The German government has extended its significant Bitcoin (BTC) transfers over the past day, continuing the trend that began last month.

Bitcoin addresses linked to German authorities sent another 700 BTC, worth $40.47 million, to the ‘139PoP’ address this weekend. This transaction was identified through the on-chain analytics firm Arkham.

German Government Bitcoin Transfers

Reports suggest that this transfer indicates a potential intention to sell the assets, as the unlabeled address may belong to an institution or an over-the-counter service provider. Meanwhile, this is not the first time the German government has interacted with the address. In the last three days, the authorities have sent more than 1,200 BTC to this wallet.

The German government began transferring Bitcoin to crypto exchanges like Coinbase, Bitstamp, and Kraken last month after seizing 50,000 BTC from the film piracy site Movie2k earlier in the year. Blockchain analytic platform Lookonchain noted that Germany has made a BTC transfer every day this month. This transaction reduced its holdings to 39,826 BTC, valued at around $2.3 billion.

Read more: How To Make Money With Intel-To-Earn on Arkham Intelligence

This continuous selling activity has drawn criticism from Joana Cotar, a member of the German Bundestag. The Parliament member urged the government to develop a comprehensive Bitcoin strategy instead of hastily selling its holdings.

Cotar further argues that Bitcoin offers an opportunity to diversify the state’s assets and reduce the risks associated with traditional investments. Additionally, she pointed out that Bitcoin’s scarcity and deflationary nature make it a hedge against inflation and currency devaluation.

“Instead of holding Bitcoin as a strategic reserve currency, as is already being debated in the USA, our government is selling on a large scale,” Cotar lamented.

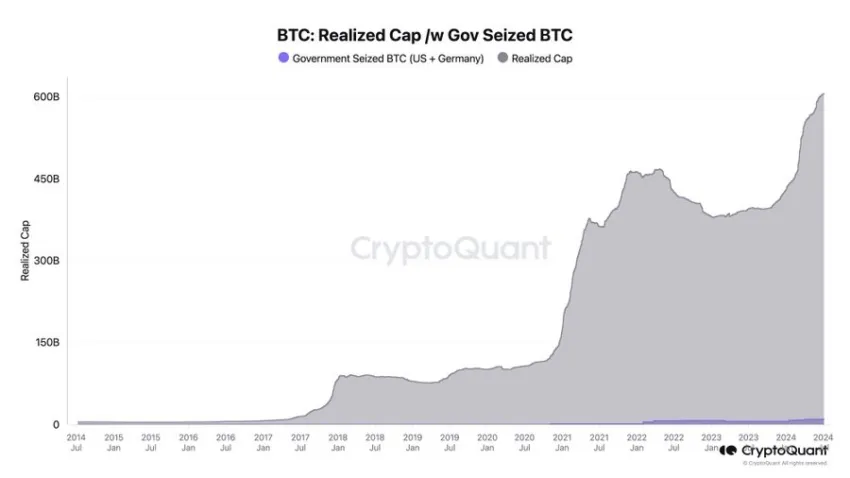

Meanwhile, TRON founder Justin Sun offered to purchase the German government’s BTC holding to reduce its market impact. However, CryptoQuant CEO Ki Young Ju argues that government selling activities have had minimal impact on BTC prices because they account for only 4% of the total cumulative realized value since 2023.

“$224 billion has flowed into this market since 2023. Government-seized BTC contributes about $9 billion to the realized cap. It’s only 4% of the total cumulative realized value since 2023. Don’t let govt selling FUD ruin your trades,” Ju wrote.

Read more: Who Owns the Most Bitcoin in 2024?

Data from Arkham shows that governments, including the US, Germany, the United Kingdom, and El Salvador, hold substantial amounts of Bitcoin, totaling approximately $18 billion.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.