The global financial landscape has become more complex with time. From navigating the commodities space to dipping into the vast world of real estate, small business partnerships, and even digital assets, the modern world can be pieced together by its financial arrangements. Yet, not every arrangement is the same. This is where the Howey Test comes in handy, helping to unblur the lines between investment contracts and other financial arrangements.

But why does discussing the Howey Test — an instrument from the 1940s — make sense in 2023? In crypto, it is appropriate to distinguish utility tokens (grant-specific tokens), security tokens, and other non-profit entities and other investment contracts. And with the SEC vs. XRP case on the verge of conclusion, it seems the right time to revisit the Howey test.

BeInCrypto Trading Community in Telegram: read the hottest news on crypto, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

- A Howey Test starter pack: history, importance, and relevance

- The Howey Test: Understanding the core components

- How does the Howey Test relate to the crypto space?

- Howey Test and the Bitcoin network

- Howey Test and Ethereum

- Howey Test and NFTs

- Pros and cons of the Howey Test

- Some alternate approaches

- Howey Test and crypto clarity: what does the future hold?

- Frequently asked questions

A Howey Test starter pack: history, importance, and relevance

The Howey Test is a way of determining whether a transaction is an investment contract. Also, the Howey Test indicates if the transactions qualify per the Securities regulation and the Securities Act of 1933, the SEC terms these as securities.

For the unversed, the Howey Test originated in 1946 as an after-effect of the SEC vs. W.J. Howey Co. case. Understanding this case and how it was unpacked in 1946 is crucial to making sense of the Howey Test framework in general.

Here is the scenario underpinning the SEC vs. W.J. Howey Co. case.

W.J Howey Co. — the firm — owned Florida-specific citrus groves, selling land parcels to investors. A service contract was also offered to the investors where W.J. Howey Co would manage, cultivate, and sell citrus fruits on the investors’ behalf, giving them a portion of the profits. It is necessary to note that the fruits concerning citrus groves aren’t important here. The investment contract between W.J. Howey Co. and the investors is deemed a security in this case.

What came to light in this pivotal case?

The SEC or the Securities and Exchange Commission, argued this transaction to be an investment contract with the following conditions:

- A common enterprise is handling investor money.

- The arrangement comes with an expectation of profits, with investors seeking it.

- Profits are not self-derived. Individuals relying on W.J. Howey Co. to make decent sell numbers substantiates the same.

As the Supreme Court sided with the SEC, a clear framework was set for the regulators to test every subsequent investment contract against.

So the Howey Test helps regulators, entrepreneurs, and even investors check if the investment contract they are a part of adheres to the Securities Act of 1933 and the Exchange Act of 1934. If the investment contract passes the Howey Test and is deemed a security, the disclosures, compliance needs, and the specifics of registration also change to maintain integrity.

The relevance of the Howey Test

Modern-day financial instruments are complex. With new VDAs (Virtual Digital Assets) and their ICOs showing up almost every other day, the “securities” checking framework relevant to the Howey Test is all the more relevant in 2023.

Here is an easier way of understanding the relevance:

Imagine you, as a child, have started your own lemonade stall, pooling money from your friends (other children) who are also looking to make bigger returns once the stall becomes popular. However, the adults have helped everyone by making a few specialized rules for this scenario so that money and returns can be moved fairly.

The Howey Test is synonymous with specialized rules. And it is important for every associated party (associated with the investment contract in focus) to understand the rules for making better decisions.

The Howey Test: Understanding the core components

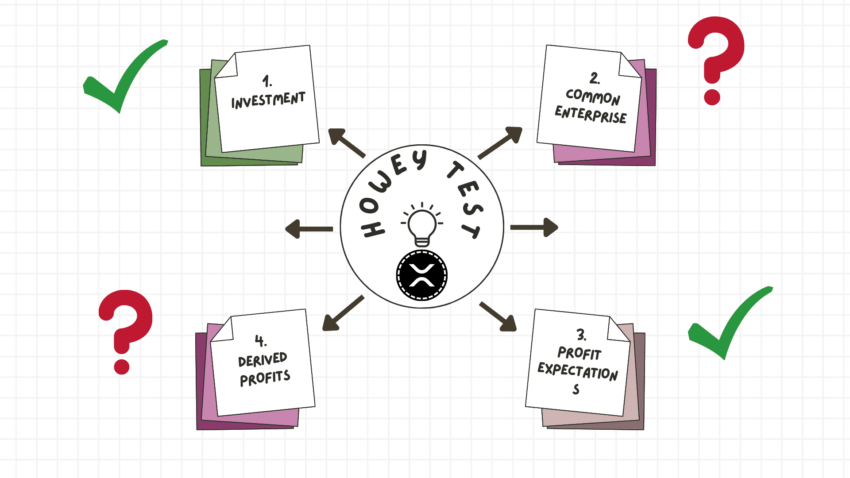

As mentioned earlier, the Howey Test is a framework. It allows lawmakers to check if a specific investment contract adheres to federal securities law and if it qualifies as a security. And for that, there are four conditions (prongs) that it (the contract or the arrangement) must satisfy:

- There should be an investment of money.

- There should be a common enterprise for handling the money.

- There should be an expectation of profits.

- There should be the chances of profits derived from the efforts of others.

Note that the second prong, “Common Enterprise,” has two interpretations. The first one is the “Horizontal Commonality.” This recognizes a project as a common enterprise if investors pool funds and profits associated with the same are project dependent.

The second interpretation is “Vertical Commonality,” where the success of the project is directly related to the promoters or even the project managers. To sum things up, the common enterprise narrative requires investors to share the same set of risks and rewards or to have promoter-specific dependencies.

Because of the decentralized nature of crypto, most cryptos hardly fulfill the Prong 2 requirements. But that’s not what the SEC thinks!

What if the Howey prongs fail?

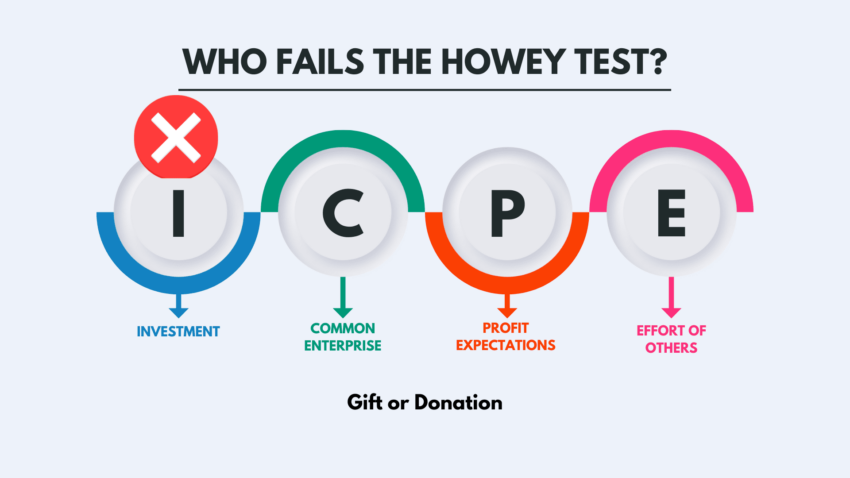

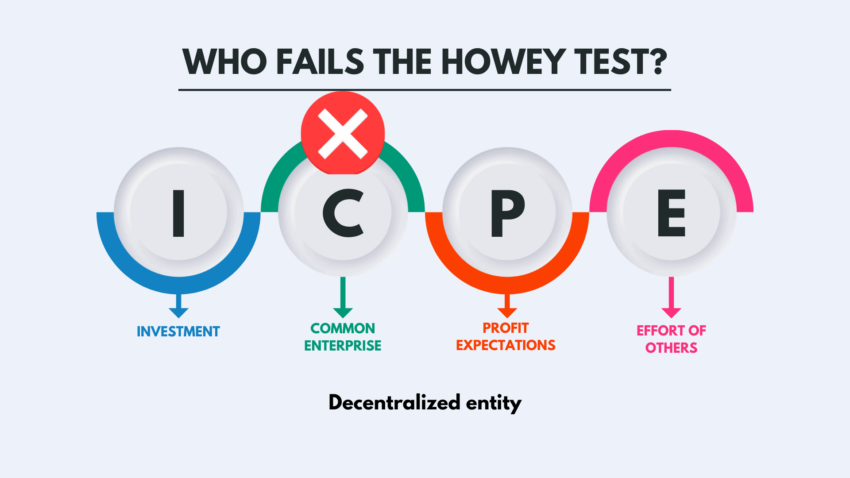

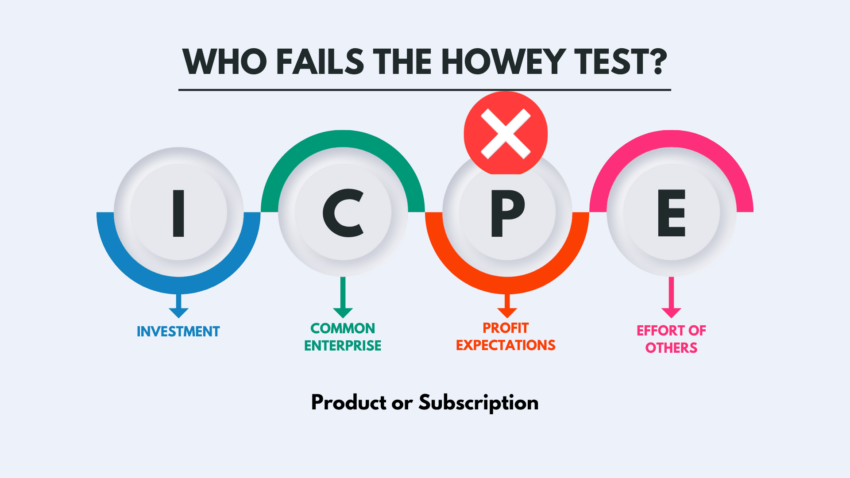

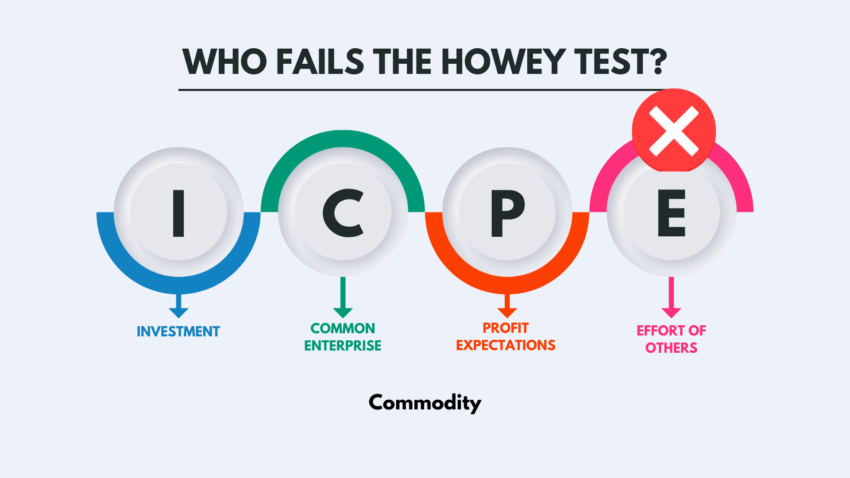

Removing one prong from the state of affairs can help determine whether a transaction is a collectible, gift, commodity, or even a service, product, or subscription.

Here is what the asset or the transaction qualifies for in the absence of the “Investment” prong:

On removal of the “Common enterprise” prong, the transaction might qualify as decentralized.

Here is a transaction failing the “Profit expectations” prong.

And finally, here is what happens when the “Effort of others” metric is removed.

To determine whether an investment is a security or not, every prong of the Howey Test framework should be checked. The asset or investment contract only qualifies as a security if all four prongs or metrics are satisfied.

Back to the lemonade example

Let us now revisit our “lemonade stall” example to understand the Howey test and its four prongs.

Let us assume that a group of friends — Bob, Alice, and Carol — put up the lemonade stall we discussed. They pool investments and work together to prepare and sell lemonade. We can now compare it against the Howey Test framework.

- Investment of money: Three friends pooling money to buy lemons and cups does involve investment. This checks the first prong.

- Common enterprise: All the friends in the example above work together, with the lemonade stall being the common enterprise. The second criterion is satisfied.

- Profit expectations: All the involved friends are looking to make some money with this lemonade venture of theirs. Hence, the third criterion is also satisfied.

- Profits from the effort of others: Alice, Bob, and even Carol are contributing physically and finally to the project. Hence, the profits are derived from their own efforts, not the efforts of others. Imagine if a fourth friend Jack comes into the mix, who contributes financially to the project but doesn’t participate in physical work. The financial arrangement of Jack qualifies as a security.

And that is what a simplified breakdown of the Howey Test framework looks like.

How does the Howey Test relate to the crypto space?

The crypto world comprises a wide range of tokens, assets, and scenarios. Therefore, evaluating crypto scenarios per the Howey test framework should be on a case-by-case basis. Sufficiently decentralized cryptos that are primarily used as a medium of exchange and haven’t raised funds using Initial Coin Offerings (ICOs) might not be considered securities, per the Howey Test framework.

However, quite a few cryptos have led the SEC to consider if some projects do in qualify as an investment according to the Howey framework. Here are the concerns that often require detailed tests:

- Projects using ICOs for raising funds.

- Security offerings that inadvertently represent some ownership and dependence of tokens on a specific company.

- Profit sharing as part of the token sale mechanism. This might involve earning liquidity tokens when you use your existing tokens to participate in liquidity mining.

- Centralized governance in the case of projects with minimal adoption. Or some PoS cryptos where centralized bodies manage a lot of staking concentration.

- Significant promoter influence.

There are a handful of other concerns, but those outlined above are the factors that primarily require a Howey test. Let’s compare some of the more popular virtual digital assets against the Howey test framework to understand how they are perceived by the SEC.

Howey Test and the Bitcoin network

Here is how the Bitcoin network tests per the Howey Test framework:

Prong 1: Buying BTC on exchanges is possible. Hence, the sense of investment holds despite being a decentralized currency.

Prong 2: There is no common enterprise as BTC is sufficiently decentralized. There is no company handling and managing Bitcoin.

Prong 3: There are some profit expectations due to its store of value narrative. Plus, people trade BTC, and therefore, the third prong holds.

Prong 4: No passive form of income generation is in play, like staking. Every miner or node looking to earn BTC or rewards must work courtesy of the decentralized nature of the same. Hence, the fourth prong doesn’t hold.

Per the Howey Test framework, bitcoin doesn’t satisfy all four prongs, so it isn’t considered a security. Jay Clayton, former SEC Chair, also stated that bitcoin was not a security in 2018.

Howey Test and XRP

How does XRP or Ripple look from the lens of Federal Securities Law? Here’s how the Securities and Exchange Commission or SEC views XRP from the Howey Test perspective:

Prong 1: As a digital asset, XRP can be bought, sold, and even traded. This approach towards investment satisfies the first prong.

Prong 2: SEC mentions that Ripple Labs is the company behind XRP — the digital asset. Per the narrative, the second prong satisfies itself if the control of Ripple Labs on the distribution and development of XRP is established. For now, let’s say this prong is debatable, considering the ongoing SEC vs. XRP case.

Prong 3: People have bought or have been buying XRP with a focus on profits. Plus, with the supposed control of XRP by Ripple, profit expectations seem influenced. This might also satisfy the third prong if proven. Also, let’s assume that even this aspect is debatable. Yet, investors are very much focused on profits, made evident by the rallying spurts at the trading counters.

Prong 4: XRP investors, per the previous narratives, look to company announcements to drive the prices of the digital asset. Even this fourth prong might be satisfied if the connection between Ripple Labs and XRP is proven.

The state of the prongs will depend on the SEC vs. XRP case verdict.

XRP’s arguments

And while the SEC believes every prong to be true, Ripple Labs is refuting the SEC claims with the following points:

- XRP is looked at as a currency — a cross-border medium of exchange.

- It is a use-case and functionality-specific currency with a distinct presence from investments made in Ripple Labs.

- XRP ledger is adequately decentralized and should not be regarded as a common enterprise.

As the verdict day approaches, we will have more clarity on this.

Howey Test and Ethereum

The Ethereum network’s shift to PoS from PoW ramped up the Howey Test and securities debate. Here is how the current state of prongs fit into the mix:

Prong 1: The investment quotient remains intact as Ethereum’s native coin, ETH, can be bought, traded, and even staked for some return on investment. Hence, Ethereum qualifies as an investment.

Prong 2: Both horizontal (pooling of funds) and vertical (role of promoters) interpretations ensure that the common enterprise factor isn’t fulfilled.

Prong 3 and Prong 4: The expectation of profits remain, but they aren’t at the expense of others making the efforts. Validators winning rewards still need to work hard to qualify. Hence, profits are still self-derived, dissuading the fourth prong as well.

Overall, Ethereum PoS doesn’t qualify as a security and might not need to adhere to the securities regulation and the securities act of 1933.

Howey Test and NFTs

A lot of ambiguity exists when evaluating NFTs per the Howey Test framework. NFTs, when considered as digital artwork, might not qualify for the Howey Test for the following reasons. They can be minted (not always invested in). NFTs are related to decentralized networks (not always part of centralized collectibles). And they might not always be profit-specific (NFT profile pictures, ENS domains, and more).

Plus, only if your NFT sale is programmed to give you secondary royalties does the “profit derived from others” prong comes into play.

Overall, NFTs, in most cases, do not pass even the majority of Howey Test metrics. Yet, the evaluation still needs to be on a case-to-case basis.

What should crypto firms keep in mind?

In case the investment type or an asset qualifies as a security, a company might have to keep up with the following concerns:

- Detailed and compliant registration statements.

- Disclosures to investors

- Compliance with trading rules, regulators, and other requirements relevant to the securities regulation.

- Compliance with AML and KYC requirements.

- Investor protection

- Compliant marketing and promotional gigs.

With so many aspects to cover, it is understandable why bringing the Howey Test to crypto is almost always met with resistance.

Pros and cons of the Howey Test

Pros

- Investor protection

- Legitimization of the space

- Regulatory clarity

- More power to Blockchain and builder-specific perspectives

Cons

- Stifled innovation

- Risk of overregulation

- Ambiguity in implementation as a plethora of crypto types exist

- International variations in the “securities tag.”

Some alternate approaches

To better understand the cons of the Howey Test, here are some alternate approaches you should know about. Regardless of the other approaches, the Howey Test is still the most popular one around:

- The Reves test

Much like the SEC vs. W.J. Howey Co. case, this approach was born from the Reves vs. Ernst & Young case. It also involves four prongs, namely: the buyer-seller motivation, distribution plan, investor expectations, and the existence of alternative, investor-protecting regimes.

- The “Gary Plastic” test

This test, corresponding to the SEC vs. Gary Plastic Packaging case, is a way to evaluate if a non-security can, at any time, be considered a security. Additionally, the parameters here include marketing and promotions in play, the existence of common trading areas, and investor expectations.

- The Risk Capital test

This evaluation type is popularly used in U.S. courts to determine whether an investment is a security. The metrics used here include the risk quotient associated with the investment, control of the investors on the company, and capital risks posed by the effort of others.

And while these tests are restricted to the U.S., other economies have their own frameworks to check for whether an investment may be a security. These include the Markets in Financial Instruments Directive for the European Union, the Swiss Financial Market Supervisory Authority, Canada’s Pacific Coin Test, and more.

Howey Test and crypto clarity: what does the future hold?

So what does the Howey test mean for the future of crypto? While the Howey Test and the four prongs define the regulatory landscape for financial instruments, including crypto, it is still inherently suitable for traditional investments and instruments.

In an ideal world, the Howey test would set a regulatory precedent while recognizing the unique traits of crypto. Plus, ongoing collaboration and dialogue between businesses, consumers, and regulators will always be required for all parties to navigate the complex realm of digital assets successfully.

Frequently asked questions

What are the four elements of the Howey test?

Does cryptocurrency pass the Howey test?

Does XRP pass the Howey test?

What does it mean to fail the Howey test?

Why is bitcoin not a security?

Does Ethereum pass the Howey test?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.