Ethereum transitioned to a proof-of-stake ecosystem in 2022. The concept of Ethereum staking replaced Ethereum mining, opening new possibilities for staking rewards and mainnet security. But the road didn’t end with Ethereum staking. Instead, the network has seen a number of new developments and advancements, with EigenLayer one of the newest entrants in the space.

EigenLayer pioneers Ethereum restaking, an innovative concept where already staked Ethereum can be used for lending security to other elements of the mainnet — bridges, protocols, oracle networks, scaling solutions, and more. This allows stakers to earn additional rewards from these entities, helping compound gains. This guide delves deeper into EigenLayer, taking a closer look at its mechanics, benefits, risks, and overall impact on the Ethereum network.

- How to take advantage of ETH for EigenLayer?

- Kraken

- OKX

- Wirex

- Coinbase

- KuCoin

- What is restaking?

- What is the EigenLayer?

- The mechanics of EigenLayer

- Components of Eigenlayer

- Making sense of the EigenDA

- How to use EigenLayer restaking?

- What’s built on top of EigenLayer?

- Benefits of EigenLayer

- What are the concerns?

- What does EigenLayer mean for broader blockchain ecosystems?

- Frequently asked questions

Methodology

A variety of criteria were considered when choosing the best platforms to buy ETH. These include fees, goods and features, accessibility, security, and other elements. All platforms were tested for six months by BeInCrypto’s product testing teams. The top platforms that were chosen are:

• Kraken

• OKX

• Wirex

• Coinbase

• KuCoin

Kraken

Kraken makes the list of top platforms to purchase ETH for restaking for a few reasons. Kraken supports over 100 countries, a variety of payment methods, and fiat currencies. It is also regulated, making it a top choice for security.

OKX

OKX is recognized as an all in one exchange, offering a multitude of products and services. Some of these include a proprietary blockchain, wallet, mining pool, and many other services. The exchange also supports security by offering proof of reserves.

Wirex

Unlike many of the choices, Wirex is a payment processing service. It offers crypto purchases, in addition to crypto cards. The exchange is regulated and has money transmitter licenses in many U.S. states. Additionally, it also supports a variety of payment methods and has low fees.

Coinbase

Coinbase is the second most popular exchange in terms of trading volume globally. The fees are simple and range from $0.99-$4.19 depending on the transaction size. The exchange has a proprietary wallet, blockchain, custodial services, a brokerage and an exchange.

KuCoin

KuCoin is a global exchange that supports a variety of features, such as: fractional NFTs, trading bots, derivatives, and more. The exchange is supported in more than 200 countries and offers a low trading fee of 0.1%. You can also generate passive income via staking and other Earn features.

To learn more about BeInCrypto’s verification methodology, click this link.

How to take advantage of ETH for EigenLayer?

Restaking on EigenLayer stands to create a unique experience for both its actively validated services and Ethereum itself. Frontrunning the potential boom in user experience is the one way you may be able to take advantage of this new innovation. If you want to buy Ethereum for these purposes, here are a few of the best platforms to support this transaction.

Kraken

Kraken was established in July 2011 and has built up a solid reputation as a secure and trustworthy platform. Notably, the U.S. based CEX has not had any major hacking events. Since its founding, Kraken has expanded to become one of the biggest and most reputable cryptocurrency exchanges, earning praise for its extensive selection of cryptocurrencies, robust security measures, and easy-to-use interface.

OKX

Established in 2017, OKX stands out due to its extensive array of cryptocurrency trading options. It appeals to both retail and institutional investors because to its extensive feature set, which includes futures, options, and spot and derivative trading. With low fees and a solid customer service option, OKX presents an easy and cheap way to buy ETH.

Wirex

Pavel Matveev and Dmitry Lazarichev founded Wirex in 2014 in the U.K. The multifunctional platform boasts a money transmitter, payment processor, and cryptocurrency exchange functions. Through Wirex, customers can easily trade traditional fiat currency for cryptocurrencies. Wirex is known best for its crypto card offerings, but the platform also presents a straightforward way to accumulate Ethereum.

Coinbase

As one of the most well-known and trusted CEX’s, Coinbase is well-liked thanks to its easy-to-use interface, strict adherence to regulations, large selection of supported cryptocurrencies, solid security protocols, huge library of supplementary services, and thorough educational materials. The platform offers an easy way to buy Ethereum for both beginners and more advanced users.

KuCoin

KuCoin is renowned for its user-friendly platform, which provides KuCoin Shares (KCS) for revenue sharing. It also offers cheap fees, a large selection of cryptocurrencies, including new tokens, and robust security measures. KuCoin is highly transparent when it comes to its fee structure and also offers a reliable on-chain staking service.

What is restaking?

Before discussing EigenLayer, it makes sense to briefly touch upon Ethereum restaking as a concept. As part of the Ethereum merge and ETH 2.0 upgrade roadmap, the network introduced the concept of validators for securing the network. These validators stake their ETH as a commitment to the chain, helping secure the entire mainnet.

However, Ethereum isn’t just a basic chain; tons of AVS or Actively Validated Services are built on it. From oracles to bridges to DApps to other decentralized finance (DeFi) protocols, these elements also require security, per the proof-of-stake (PoS) model. Restaking eliminates the need for the AVS to set their own validators, allowing mainnet-staked Ethereum to act as the first line of defense against malicious parties.

Ethereum restaking can be considered pooled or borrowed security without affecting the sanctity of the staked ETH in the first place. EigenLayer pioneered this concept, allowing a unified interface for the standard stakeholders to commit security to a broader range of protocols.

Did you know? Restaking as a concept also opens up new use cases for the Ethereum network. These include data availability for layer-2 rollup solutions, enhanced cross-chain transactions, decentralized sequencers ensuring efficient transaction ordering, and Miner Extractable Value (MEV) managing solutions.

What is the EigenLayer?

For starters, EigenLayer is a protocol built on top of Ethereum in June 2023. Sreeram Kannan is the brain behind the protocol. His vision was one of allowing ETH stakers to extend the mainnet’s security and trust to other apps and services sans a new set of validators. The idea with EigenLayer is to lower network startup and management costs and cut out complexities that come with bootstrapping security for new projects.

To reiterate, EigenLayer is still a relatively new tool that aims to combat the following:

- Security scalability concerns

- Issues related to capital efficiency

- Plateauing staking rewards

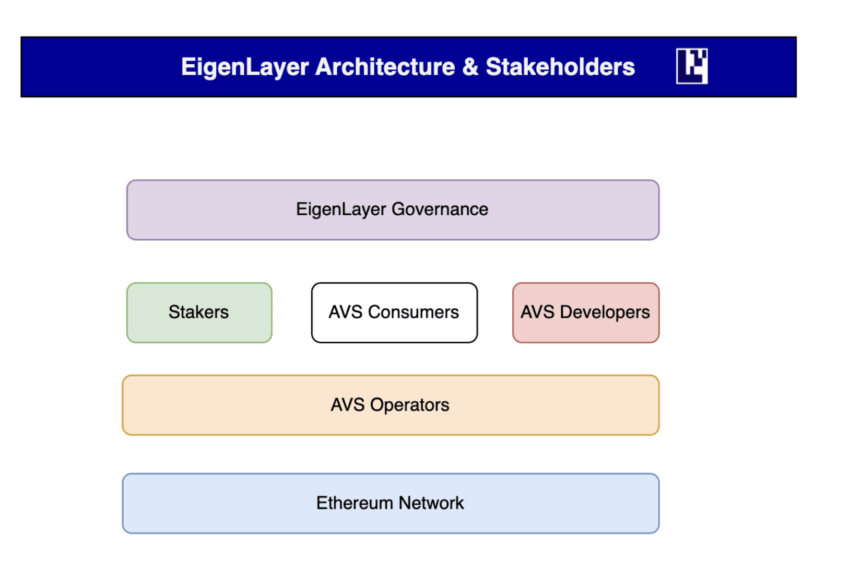

EigenLayer strengthens Ethereum’s existence as a foundational blockchain and makes way for a more interconnected ecosystem of services and DApps. Plus, it has perks for restakers and operators, who are assigned the responsibility of restaking to AVS, and developers, who build new Ethereum protocols.

Here is another way of looking at it.

Imagine the staked ETH as solar panels you have positioned to capture sunlight and generate electricity for your home — Ethereum. EigenLayer can be considered a power routing system that can contribute to a community grid or a neighborhood lighting array, provided your home needs are getting fulfilled in the first place.

This concept of leveraging or outsourcing solar energy is synonymous with restaking.

The mechanics of EigenLayer

Despite there being a plethora of complicated jargon on this topic, EigenLayer and its role are relatively simple and easy to comprehend. It is a protocol with a significant DeFi presence, courtesy of the value locked. The value comes from the staked ETH that people push or are pushing into the EigenLayer protocol, allowing it to extend the same to the AVS automatically.

Do note that staked ETH is different from wrapped ETH, which is all about tokenizing ETH for use across DeFi apps and other cross-chain protocols.

“How about a ZCash network leveraging Ethereum economic security and decentralization via “restaking”? @eigenlayer Can run arbitrary consensus protocols as long as slashing is possible.”

Sreeram Kannan, Founder of the EigenLayer: X

Components of Eigenlayer

For the unversed, EigenLayer, at its core, comprises the following:

- AVS: Protocols or services (DApps) built on top with Ethereum as the primary base.

- Restaked rollups: Examples include AltLayer, which enhances execution scalability with the help of EigenLayer Validators.

- Operators: Entities responsible for maintaining network integrity and validating transactions within the EigenLayer ecosystem.

At its current state (as of February 2024), EigenLayer doesn’t allow validators to choose the AVS they want to secure. The process is automatic. By the time actual AVS-based restaking comes into play, specific protocols, services, and sidechains will receive specific attention.

Another interesting thing about EigenLayer is that it doesn’t interfere with the foundational security of the Ethereum network. Instead, it primarily hinges on two concepts — pooled security and free market governance.

The first one — pooled security — is at EigenLayer’s core. The idea here is to get the collective security posture of the Ethereum network and extend the same to other protocols and even blockchains. You can think of it as a “neighborhood watch program.”

The concept of free market governance comes from the AVS, which can shell out higher rewards for more staked ETH security. As staking rewards exist, the governance model of each protocol, however small, can include the mainnet users.

Making sense of the EigenDA

The EigenDA stands as an actively validated service within the EigenLayer ecosystem. At its core, EigenDA is a data availability service on top of Ethereum, catering to the rollup solutions. Like any other AVS, EigenDA uses the restaked ETH to secure itself further without having to rely separately on a validator network.

In case you are interested in other actively validated services that EigenLayer restakes to, in addition to the EigenDA, here are the top few options:

- AltLayer: A tool provider for the Rollups-as-a-Service model, which relies on the EigenLayer validators for state transition verification.

- Blockless: It uses the EigenLayer restakers to achieve trustless computing.

- Celo: It stands for decentralized sequencing and liquidity sharing via EigenLayer’s availability layer.

Besides the mentioned name, other options include Omni, Hyperlane, and Espresso, each with a functional utility.

Notably, the EigenDA forms the availability layer of the EigenLayer, which also comprises the restaking infrastructure and the base architecture with other protocols built on top of it.

How to use EigenLayer restaking?

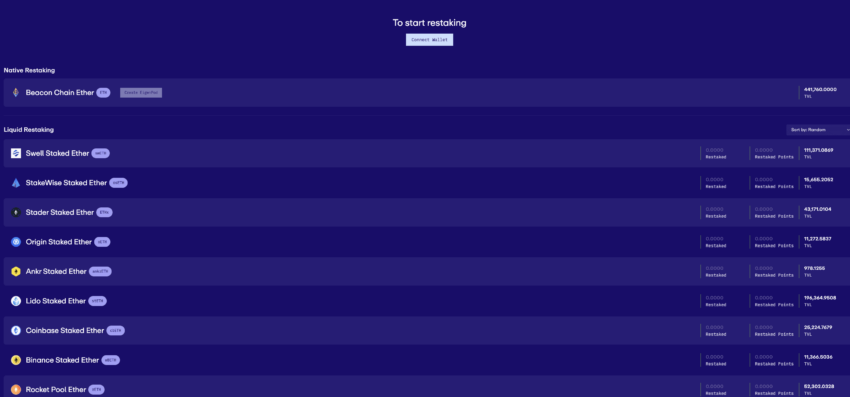

EigerLayer restaking, handled via the EigenLayer interface, happens in one of two ways. The first approach involves native restaking where validators holding onto their Beacon Chain staked ETH — 32 ETH — can create EigenPods, change the validator withdrawal address to the EigenPod address, and start restaking.

Staking rewards and the restaking perks from the AVS are credited to the EigenPods. You can directly unstake and withdraw the same after a 7-day escrow period.

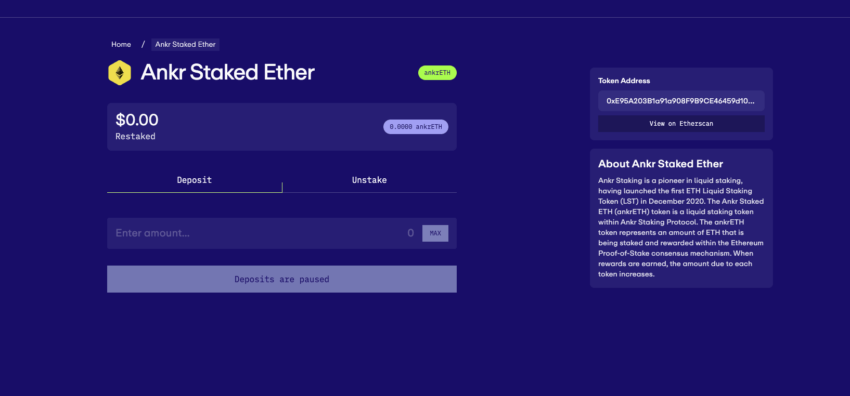

But then, if you aren’t an active validator and have only staked ETH via liquid staking providers like Lido and Swell — following the tokenization route — EigenLayer lets you restake the liquid staking tokens too. The next deposit window for EigenLayer opens on Feb. 5, 2024. This time, a few limits have been imposed to prevent concerns related to centralization.

One such limit is the 33% cap on the allocation of LST/LRT tokens and single deposits to promote restaking diversification.

The concept of paused deposits

If you are already on the EigenLayer interface, you might see that some deposits from select custody options and staking providers have been paused. This might be due to one of the many Ethereum EIPs. There is the EIP-7514, which sets a validator churn limit — the rate at which validators enter and leave. Per this limit, there might be slowness in the activation of staked assets, which might impact the restaking pace. This EIP is a built-in measure to safeguard the Ethereum infrastructure.

What’s built on top of EigenLayer?

While we did see what AVS options are built atop EigenLayer, there are liquid restaking platforms that also leverage the infra of EigenLayer.

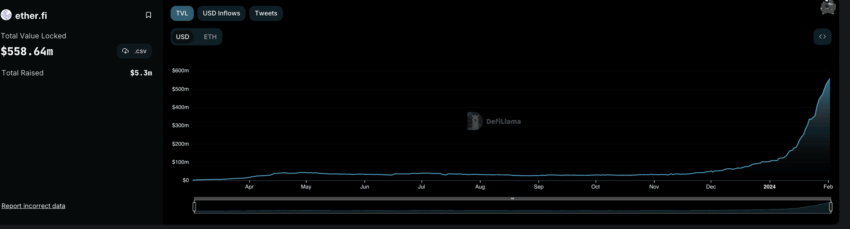

These include the likes of Renzo, which allows for direct ETH restaking via the Beacon Chain. The EigenLayer, Ether.Fi, leads the liquid staking platform race with its Liquid Restaking Token, eETH, and Kelp — featuring a reward system called Kelp Miles to incentivize users depending on how much and for how long they restake.

Benefits of EigenLayer

Now that you know something about the restaking pioneer — EigenLayer — let us explore some of its benefits:

- Improved capital efficiency as instead of locking native ETH, staked ETH can be used to lend security to protocols.

- A chance at higher rewards, with staked and restaked ETH attracting a separate set of perks.

- Access to novel AVS and DApps in the form of EigenDA’s data availability functionality.

- Some novel protocols, secured by restaking via the EigenLayer, can also help lower Ethereum gas fees.

- EigenLayer’s data availability layer makes way for higher transaction throughput as many processes need not queue up unnecessarily, making the Ethereum network more efficient.

- No need to worry about custody options, as the staked ETH is always in your control. Restaking the tokenized versions of self-custody ETH from the likes of ANKR and LIDO doesn’t mean handing them over to EigenLayer.

- An extensive security suite comprising periodic audits, multisig governance, guardrails, and withdrawal escrow.

It is worth noting that the quality of smart contracts in play, which play a role in restaking, is top-notch. This means measures have already been put into the code to avoid overcommitment of resources.

What are the concerns?

Eigenlayer does come with its fair share of challenges and concerns. These include:

- Slashing risks, which, if inflicted, can cut through the staked ETH rather quickly. However, this only happens if the validators in charge of the staked ETH misbehave.

- Yield risks, with stakers chasing the high yield AVS, lowering the yields for the actual users of the protocol.

- Centralization risks, which might pose systemic risks to the Ethereum network if the staked ETH is concentrated in a few restaking pockets. This risk is synonymous with the concerns related to the staking pools.

As mentioned earlier, EigenLayer involves smart contracts. And despite their high quality, this does bring some security risks. Some smart contract security risks include reentrancy attacks, gas limit issues, and parameter attacks.

What does EigenLayer mean for broader blockchain ecosystems?

A technical concept at heart, the EigenLayer isn’t all brawn. Instead, it could very well revolutionize the decentralized finance (DeFi) space, first by handling the issue of fragmented trust and then by making another staking-based asset class available for users. Newer protocols, instead of setting up full-fledged infrastructure for security and just piggybacking, can make way for a more unified Ethereum as part of its ETH 2.0 upgrade.

Frequently asked questions

What are the risks of EigenLayer?

What is EigenLayer Restaking?

What is the limit of EigenLayer?

What is EigenLayer AVS?

Who are EigenLayer’s competitors?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.