PancakeSwap, the most used decentralized application on the BSC network, is famous for its token launches, as well as for its many different features. The DEX makes trading extremely accessible, even for those new to the DeFi scene.

Here is a complete step-by-step guide on how to use PancakeSwap to trade, provide liquidity, and stake your CAKE tokens.

In this guide:

What is PancakeSwap?

PancakeSwap is a decentralized exchange on the Binance Smart Chain (BSC) and facilitates the swapping of BEP-20 tokens. Although it is the largest of these DEXs on Binance Smart Chain, there are DEXs that have significantly higher average trading volumes on Ethereum, such as Uniswap.

BEP-20 represents the type of Binance Smart Chain native tokens. BEP stands for BSC Evolution Proposal. Note that ERC-20 tokens can be converted to BEP-20 tokens through a Binance bridge. If you do not have a Binance account, you can use any of the bridges listed here to wrap your tokens into the BEP-20 standard.

PancakeSwap was launched in Sep. 2020, and the platform is regularly audited and verified by security companies such as Certik and SlowMist. The identity of the developers is unknown. PancakeSwap is a fork of Uniswap, the popular Ethereum DEX.

Before we explain how to use PancakeSwap, we first cover how it works and the tokenomics. We also explain in detail many of the important features.

Automated Market Maker

PancakeSwap uses an automated market maker (AMM) model. Trades are safely and automatically done using the protocol’s liquidity pools, which are created through smart contracts. Instead of dealing with an order list and looking for someone to swap your tokens with, PancakeSwap users lock their tokens in a liquidity pool using smart contracts. This allows you to swap as many tokens as you like, while users become liquidity providers (LPs) and deposit their coins in a pool to receive a part of the trading fees and other rewards.

PancakeSwap’s native token is called CAKE, and it mainly functions as a governance token, but it can also be used for staking and other DeFi specific actions.

PancakeSwap’s main features (which are displayed in their top menu) are:

- Trade: includes trading, limit orders, adding liquidity

- Earn: yield farming

- Win: the lottery

- NFTs

Trade

To use all these features on PancakeSwap, you’ll first need to connect your wallet to the application. MetaMask, TrustWallet, and Binance Chain wallet are some of the most used wallets. Make sure you have a compatible wallet before looking for how to use PancakeSwap.

The trading feature is similar to other AMMs, and it facilitates cryptocurrency trading on the BNB Smart Chain. At the core of PancakeSwap stand the three options that all AMM have by now: trading, liquidity pools, and limit orders.

Trading on PancakeSwap is straightforward, and you can access the option by clicking on “Trade” and selecting the token pair you wish to swap.

If you want to have more control over your trade, you can use the “Limit Order” feature, which lets you place orders to trade at a set price and not the current market price. For both normal trades and limit order, traders can adjust the default transaction speed (standard, fast, or instant), as well as the slippage tolerance, as you would for normal trades.

Traders can also disable multi hops for their trades if they want to trade only direct pairs. If you have used AMMs before, you must be familiar with how you can add liquidity to the protocol. You can find the option under Trade > Liquidity, where you can select the two coins to deposit in a liquidity pool. However, make sure you understand impermanent loss before using this feature on any DEX.

After you successfully deposit liquidity on the protocol, you will receive LP tokens to represent your share of the liquidity pool.

Earn

To learn how to use PancakeSwap, users must understand the mechanism behind the trade option.

Like other DEXs, such as SushiSwap, you earn rewards through yield farming on PancakeSwap. After receiving the LP token from your liquidity pool, you can use them for yield farming. Different LP token farms promise different returns.

The available farms can be found under Earn > Farms on PancakeSwap. This is a list of incentivized pools where LPs can stake their LP tokens to earn rewards. These pools can only generate rewards for a limited time, and you will have to unstake your LP tokens if you want to withdraw the liquidity provided to the protocol, under the Liquidity tab. Moreover, the liquidity provided will not show under the Liquidity tab, if the LP tokens are staked in Farms.

Another feature is the Pancake Swap Syrup Pools, which allow traders to stake CAKE tokens to earn more tokens. These are also incentivized pools by the different projects listed in the list of pools. However, Syrup Pools do not present the risk of impermanent loss and are an easy way to generate more rewards.

Some Syrup Pools have yields as high as 100% APR. Early stakers are always the ones to get the highest returns. There are two types of pools for staking your CAKE to generate more CAKE tokens: Auto and Manual CAKE:

- Auto CAKE. The pool automatically generates rewards. This means that the CAKE crypto rewards can be automatically harvested and re-invested into the same pool.

- Manual CAKE. The pool does not automatically generate rewards. Therefore, traders must manually collect CAKE token rewards in order to multiply their earnings.

CAKE tokens staked in Syrup Pools can be unstaked at any time. Furthermore, — except for the CAKE pools — these Syrup pools end when the rewards are out.

Win

Under the Win tab, PancakeSwap users will find additional ways to enhance their crypto portfolio. This includes trading competitions, price prediction for BNB, and a lottery that offers CAKE prizes. Currently, the prediction product is still in the Beta version. After entering a position, users cannot cancel or adjust it.

NFTs

PancakeSwap offers an NFT market for users to buy and sell NFTs on the BNB Smart Chain.

The NFT collections displayed are categorized as Newest Collections, Hot Collections, and Newest Arrivals. The platform charges 2% of any NFT sale and uses these fees to buy back CAKE tokens and burn them weekly. NFT creators can earn royalties from their digital art. Anyone can become an NFT artist by applying through the NFT application form.

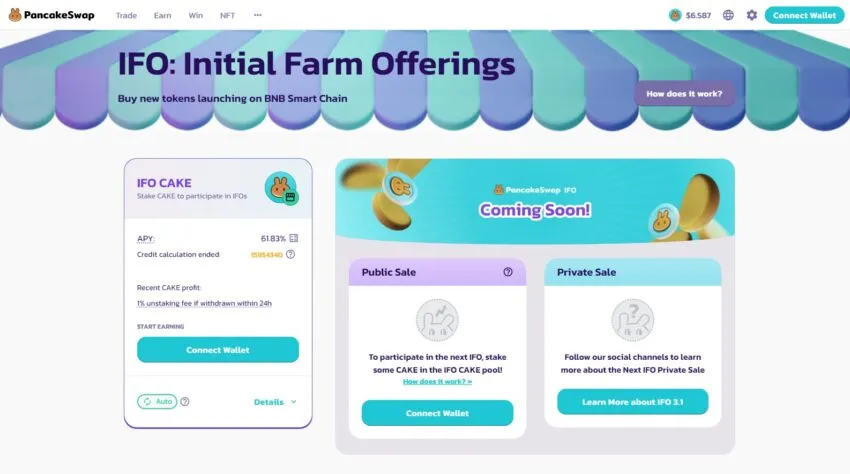

IFO (Initial Farm Offerings)

New projects can use Initial Farm Offerings (IFOs), which help them get their tokens into users’ hands through yield farming. PancakeSwap facilitates this by requiring that LP tokens from each staking pool be held on the protocol in order to gain access for a token sale. This dynamic creates liquidity providers farming rewards and encourages the creation of an initial token liquidity pool.

CAKE token

CAKE is the native and governance token of PancakeSwap, and it was launched in Sep. 2020. It is a BSC native BEP-20 token and its price has performed exceptionally well in 2021. CAKE’s primary purpose is to encourage liquidity provision to PancakeSwap. For the beginner who wants to know how to use PancakeSwap, the most important thing to note is that CAKE is at the center of it all.

PancakeSwap’s native token CAKE doesn’t have a maximum supply, which means that the protocol regularly burns tokens to reduce its supply. This makes it a deflationary token. There was no pre-sale round and the token is distributed as follows:

There are approximately 364,400 CAKE tokens minted every day, and they are distributed as follows:

- Syrup pool: 288,000 CAKE

- Farms 72,400 CAKE

- Lottery Pool 4,000 CAKE

PancakeSwap buyback mechanism and utility

PancakeSwap’s team also employs a few mechanisms to buy back CAKE tokens and burn them on a weekly basis:

- 100% of the CAKE tokens used in Profile creation and NFT minting

- 20% CAKE used in lottery tickets

- 100% of CAKE participating fees in IFOs

- 3% CAKE of every round in prediction markets

- 2% CAKE of every yield harvest in auto CAKE pool

- 0.05% CAKE from every trade on PancakeSwap v2

- 100% CAKE from winners of farm auction

- 100% CAKE from NFT market platform fees

What is the CAKE token used for? As you can see, there are many features offered by PancakeSwap that involve the use of CAKE. These are as follows:

- Governance: Users can use it to vote on new features on the PancakeSwap platform (new pools etc.).

- Staking: Holders can stake their tokes to earn more CAKE or other tokens in the Syrup Pools.

- Farm: Holders can use it to deposit liquidity and get more rewards in Farms.

- Win: Holders can use CAKE to buy tickets in lottery.

- NFTs: Users need to pay NFT platform fees in CAKE.

As of Mar. 2022, CAKE token trades at around $5.40, the total circulating supply is 276.2 million CAKE and the market capitalization stands at around $1.4 billion. CAKE tokens reached its all-time high on Apr 30, 2021, when it peaked at $44.18.

CAKE token can be traded on most centralized exchanges such as Binance, Gate.io, and KuCoin, as well as on DEXs, including PancakeSwap.

How to use PancakeSwap

Like other DEXs, PancakeSwap offers an easy platform to swap tokens on the BNB Smart Chain network. You will need some BNB (the native coin on the BSC network) in your wallet to pay for network gas fees, regardless of what operation you are about to perform on the PancakeSwap DEX.

Step 1. Connect your wallet to PancakeSwap

The first thing to do on every decentralized application (DApp) is to connect your wallet. Otherwise, you can’t access any of the features of the DApp. PancakeSwap supports many different private wallets, including Binance Chain Wallet, Coinbase Wallet, TrustWallet, WalletConnect, and others.

You’ll see the list of the supported wallets when you click on Connect Wallet.

For this guide on how to use PancakeSwap, we will use TrustWallet, but you can use any of the supported wallets.

Regardless of what wallet you’ll be using, you will need to confirm the connection from your wallet.

Step 2. Go to Trade page

On the Trade page, you can select the tokens and the amount that you want to swap. If this is the first time trading that token on PancakeSwap, you will need to enable it first before you can swap tokens on the PancakeSwap DEX.

To enable that specific token means to enable the DEX to access it, and you will have to confirm this action from your wallet. As with any blockchain action, this counts as a transaction (will incur a network gas fee) and you will need to confirm the transaction from your wallet.

And it would look something like this, depending on what wallet you’re using.

After that you enable the tokens from your wallet, the Swap option will appear on PancakeSwap.

Step 3. Trade tokens on PancakeSwap

Note that you can adjust the slippage tolerance and other settings from the settings menu. When you’re ready, click on Swap.

You will get a popup that states all the details of your trade. Click on Confirm Swap. Note that if you wait too long, the price will change, and you will have to accept the updated price.

You will then have to confirm the transaction from your wallet.

This is what the confirmation looks like on the TrustWallet mobile app.

After you confirm the swap from your wallet, the transaction is submitted to the blockchain and will show as pending on PancakeSwap for a few moments.

After a few moments, the transaction will be finalized, and you will get this message. You can view all the details of your transaction on the BscScan.

Congrats on successfully learning how to use PancakeSwap for your first trade.

Note that new tokens may not be visible on your wallet’s interface. If that’s the case, you might need to import the smart contract addresses to your wallet. Each wallet has a different option for this. You can find the tokens’ contract addresses on the BscScan transaction receipt.

How to stake CAKE token?

As we’ve already mentioned, learning how to use PancakeSwap and using CAKE tokens go hand-in-hand. Let’s see how easy it is to stake CAKE tokens on PancakeSwap. We assume you’ve already connected your wallet to the DEX.

Step 1. Go to Pools page

To start staking CAKE tokens to generate more CAKE or other tokens via the Syrup Pools, you will need to go to the Earn > Pools tab. On the Pools page, you will see all the different pools where you can stake your CAKE tokens.

Step 2. Choose the pool and enable Syrup Pool

We assume you already have CAKE tokens in your wallet. If you don’t have any CAKE tokens, you can use the PancakeSwap trade option for buying and selling CAKE.

Note that you can choose between the CAKE pools and the other Syrup Pools, depending on what kind of rewards you are after. If you want to generate more CAKE tokens from your already owned CAKE, then you can choose one of those CAKE pools (auto or manual).

If you want a different token, feel free to browse through the list of Syrup pools. You can also sort the pools (Hot, APR, Total Stake, Earned, Latest).

After you decide on the pool you want to stake your CAKE token in, click on it, and you will see the options to deposit your CAKE.

Note that you will need to enable the pool if this is the first time staking your CAKE to that pool.

Step 3. Stake CAKE tokens in Syrup Pool

After you’ve enabled the pool, the Stake option will become available. Click on Stake.

You can then choose what amount of CAKE tokens to stake in that pool. Remember that you can stake CAKE to multiple pools.

Click on Confirm. You will have to confirm the staking transaction from your wallet.

After you confirm the CAKE staking from your wallet, you will see the CAKE tokens amount staked under that pool.

Congrats on successfully staking CAKE tokens on PancakeSwap.

How to add liquidity on PancakeSwap?

If you want to generate a passive income from your crypto holdings, you can add liquidity to PancakeSwap and get a part of the trading fees paid by those who use the trading function.

Liquidity providers will earn 0.17% of all trades on this pair proportional to their share of the pool. Fees are added to the pool, accrue in real-time and can be claimed by withdrawing the provided liquidity.

Before proceeding, make sure you understand the risks posed by liquidity providing, such as impermanent loss. This can affect your potential profit from providing liquidity on any AMM DEX.

Step 1. Go to the Liquidity page and choose your pair

To add liquidity on the PancakeSwap protocol, go to Trade > Liquidity. Click on Add Liquidity and select the tokens you want to deposit in a liquidity pool.

Step 2. Select the tokens to add as liquidity

As with any AMM DEX, when adding liquidity, you will need to deposit the same amount of two different tokens. You can choose any pair of tokens, and you will receive LP tokens to represent your deposit to that specific liquidity pool. Note that there are special incentivized pools that let you stake your LP tokens to earn even more rewards. Not all LP tokens can be staked, so make sure to check the current pools under Farms.

Step 3. Deposit liquidity on PancakeSwap

After you select the tokens’ pair to deposit, click on Supply.

You will get a summary of your deposit, stating how many LP tokens you will receive. Click on Confirm Supply.

You will have to confirm the transaction from your wallet.

Click on Confirm.

After a few moments, you will get a confirmation from both PancakeSwap and your wallet that the smart contract transaction has been executed. You should now see the provided liquidity on the Liquidity page.

If your LP tokens have an incentivized pool under Farms, you can go and stake them there, to generate additional rewards from your crypto.

Congrats on successfully adding liquidity to PancakeSwap.

SushiSwap vs. Uniswap vs. PancakeSwap

Uniswap was the first DEX. PancakeSwap and SushiSwap are forks of Uniswap. However, each one has evolved over time and developed unique features that have helped them grow in popularity.

The main differences between these three DEXs are the networks they support. Uniswap supports Ethereum and its layer-2 solutions (Polygon, Arbitrum, and Optimism). SushiSwap supports the majority of smart chain networks, including Ethereum, Polygon, and BSC. PancakeSwap can only be used for the BNB Smart Chain network. However, users can use many different bridges to convert ERC-20 tokens to BEP-20.

They all have the same fees:

- They don’t have any withdrawal fees, since they are all DEXs.

- Taker and maker fees are 0.30% on Uniswap and SushiSwap, and 0.20% on PancakeSwap.

Uniswap’s native tokens (UNI) cannot be used for yield farming or staking anymore, but SUSHI and CAKE are still used for generating extra rewards. Also, investors that want to use the lending and borrowing functions on a DEX may choose SushiSwap, as it’s the only one of the three to offer that function.

Both SushiSwap and PancakeSwap offer the option to participate in IDOs, by using their native tokens.

As we dig deeper, there are many differences between the three DEXs. Different reasons could explain why different traders choose one DEX over the other. You could choose to use liquidity provider platforms, pay a fee, or have tokens available. The decision about which DEX to use will ultimately depend on your personal needs and the one that you are most comfortable using.

Should you use PancakeSwap?

If you want to trade BEP-20 tokens, which are native to the BNB Smart Chain network, you will most likely choose PancakeSwap as the default DeFi application. The protocol offers many different features, from cryptocurrency trading to token staking. Users can participate in yield farming and other DeFi operations.

It’s now up to you to discover how to use PancakeSwap for your investments and trades, now that you’ve learned the basics of how the DEX works.

< Previous In Series | Exchanges | Next In Series >

Frequently asked questions

How do you use PancakeSwap?

How do I buy and sell on PancakeSwap?

Do you need Binance to use PancakeSwap?

How does PancakeSwap work for beginners?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.