answers!

The crescendo

October end saw crypto exchange moguls throwing jibes at each other, with Changpeng Zhao commenting on SBF’s stance on DeFi and SBF retorting sharply by bringing in the U.S.-China tensions into the mix.

November 2

CoinDesk reveals Alameda Research’s balance sheet.

Talking points:

- FTT is the major holding

- SOL is the second most significant holding

- BTC, ETH, Fiat…. What’s that

November 6

Binance and Changpeng Zhao decide to sell FTT holdings, comparing a brewing scenario with the TerraUSD debacle. By the way, Binance once invested in FTX, and when the divestment happened, it got a handful of FTT tokens.

Talking points:

- The announcement brought panic, and FTT prices started declining

- Caroline Ellison — CEO of Alameda Research — wanted to buy the ones CZ was offloading

November 7

SBF tweeted that FTX assets are fine. None of those tweets exist on his handle, but you will find them when you read further. From arguing, the crypto moguls suddenly started talking about a partnership:

Binance tweeted that it would look at FTX’s book and then decide if it wanted to buy the exchange or not. Even SBF tweeted this and said that all that’s stopping Binance from taking over FTX is a simple DD or Due Diligence. Well, it wasn’t that simple.

The FTX collapse

FTX had to close shop between November 8-11. Here’s what happened:

- Binance said no to buying FTX

- FTX paused withdrawals

- Markets plunged

- FTX and its affiliates filed for bankruptcy

Still unsure about the FTX-Alameda schematics. Here is an FTX collapse explainer as seen on Reddit:

2022: A year in review

The hack

On Nov. 11, 2022, following the bankruptcy filing, FTX wallets (including those in the U.S.) experienced wallet hacks. Over $663 million was drained. While some appeared as withdrawals, approximately $450 million was likely stolen. The hacker, who had not been identified, might have utilized Kraken to transfer funds.

Furthermore, the hacker made multiple hops to shuffle funds around undetected. At that time, he held $288 million in funds, all in ETH, after swapping stablecoins for them. The hack diminished the prospects of retrieving customer funds. Nevertheless, investigations continued.

Regarding the aftermath, the current CEO, John Ray III, was astounded. He remarked that he had never witnessed such a catastrophic failure. He believed this situation was worse than Enron’s bankruptcy. Given his experience managing Enron’s restructuring, he was well-placed to judge the extent of FTX’s downfall.

FTX hackers revealed

On Jan. 24, U.S. federal prosecutors charged Robert Powell, Emily Hernandez, and Carter Rohn for conducting a SIM swap attack, thereby fraudulently acquiring the identities of 50 individuals. This led to the defunct FTX exchange losing $400 million in crypto assets, according to Bloomberg.

By using an employee’s account, the group illicitly moved these funds across various exchanges to launder the money. Authorities have labeled this scheme an ‘insider job,’ which involved the attackers using SIM swapping to hijack victims’ mobile numbers and bypass two-factor authentication, thereby accessing and emptying cryptocurrency wallets.

Authorities have arrested the trio, charging them with identity theft, access device fraud, and conspiracy to commit wire fraud.

What’s happening in 2024?

CNBC reported that on March 28, 2024, a Manhattan federal court sentenced Bankman-Fried to 25 years in prison, a term significantly shorter than the 40 to 50 years federal prosecutors had sought but far exceeding the five to six-and-a-half years his lawyers recommended. Additionally, he will have to pay the U.S. government $11 billion in forfeiture.

The judge, reflecting on his 30 years of service on the federal bench, remarked that he had never witnessed trial testimony quite like Bankman-Fried’s. While Bankman-Fried acknowledged some responsibility, he maintained that his exchange’s customers would eventually recover their funds. He attributed the delay in making customers whole to the federal bankruptcy court’s actions.

“There is a risk that this man will be in a position to do something very bad in the future.”

Judge Lewis Kaplan

Bankman-Fried’s family expressed that they were heartbroken for their son and will continue to defend and support him.

What is (was) FTX way before the collapse?

FTX is a crypto exchange/trading platform based out of the Bahamas. Sam Bankman-Fried (SBF), an MIT graduate, founded FTX in 2019. By early November (before things got ugly for FTX), it was the second-largest centralized exchange by volume after Binance.

But wait, if FTX was only meant to be a platform for bringing crypto buyers and sellers together (what an exchange does), how did it even find itself at the center of this chaos? Let’s not get ahead of ourselves. In time, we will come to the entire story of the FTX crash.

But first, let’s see what FTX achieved in its time.

FTX had the backing of marquee investors like Temasek, Softbank, and Sequoia. And it quickly soared in terms of trading volumes, registering close to $2 billion at its peak. Led by SBF, FTX was a “Squeaky Clean” name in crypto. The platform was doing good, making a name for itself with all the promotional hype advertising that money could afford. And money was something FTX had in plenty.

It was in May 2022 when FTX expanded its vision by featuring stock trading functionality. This initiative was led by FTX U.S. — the platform’s U.S. division. FTX even had its own token, the FTT token, which was really doing well before November 2022. Plus, its sister firm Alameda Research’s Solana holdings really did great things for SOL’s price action. FTX was big and lifted everything it touched along with it.

But that’s not all that stood out. FTX promoted itself and crypto quite a lot. It even invested in and acquired several other firms during its ascendancy. Let us relive those good old FTX days when aggressive marketing was a norm for the SBF-led platform.

Currently, John Ray III, a restructuring expert, has taken over from Sam Bankman-Fried as the FTX CEO.

Naming rights

In June 2021, FTX signed a $135 million deal with the Miami-Dade Country and Miami Heat to have its name displayed in the Miami arena — the home stadium for Miami Heat — for the next 19 years. However, the deal now seems to be dead in the water as FTX has filed for bankruptcy. Getting the naming rights for the Miami area was one of the many sports sponsorship deals that took effect when FTX was flying high.

FTX’s bankruptcy led to the sign dismantling at the FTX arena.

Super Bowl ads

We do not usually see crypto companies putting up advertisement shows during grand sporting events. And that too during a bear market — no chance whatsoever! FTX didn’t think so when its hugely popular Super Bowl ad went live during the event.

The concept was simple. The ad was about one personality belittling every era-defining invention like the wheel, toilet, and even the light bulb. By the end of the ad, the personality was seen making a jibe at FTX — a safe and easy way to get into crypto. And he tops this off by saying that he is never wrong about this kind of stuff. A sarcastic yet hubristic ad that scaled up the popularity charts quickly.

FTX reportedly had to shell out over $6.5 million for that 30-sec Super Bowl ad.

Getting Larry David into the fold

FTX got Larry David — an American comedian and the co-creator of Seinfeld — for their Super Bowl ad. While Larry David predicted that FTX wasn’t the safe and easy way to get into crypto, it only looked sarcastic and funny then. In November 2022, all that sarcasm shown by Larry David makes a lot of sense, as FTX didn’t actually make it.

The Larry David ad made FTX one of the more retweeted Super Bowl brands.

Other FTX sponsorships

While the Miami arena naming right and the Super Bowl ad featuring Larry David garnered the most attention, FTX forged other sponsorships along the way. In 2021, the sponsorship agreement between Mercedes and FTX came to the fore. However, FTX’s bankruptcy now means that the deal ceases to exist.

2021 saw FTX entering the Esports arena by signing a deal with TSM — concerning the LoL (League of Legends) series. Soon after, FTX and Furia — another Esports organization — joined hands. However, the one-year Furia deal isn’t active anymore.

Also, MLB (Major League Baseball) was seen entering into a five-year partnership with FTX in 2021. That’s not all; FTX has ties to college sports, with it entering a “Naming Rights” deal with the University of California in 2021 for a hefty sum of $17.5 million.

Sporting stars like Gisele Bündchen and Tom Brady have associations with FTX, as both own stock in the company. With FTX filing for bankruptcy, the net worth of Tom Brady and Gisele Bündchen has already taken a hit.

All of that shows how active FTX was in promoting itself. Every move it made worked wonders for its FTT token.

What is the FTT token?

FTT is FTX’s native token and one of the primary reasons why the FTX collapse sped up. It is a utility token ensuring that customers get a discount on the trading fee. It even works as an exchange token, allowing users to deploy the same as collateral against future positions. With FTX bankruptcy now loud and clear, the FTT token isn’t looking all that useful at the moment.

The collapse of FTT token: reason for the FTX meltdown?

While we will come to reasons for the FTX meltdown later in this post, let us first take a closer look at the collapse of the FTT token.

But before that, let’s look at FTT’s price history:

The FTT token went all the way up to $85.02 in September 2022. Even in early November 2022, the FTT price was well above the $22 mark. Do wait, as we will discuss the significance of $22 later.

The FTT token collapse began when the ex-CEO of Binance CZ (Changpeng Zhao) announced on Twitter that Binance planned to sell off the FTT stockpile it received from FTX during divestment. He stated that this decision responded to some “recent revelations.” We will delve into those details later.

With FTX flying high and FTT doing relatively well for a crypto exchange’s native token, Sam Bankman-Fried quickly gained the tag of a crypto superhero. So, it’s only appropriate to discuss him before we go deep into the FTX exchange bankruptcy.

Who is Sam Bankman-Fried?

Sam Bankman-Fried, or rather Samuel Bankman-Fried, was the poster child of crypto for the better part of six months. Coming to the background, he founded FTX — the now-bankrupt trading and its U.S. affiliate FTX U.S. He also was one of the richest individuals in crypto and was even heralded for his willingness to jump in to aid ailing crypto firms — especially when he extended a helping hand to Three Arrows Capital and Celsius during the Luna crash. But that’s not really who he is. Let’s delve deeper into the life of a man who beckoned the darkest November in the history of crypto.

Who is he really?

There was a time when Sam Bankman-Fried quickly capitalized on the crypto frenzy and became the world’s richest when it comes to 29-year-olds. At 29, his net worth was $22 billion. The $60 billion Luna-Terra meltdown projected him as a hero. It is speculated that he saw the crisis as an opportunity to make more money whilst bailing out some affected centralized organizations.

He helped BlockFi—a crypto lender—with $750 million. While his net worth took a beating in 2022, still around $15 billion, he was looking to play the long game. However, things didn’t exactly work out as he had planned. We will see why.

Who were Sam Bankman-Fried’s parents?

SBF is the son of two Stanford professors — Barbara Fried (Mother) and Joseph Bankman (Father). He came into the crypto scene with a lot of trading background, where he traded ETFs as a part of a quant trading firm. Years later, he set one for himself. It is speculated that his father held an important position at one of his ambitious organizations.

What was his motto?

Bankman-Fried was a self-proclaimed altruist, and his motto was termed “effective altruism.” This meant that he was always more than willing to give away all his money as a selfless act.

What was the “DeFi killing“ bill?

In October 2021, Sam proposed the “Possible Digital Asset Industry Standards,” where he proposed a few crypto regulation ideas. The ideas would, in a way, limit the expansion of DeFi by adding in the following features like address blacklisting and crypto investment qualification. The crypto community termed this as a DeFi killing bill, slowly making SBF fall out of favor across the community.

Here is the draft of the bill he was speculatively floating around.

And all of that came in days following the insane donation promises to the tune of $1 billion during the 2024 U.S. presidential elections.

Donations

SBF aggressively made donations to Joe Biden’s presidential campaign in 2020 to the tune of $5.2 million. The FTX CEO even made a contribution of $16 million towards the PAC (Political Action Committee) spending in 2022. However, things went out of control when he said that his donations in 2024 could go as high as $1 billion, during a podcast interview.

First, the donations and then the DeFi killing draft! Let us connect the dots, shall we?

But these weren’t reasons big enough to force FTX into filing for bankruptcy. There was another actor involved, termed the Alameda Research.

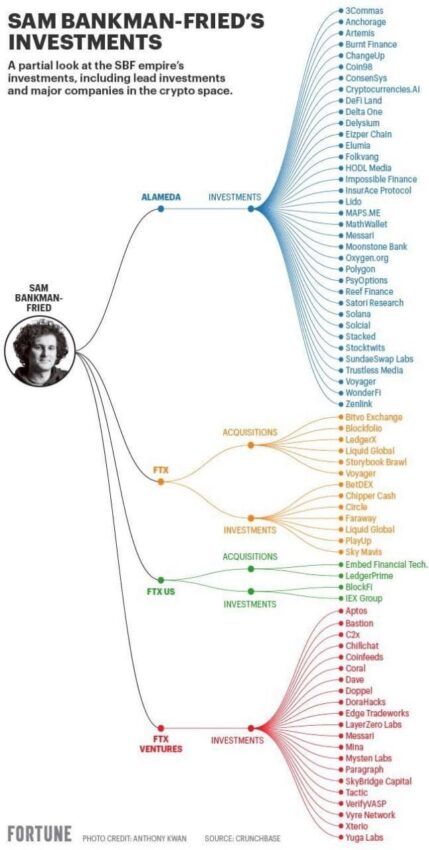

Unpacking Alameda Research

Alameda Research is a quantitative trading firm for cryptocurrencies. It is also FTX’s sister company, a hedge fund, and also SBF’s brainchild. Alameda’s BS (Balance Sheet) deficit is one of the reasons why FTX — the crypto exchange — went bankrupt. Alameda Research triggered the era-defining FTX collapse. Do remember that SBF started with quant trading before getting into crypto. Well, some wish he didn’t.

Who was in charge of Alameda Research?

While SBF envisioned Alameda, heading it is Caroline Ellison — an American executive. It was Caroline Ellison who said that Alameda would happily buy Binance’s FTT token at $22 — as Changpeng Zhao had plans to sell.

While it’s all speculative, Carolie Ellison might be SBF’s ex-girlfriend. She is a Boston native and also a Stanford graduate. Yeh, and she is also a Harry Potter fan. But that doesn’t matter, does it?

Which companies did Alameda invest in?

Alameda has always been a heavy DeFi investor. And that doesn’t align with the DeFi killing bill! Last reported, Alameda has investments in Messari, Coin98, Voyager, Zenlink, and several other firms. Data from Crunchbase suggests that Alameda made close to 185 investments over the past five years, with Fordefi coming across as one of them.

Alameda is also known for establishing DeFi deals across the Solana and Ethereum ecosystems. Here is an analysis from the on-chain analytics platform Lookonchain, citing the DeFi holdings:

IDOs and market manipulation

We did mention that Alameda was a hedge fund, right? A firm that makes money depending on the price action volatilities relevant to specific cryptos or all cryptos!

And has been speculated that Alameda used FTX’s money — the ones fed in by unwitting customers — to make the trades. Short or long, customer funds were collateral. What’s triggered most is the issues concerning joint ownership — SBF controlling both the FTX cryptocurrency exchange and Alameda research.

However, this wasn’t the first time when Alameda received some flak:

On 5 April 2022, Sasha Ivanov — CEO at Waves — made accusations of Alameda for manipulating the prices of the WAVES token. Sasha said that Alameda purposely made this happen to cover for a short position. That is to sell higher and then buy at a lower price once the value of the crypto drops. A classic case of market manipulation, many would say!

However, things didn’t end there. In October 2022, Solend founder Rooter made claims that Alameda Research sent across $100 million in funds during the November 2021 IDO, only to inflate the market cap. And close to $80 million didn’t make through in the end.

So now we have all the actors in place: FTX, FTX CEO Sam Bankman-Fried, FTX’s native token FTT, and the sister firm Alameda Research. Now let us connect the dots.

FTX collapse explained

There was some bad blood in the crypto community against SBF after the DeFi draft came into existence. Binance ex-CEO Changpeng Zhao criticized his stance, to which, on Oct. 29, 2022, SBF replied with a counter tweet that said that it’s exciting to see CZ repping for the industry in DC, but the question is, can CZ even be in DC?

That triggered off some political mud-slinging, as CZ was born in China, and SBF is from the U.S. But that’s not even the start of this fight between the crypto moguls.

In 2019, Binance was one of the first investors in FTX, as they saw potential. As FTX grew, Binance chose to divest — considering FTX a threat (speculative) — exiting with tokens worth $2.1 billion in FTT and BUSD.

The timeline of FTX collapse

The CoinDesk reveal

It all started when CoinDesk could access Alameda’s balance sheet. There were a few startling revelations:

- FTT formed a large chunk of Alameda’s holdings out of the reported $14.6 billion.

- $6.1 billion in FTT came to light, which was at least $1 billion higher than what the entire circulating supply of FTT would amount to.

- Other sizable Alameda holdings included SOL tokens — $863 million locked and $292 million unlocked.

This meant that the ties between Alameda and FTX were pretty strong, against what SBF had been emphasizing for long. It also could mean that Alameda made of customer FTT, which FTX made them buy promising discounts on trading fee.

Also, in July, Binance removed all trading fees from any BTC pair, which brought several people from other exchanges to Binance. Shilling FTT as a discount offer might have been SBF’s plan to counter it, albeit with bigger motives.

Changpeng Zhao has entered the chat

Days after the CoinDesk unveil, ex Binance CEO, Changpeng Zhao took to Twitter and said that due to the “recent revelations,” Binance has decided to sell off its share of FTT tokens.

This triggered a market-wide sell-off, badly hitting the FTT prices.

Caroline Ellison — CEO of Alameda — tried setting up a buy net by mentioning that Alameda would happily buy all the FTT tokens at $22 apiece. But it didn’t help. FTT started bleeding, and several positions were liquidated.

It was on 8 Nov. 2022 that FTT price fell under $22. It has been tail spinning since.

SBF tweets

On 7 Nov. 2022, SBF tweeted that FTX assets are fine, just to send across some hard-to-come-by optimism. However, the tweet isn’t around yet.

Even a tweet mentioning that FTX doesn’t invest its client holdings isn’t around anymore. And deleted tweets are never good!

By now, the FTT token had lost 83% of its value, and SBF’s net worth dropped to $991 million from $15 billion. By now, the FTX collapse was imminent.

Buy or no buy

FTT losing its value caused liquidity concerns for both Alameda and FTX. And the panic began to affect other digital currencies, including BTC and ETH. Moments into the day and SBF tweeted that FTX and Binance have come to a strategic arrangement.

To this, Changpeng Zhao tweeted and said that they are planning to fully acquire FTX — helping them and the entire market from the liquidity concerns. However, the deal’s fate depends on due diligence and how kosher the FTX books are. Furthermore, the letter of intent that the moguls signed was non-binding — meaning backing out was always an option.

By now, customers started having trouble with their withdrawals at FTX. SBF messaged his employees that during the past three days, FTX processed $6 billion in withdrawals and thereby putting a pause on the same in the near term.

After seeing that the FTX balance sheet wasn’t all that kosher, Binance backed out of the deal, leaving the crypto market players to fend for themselves.

And while FTX.us was initially immune to this liquidity crunch, FTX filing bankruptcy didn’t spare it either.

If you are new to crypto and just choose your exchange, make sure to review Proofs of Reserves and carefully study reviews.

Recommend to read: Best crypto exchanges for beginners

Who’s been affected by the FTX collapse?

The FTX contagion continues to spread. And many companies that have previously been invested in by FTX and Alameda research have started showing catastrophic effects. FTX, along with Alameda Research and 130 other affiliated firms, filed for Chapter 11 relief or bankruptcy on 11 Nov. 2022.

And filing for bankruptcy brought a tumultuous FTX collapse saga to an end. Solana and its SOL token price saw a sharp dip, falling by 33.50% over the past seven days at press time. Solana, being the collateral of choice after FTT, was expected to drop once the fallout of FTX took effect. Last reported, over $700 million in funds were seen existing Solana-native dApps since the contagion grew in size. As of now, Solana DeFi TVL has taken a hit — dropping by over $300 million over the past seven days or so.

BlockFi — a company that SBF once bailed — has already filed for bankruptcy. Also, Liquid Global — an exchange that took FTX’s help — has halted withdrawals for now. Recent revelations show that FTX.us extended a loan of $250 million to BlockFi.

The impact on the broader crypto industry

Despite kickstarting with the devaluation of the FTT token, the fallout of FTX currently impacts the broader crypto space. Furthermore, the FTX collapse explained one simple thing to all of us no exchange should ever use customer funds for taking trading positions, and that too against their knowledge. The FTX CEO did that to his own peril, and now the fallout of FTX affects the entire space, with the likes of BTC, ETH, and SOL continuing their downward spiral.

Yet, time will tell the impact on other digital currencies after the fallout of FTX as we wait for the market to stabilize. Currently, customer funds remain the most important concern for the global crypto industry.

Altruism or meanness?

The current state of affairs at FTX is under the leadership of John J. Ray III. The situation is dire, with many customers facing the loss of their life savings due to the FTX fallout and the FTT price hitting all-time lows. Exchanges now focus on declaring “proof of reserve” to demonstrate how they utilize client funds. Binance has taken the lead by disclosing its user funds in cold storage reserves, the most secure crypto wallets. The FTX collapse has underscored the importance of owning the keys to one’s crypto, highlighting the necessity of proof of reserves.

It has become evident that Bankman-Fried’s actions were not driven by altruism but by a plan to get rich, which backfired disastrously. The FTX collapse saga continues to unfold, and we will keep providing new insights as they emerge.

Frequently asked questions

FTX announced that nearly all its customers would receive the money they owed two years after the cryptocurrency exchange collapsed. Some customers will even get more than what they were originally owed. This marks a significant recovery effort following FTX’s implosion.

In 2024, Bankman-Fried was sentenced to 25 years in prison. This sentencing resulted from the scandal that heavily impacted the cryptocurrency market. His conviction marked a pivotal moment in the aftermath of FTX’s collapse.

It is speculated that FTX used customer funds to take trading positions at its sister firm, Alameda Research, using FTT tokens as the primary resource. So when the FTT price started to drop, most positions liquidated themselves, making Alameda and FTX insolvent.

It was Sam Bankman-Fried’s debatable business model that triggered the FTX collapse. It is speculated that he used customer funds to trade and make money. With Alameda’s balance sheet out in the open, showing a majority of its holdings to be in FTT, things started to get out of hand, causing broader market concerns.

U.S.-bound FTX was doing better than FTX Bahamas. However, the current bankruptcy filing has even made FTX.us solvent. So, FTX might not be operational in the U.S.

FTX has collapsed due to its native token, FTT, losing value; FTT price nosedived after Binance CEO made it public that the company intends to exit all of its FTT holdings.

People with money in FTX are stuck for now. While the funds haven’t been lost, recovery might take a long time, but things should look more hopeful by the end of 2024.

FTX cannot be trusted as it has taken an active role in helping spread the collapse contagion. User funds are stuck, the FTT token price is closing in on all-time lows, and even companies that FTX invested in or bailed out, like BlockFi, are feeling the heat.

The FTX meltdown was a contagion effect caused by the possible collusion between the FTX cryptocurrency exchange and the trading firm Alameda Research. As the FTT token started losing value, Alameda’s trading position started liquidating, which eventually caused a ripple effect and took SBF down.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.