Despite originating from crypto-hostile China, Binance has managed to become the world’s largest cryptocurrency exchange, recording over 170 million active users in 2024. Now headquartered in the Cayman Islands, Binance’s mission has been to offer a full suite of crypto trading services. One of the key pillars of this offer is the Binance Smart Chain (BSC), an open-source smart contract platform allowing people to partake in Finance 2.0.

This guide will show you what BSC is all about and how to take advantage of all of its features.

- Binance Smart Chain explained

- Binance Chain vs. Binance Smart Chain

- How does BSC work?

- BSC gas fees compared to Ethereum

- BSC tokenomics

- BSC staking rewards

- What is Binance DEX?

- DeFi on Binance Smart Chain

- What are the best crypto wallets for Binance Smart Chain (BSC)?

- Is Binance Smart Chain worth investing in?

- Frequently asked questions

Binance Smart Chain explained

Binance Smart Chain (BSC) represents the second generation of blockchain technology. While bitcoin (BTC), litecoin (LTC), dogecoin (DOGE), and others are the most known cryptocurrencies, they are merely the first generation of blockchains with the sole purpose of producing one product — digital money.

In contrast, Binance Smart Chain is a generalist blockchain platform ready to deploy smart contracts. These automated pieces of code can codify any conceivable logic, including traditional banking services — exchanges, borrowing, and lending. On a technical level, BSC’s smart contract development is possible thanks to EVM — Ethereum Virtual Machine.

Just like there are engines in the video gaming industry that power games, such as Unreal Engine or Source, so there are blockchain engines. Because of the decentralized nature, an EVM must function as a decentralized computer, executing smart contracts dispersed across thousands of computers — network nodes.

Because of this shared EVM legacy, BSC can easily support smart contracts written on other EVM-compatible blockchains. Once again, this is analogous to the porting of a PC game to PlayStation or Xbox and vice-versa. The engine compatibility is the key.

Through Binance API (application programming interface), developers connect to Binance servers in order to code smart contracts in any number of programming languages — GO, Java, JavaScript, C++, C#, Python, or Swift.

Binance Chain vs. Binance Smart Chain

Binance deployed Binance Chain in April 2019 in order to facilitate near-instantaneous trading. The trade-off for this ultra transaction speed was the lack of smart contract programmability. Because smart contracts require a much greater degree of computational power, Binance made a decision to launch a specialized fast-trading blockchain network first.

If you recall, Ethereum faced many such congestions, particularly when NFTs entered the spotlight. For instance, when people rushed to collect and trade CryptoKitties (cartoon cats as NFTs), the entire Ethereum network halted to a standstill in December 2017. With such congestion issues being inevitable, Binance deployed Binance Smart Chain in September 2020 as BC sidechain.

Assisting Binance Chain with smart contracts, BSC is fully compatible, allowing the migration of crypto assets from one chain to another. While Binance Smart Chain supports BEP-20 token standard, Binance Chain supports BEP-2 token standard. Just as is the case with Ethereum’s ERC-20 token standard, BEP-20 focuses on the easy deployment of tokens across DeFi protocols.

The easiest way to move the funds from BSC to BC and vice-versa is through the Binance Chain Wallet. It allows you to access funds on BC, BSC, and Ethereum. Whether you want to trade NFTs or engage in yield farming for passive income, it seamlessly integrates into your browser as an extension.

However, the Binance Chain wallet is yet to arrive on mobile devices as an app. This is not an issue because if you already have an account on Binance, it is also a web wallet, accessible through any device and operating system. Nonetheless, keep in mind that web wallets are custodial — they hold your private key, therefore, third-party control over your funds.

How does BSC work?

As a second-generation blockchain, BSC uses proof-of-staked-authority (PoSA) consensus algorithm. This means that it combines delegated proof-of-stake (PoS) with proof-of-authority (PoA). This makes BSC much more energy-efficient than first-generation blockchains relying on proof-of-work (PoW), such as Bitcoin or Ethereum.

Bitcoin often pops up in news headlines due to the amount of electricity its PoW needs to secure the network, most commonly titled as “Bitcoin uses as much power as X country.” PoS removes such energy baggage by using economic staking — validators — instead of computational power — miners — to confirm transactions and add new data blocks.

Delegated proof-of-stake

A delegated PoS is a further step up by introducing voting and delegation mechanisms, so that those with the most staking power don’t dominate the entire network. Almost all newer smart contract blockchains use some PoS derivation — Cardano, Algorand, Solana, Avalanche, Cosmos, etc. PoS have become popular not only because they remove miners as such, but they rely on an incentives structure to secure the network.

Proof-of-authority

After all, those with the most stake (tokens locked in) receive greater rewards to preserve the network. However, because it may happen that stakes of equal size have different values, developers made use of Proof-of-Authority for additional security. PoA simply replaces monetary value with the validator’s identity.

Presently, Binance Smart Chain has 21 validators in charge of processing transactions and securing the network, making it a highly centralized smart contract platform. For comparison, Ethereum, on its way to ETH 2.0 upgrade, has over 200,000 validators.

Lastly, when BSC needs an upgrade or a patch, it enters an epoch period consisting of 240 blocks (about 20min). As another PoS property to curtail malicious behavior — double signing and node downtime — BSC also employs a “slashing” governance mechanism, which removes a significant portion of validator’s stake.

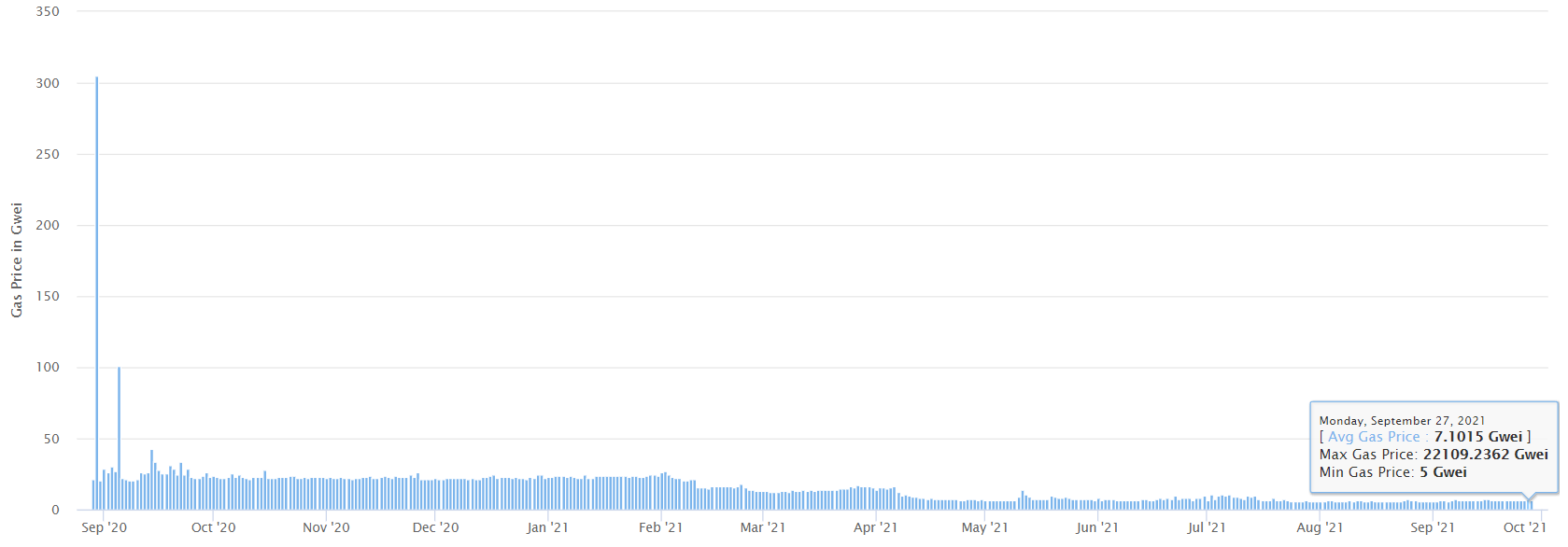

BSC gas fees compared to Ethereum

Because blockchains are decentralized networks without a centralized oversight, that doesn’t mean they are free to use. Anytime a validator processes a transaction, their reward comes from gas fees, denominated in gwei as one-billionth denomination of ETH.

1 gwei = 0.000000001 ETH

If we compare BSC with Ethereum, the former is far more affordable.

As you can see, since its launch, BSC gas fees have decreased considerably, from the initial average of 25 Gwei to the present 6.4 Gwei. In contrast, Ethereum’s gas fees have been fluctuating wildly.

Presently, Ethereum’s average gas fee is 95 Gwei — 14x higher than on BSC!

Of course, to determine the gas fee in U.S. dollars, we first have to multiply Gwei by 21,000 — the minimum gas amount required to process a transaction. We then arrive at the following gas fee difference between the two blockchains:

- Binance Smart Chain average gas fee per transaction – $0.35 USD

- Ethereum average gas fee per transaction – $5.2 USD

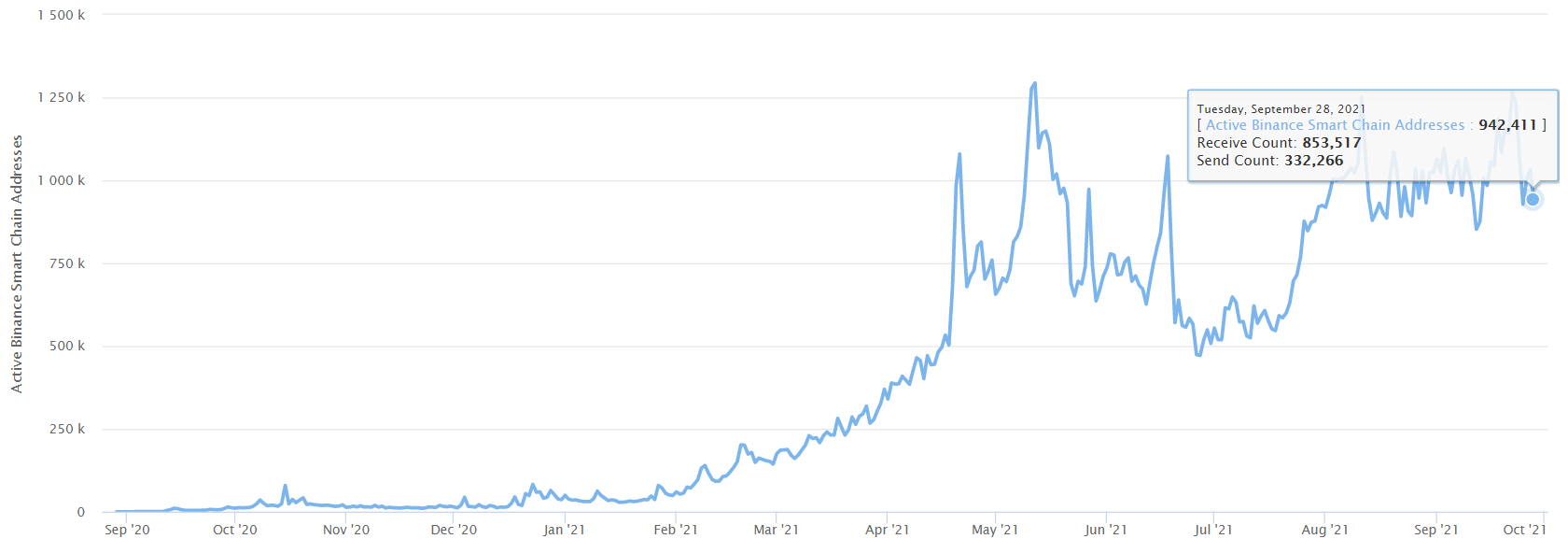

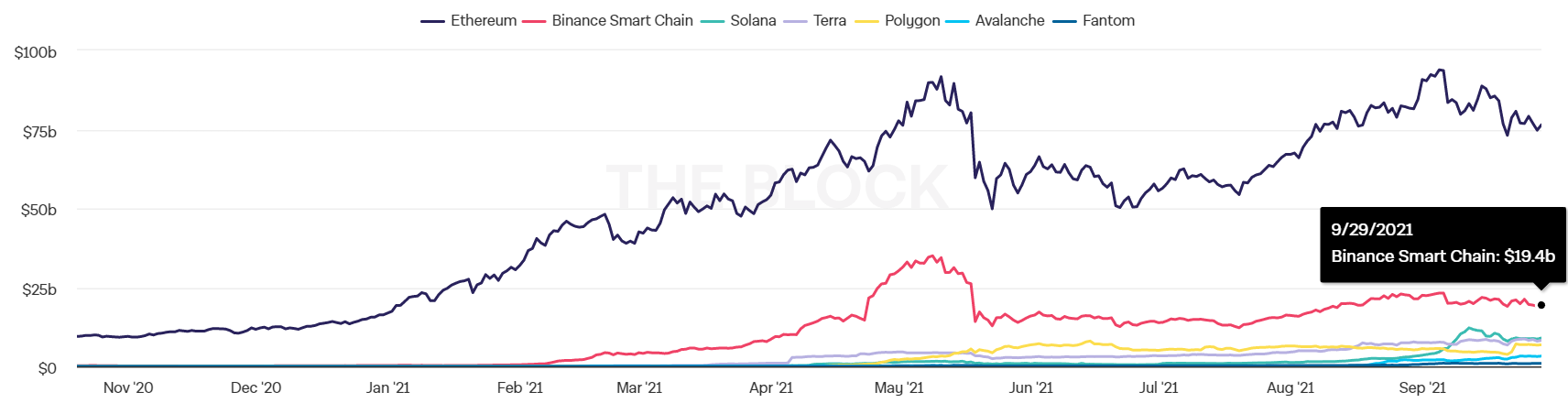

Additionally, these are just the base fees — those that don’t include more complex transactions involved with DeFi protocols. Resulting from this stark difference in transaction fees, BSC became hugely popular. As of 29 September, 2021, Ethereum holds 722,368 active addresses.

At the same time, BSC has 942,411 active addresses.

A 30% daily activity in favor of BSC is remarkable given the fact that Ethereum holds four times more crypto assets as gross value locked (GVL).

BSC tokenomics

What ETH is to Ethereum, Binance Coin (BNB) is to Binance Smart Chain. Holders can use the asset to pay transaction and trading fees on the Binance exchange itself, including the Binance decentralized exchange (DEX). The native BSC cryptocurrency launched during the ICO conducted in July 2017 as an ERC-20 token, less than two weeks before Binance launched.

Initially, one could get 2,700 BNB for a single ETH or 20,000 BNB for a single BTC. In a year-to-date (YTD) period since then, BNB outperformed bitcoin by 825% and ethereum by 572%.

Presently, 1 BNB equals $366 USD, with a maximum token supply of 200 million BNB coins. Out of that supply, about 168.1 million are in circulation. When it comes to Binance Coin inflation, the supply undergoes quarterly (every three months) burning — removing tokens from circulation — with the aim to eventually halve the total supply to 100 million BNB.

Therefore, BNB mirrors bitcoin’s deflationary nature, with the exception that a highly centralized for-profit company manages it. Binance controls or owns at least 50% of BNB supply. The founding members received around 80 million BNB (40%), with angel investors receiving another 10%. Correspondingly, the fate of Binance will closely determine the fate of the BNB cryptocurrency.

This is not a comforting thought considering that Binance is often a target of regulatory agencies across the world, in addition to recent accusations of engaging in insider trading.

Before Binance launched Binance Chain, BNB started as an ERC-20 token on its competitor chain — Ethereum.

BSC staking rewards

If you have read the part about BSC’s Proof-of-Stake consensus, then you must know that staking is the key to achieving a passive income on the BSC blockchain. If you choose so, you can become a BSC validator to make that happen. Unfortunately, the requirements are rather high:

- Minimum stake of 10,000 BNB, which translates to $3.7 million USD at press time.

- A 64-bit Virtual Private Server (VPS) with a minimum configuration of 16 GB RAM, 500 GB storage space, and 1Gbps fiber internet connection for running a full node (entire copy of BSC blockchain).

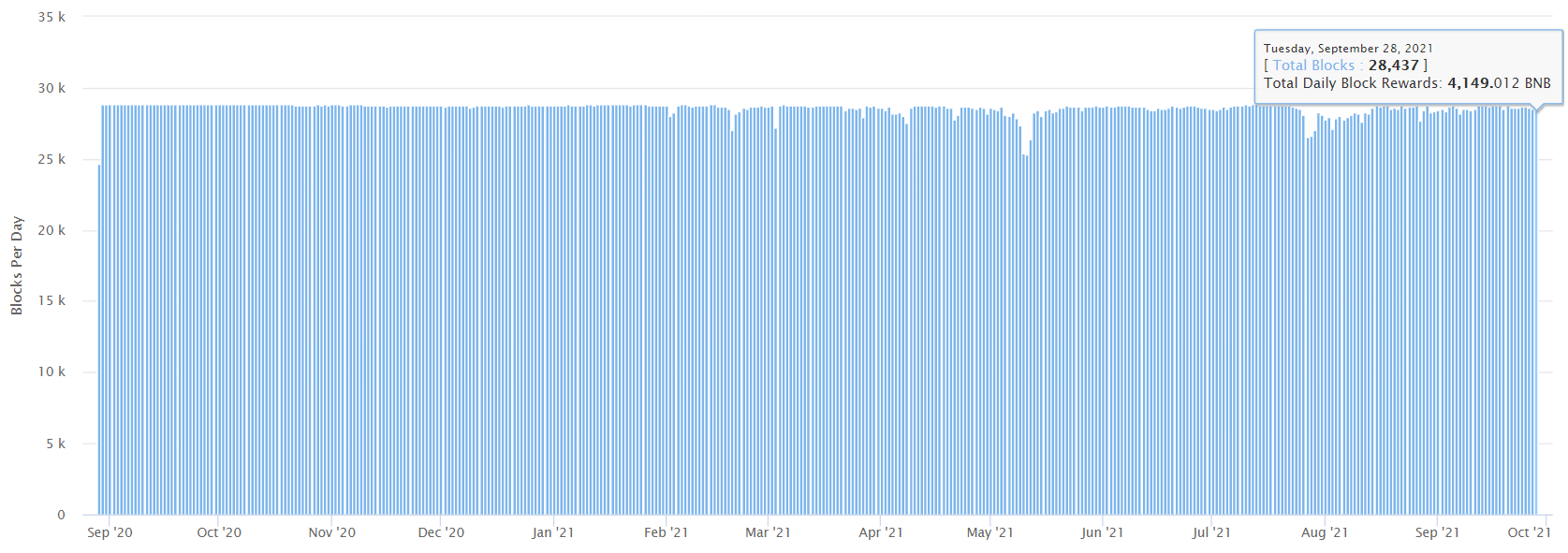

In return for securing the network and handling transactions, BSC APY (annual percentage yield) is around 13%. Needless to say, not many can afford the privilege of securing BSC. As of September 28, the average daily block reward on BSC was 4,149 BNB, or about $1.5 million USD.

Lastly, due to the aforementioned slashing mechanism, the validator could be sent to “jail” if the stake in the form of a self-bond falls under 10,000 BNB. Meaning, the validator’s ability to process transactions and receive rewards will be suspended for one day.

Likewise, downtime and double-signing can earn slashing as well. Downtime happens when a validator misses at least 50 blocks or around 52 minutes. As for double-signing, if a validator attempts to verify two blocks of the same height, they will lose 10,000 BNB and be permanently jailed.

What is Binance DEX?

Although Binance itself is a centralized cryptocurrency exchange, the company saw fit to launch a decentralized exchange in April 2019.

DEXes, just like Uniswap or SushiSwap, have many key benefits:

- Full custody of crypto funds

- Trustless exchange because there are no mediators

- Robustness because there is no single point of failure

For instance, as a centralized exchange, Coinbase is notorious for its downtime during high-peak trading volumes. Imagine needing to buy or sell a crypto at the right moment, only to be foiled by the exchange! DEXes solves this problem by connecting to multiple servers across regions.

Binance DEX currently offers 83 cryptocurrencies for trading. Given that Binance Chain employs the BEP2 token standard, both bitcoin and ethereum are not tradeable directly. Instead, you would have to trade via pegged tokens — BTCB or ETHB.

Likewise, when sending or receiving them, one has to always take care to select the BNB address unless they risk losing all funds. Combined with Binance Chain Wallet, trading on Binance DEX is a secure and seamless alternative to centralized exchanges if one is willing to convert non-compatible tokens to their pegged versions.

DeFi on Binance Smart Chain

Smart contracts are the foundation for decentralized finance (DeFi). In turn, the front web-face to access smart contracts on blockchains is a decentralized application (dApp). This is why, commonly, smart contracts and dApps are interchangeable terms.

Furthermore, like how tokens power smart contracts running on the blockchain, so too does blockchain governance and incentive structures run on native tokens. As we noted previously, the native token for Binance Smart Chain is Binance Coin (BNB) using the BEP-2 template. On the other hand, all the dApps use the BEP-20 standard.

Presently, BSC has 1,211,898 token contracts. The top ones by market cap are usually those that serve as bridges between other blockchains. For example:

- Binance-Peg Ethereum Token (ETH) — pegging ETH value to BSC ecosystem — at $357.4 million market cap

- Binance-Peg BSC-USD (BSC-USD) — pegging USD value to BSC ecosystem — at $69.5 million market cap

- Binance-Peg BTCB Token (BTCB) — pegging BTC value to BSC ecosystem — at 28.3 million market cap

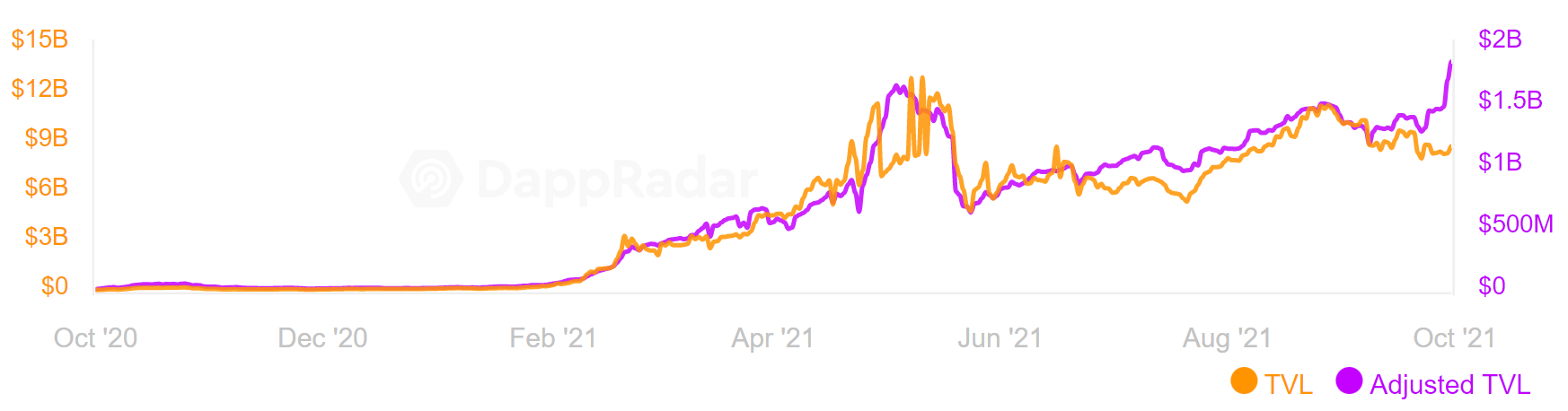

As far as the most popular dApps on BSC, a very useful tool to use is DappRadar to get the full list across different categories. Presently, Binance Smart Chain is running 1,555 dApps. Out of which, 935 are for DeFi. Here are some of the most popular ones.

PancakeSwap

As a decentralized exchange (DEX), PancakeSwap successfully replicated Ethereum’s Uniswap. It uses automated market maker (AMM) to facilitate token swapping without centralized oversight. After it had launched in September 2020, its governance token CAKE skyrocketed in value.

This was a predictable outcome of traders opting to use Binance Smart Chain instead of Ethereum due to high gas fees. Be sure to check this guide on how to stake CAKE tokens to earn passive yield farming income.

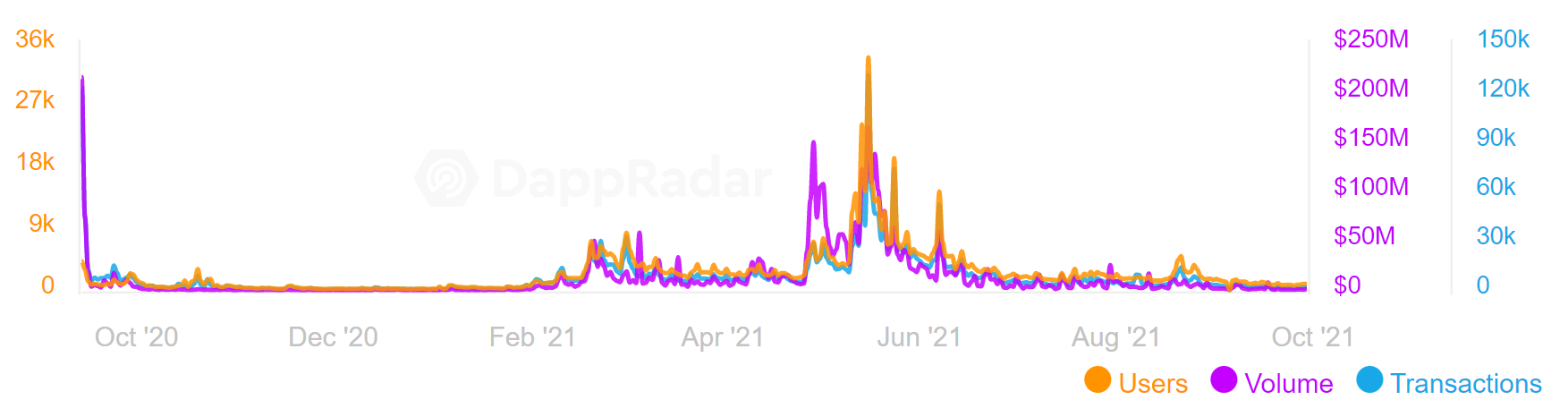

BakerySwap

For some reason, BSC dApp developers do love to use baking monikers! BakerySwap is also an AMM, just like Uniswap and PancakeSwap, but with a unique twist. Alongside yield farming for your service as a liquidity provider, BakerySwap adds NFTs on top.

When you earn BAKE tokens, you can put them to good use as a randomly generated combo meal in the form of an NFT. Then, this unique NFT collectible can be further staked to earn more BAKE tokens. In July, BakerySwap crossed a milestone by hitting 500,000 NFT transactions.

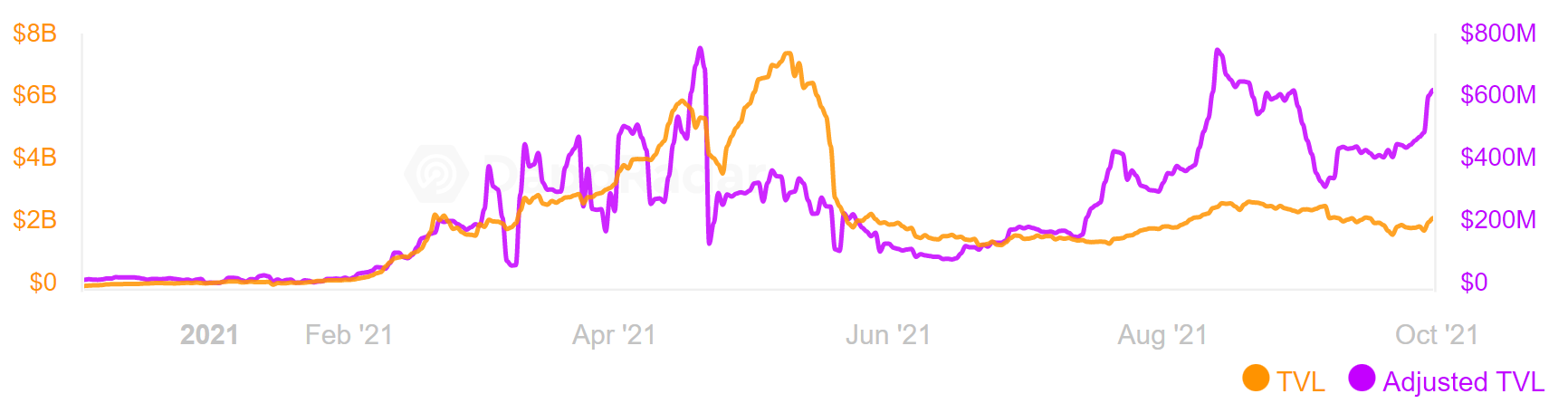

Venus

You may have noticed that decentralized finance depends on stablecoins. Because we don’t live in a world where most people use cryptocurrencies for daily expenses, stablecoins are the bridge between DeFi and traditional finance. The problem is, it is often the case that a single company runs a stablecoin — including the most popular ones like USDT, BUSD, and USDC. This doesn’t quite contribute to DeFi being decentralized.

Venus protocol steps in with the cutting-edge algorithmic stablecoin, VAI, collateralized by a basket of stablecoins and other crypto assets. Furthermore, Venus allows you to tokenize assets and create a money market for lending and borrowing. Effectively, this makes Venus a unique combo of Compound or Aave with MakerDAO, but exclusive to Binance Smart Chain.

What are the best crypto wallets for Binance Smart Chain (BSC)?

Outside the aforementioned Binance Chain Wallet, here are some of the most convenient ways to access the rich BSC dApp ecosystem, made popular by negligible gas fees.

- MetaMask — The top-rated noncustodial wallet that integrates into your web browser and then connects to any dApp. Follow this complete guide to using MetaMask. Focusing on its wide adoption rate, MetaMask also offers support for integrating the most popular Trezor and Ledger hardware wallets.

- Trust Wallet — Bought by Binance, Trust Wallet introduced staking all the way back in April 2019, in addition to Tezos (XTZ) support. As an integrated dApp browser, it is available for both iOS and Android. Currently, it supports over 40 blockchains across 160,000 tokens.

- SafePal — For extra security, it is not only a mobile wallet but comes in the form of a hardware wallet, called SafePal S1. At a price tag of around $50, this is a great way to use cold storage to make your crypto funds hacker-proof. SafePal supports 20 blockchains across 10,000 tokens.

- Math Wallet — Like MetaMask, Math Wallet is an extension for the most popular browsers — Chrome, Brave, Edge. However, Math Wallet was developed with a mission to serve as a universal blockchain wallet, allowing for multichain dApps. If you have heard of a public blockchain, Math Wallet supports it. In addition to this impressive feature, it has a staking aggregator in the form of MathVault and MathChain as a layer 2 scalability solution based on Substrate.

Is Binance Smart Chain worth investing in?

Among public blockchains, the Binance Smart Chain is ranking at the top as one that is the most centralized. Therefore, its longevity depends much on how regulators treat Binance and how the company itself conducts its business affairs. On the other hand, BSC is a very attractive smart contract platform thanks to its lightning speed and low transaction fees.

Based on those two driving forces alone, BSC became one of the most popular smart blockchains around.

Frequently asked questions

What tokens are on Binance Smart Chain?

What wallets support Binance Smart Chain?

How do I get a Binance Smart Chain wallet address?

Is MetaMask a Binance Smart Chain wallet?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.