Optimistic investors are looking ahead to what may be an upcoming crypto/macro summer. Crypto or macro summer refers to an extended period of soaring crypto prices, typically following a bear market. Read more to learn what crypto summer is, the macroeconomic trends that influence the event, and its impact on the crypto market.

What and when is macro/crypto summer?

Crypto summer or macro summer refers to an extensive period in the market in which there’s a prolonged bullish trend. This phase is marked by a substantial rise in crypto prices and a positive market sentiment.

In a thread on X, the founder and CEO of Global Macro Investor (GMI) and Real Vision, Raoul Pal, defines macro summer as the period “when the business cycle bottoms and begins to rise following the Financial Conditions Index, which leads by about ten months.”

According to Pal, the macro summer period isn’t a passing phase. Instead, it’s an important season in the crypto and financial markets that’s deeply ingrained in market cycles and the recurring nature of the global economy. Pal attributes the macro summer as a key part of “The Everything Code” thesis and believes that crypto summer also lifts tech stocks.

While the inflow of liquidity is indeed important for tech stocks, it’s the crypto sector — more specifically Bitcoin — that tends to respond especially positively to these conditions.

In the above-referenced thread, Pal also tweeted that macro summer had already begun:

“Well, macro summer has started, it’s the part of The Everything Code cycle where the ISM picks up (GDP growth), and that is driven by liquidity, which bottomed at the end of 2022.”

According to Pal, however, the full crypto summer doesn’t fully set until altcoin season commences and the market enters into the “full banana zone.” The banana zone refers to a phase where the price of digital assets increases and is preceded by liquidity growth in crypto summer.

FOMO and macro summer

Although crypto summer is marked by an extended phase of prolonged increases in crypto prices, investors should still do their own research. Those looking to buy digital assets, such as Bitcoin (BTC) or Ether (ETH), during a macro summer should ensure they aren’t doing so because of FOMO.

The crypto fear and greed index is an excellent tool for analyzing crypto-specific emotions and user sentiments. It’s worth looking at if you want to gauge market sentiment. However, it shouldn’t be used as the sole indicator on which to base investment decisions. You should also consider looking for bull flag patterns or analyzing other chart patterns and technical indicators before investing.

Macroeconomic trends influencing crypto summer

There are various macroeconomic trends that influence crypto summer and lead to economic growth. Let’s take a look at a few.

Economic growth

Economic growth is an important factor influencing crypto summer. During periods of economic growth, investors tend to be more confident, which increases their risk appetite. In turn, this influences investment in the crypto sector.

Inflation

Inflation is another macroeconomic factor that’s linked to crypto summer. Bitcoin has been known to act as a hedge against the devaluation of fiat currencies, leading to increased investment during periods of high inflation. Conversely, rising interest rates due to high inflation can cause strain on the crypto market. Decreasing inflation numbers are arguably more favorable as lower interest rates result in easier access to liquidity.

Liquidity

With more money flowing into the economy and the financial markets, asset prices start to inflate. That holds true for traditional investments, such as stocks, but also for new investment opportunities, such as digital assets. So, an increase in liquidity is another key factor driving crypto summer.

Market trends during crypto summer

Macro summer represents a period of growth and optimism in crypto. Below are some market trends to take note of during crypto summer.

A market rally

The most noteworthy trend witnessed during crypto summer is the market rally. During this period, there’s usually a significant rise in the price of major digital assets.

A good example of a significant market rally was in 2017 when the price of BTC soared to ~$20,000. The period marked an influx of widespread media coverage, retail investors, and the emergence of various now well-known blockchain and crypto projects. In addition, from late 2020 to mid-2021, the price of BTC rose to over $60,000 while ETH experienced unprecedented growth.

This phase was driven by increased investment from institutional investors, mainstream acceptance of cryptocurrencies, and growth in the DeFi and non-fungible tokens (NFTs) space.

Increased adoption

A major crypto market trend during macro summer is the increased adoption of digital assets. Because of the continued optimism in the market, more institutions and businesses are likely to integrate digital currencies.

Regulatory changes

The crypto sector remains largely unregulated. While a handful of countries have outrightly banned digital assets, others are still coming up with regulations to pass regarding cryptocurrencies. Regulatory changes can have an impact on the value of both individual crypto assets and the market at large.

For instance, the US Securities Exchange Commission’s (SEC) decision to approve spot Bitcoin ETFs in early 2024 had a positive impact on the price of Bitcoin.

Crypto regulations provide long-term clarity to investors which helps to confidence. But what about the impact of regulatory change on crypto prices? Check our complete guide to crypto regulation for the full low-down on the benefits and drawbacks.

Positive market sentiment

When market sentiment is positive, investors are more likely to allocate more money to crypto. This then leads to wider adoption of the decentralized assets. Nonetheless, investors must master their crypto trading emotions to avoid rookie mistakes such as poorly timing the market as the hype around certain assets grows.

Key drivers of macro/crypto summer

Let’s take a look at some of the key drivers of macro/crypto summer.

Demand and supply

As in every market, demand and supply dictate where prices go. The same holds true for price movements during crypto summer. The demand and supply for crypto are influenced by several factors, including increased adoption, regulatory changes, market sentiments, or technological advancements.

The Bitcoin halving event, for example, has reduced the rate at which new coins enter circulation, making Bitcoin a scarer asset. The Bitcoin halving event occurs roughly every four years and is significant in the crypto world. This is because the event has historically resulted in positive price action for Bitcoin and the broader digital asset market in the year to follow.

Crypto-specific events and media coverage

As explained above, events such as Bitcoin halving can have a great impact on crypto summer. This is not just because the event drives scarcity, but is also due to the mainstream coverage it generates. In 2024, most media and news coverage has focused on the impact a Bitcoin halving event can have on the sector, while predicting what investors can expect. Such coverage usually leads to increased traction and interest in digital assets.

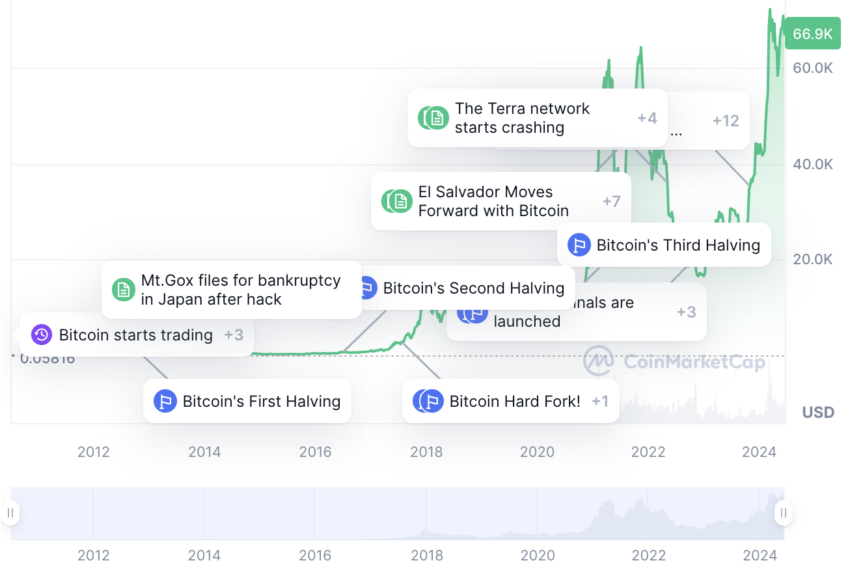

In addition, general media coverage of actions taken by various governments on crypto regulation can have a significant impact on crypto summer. Positive news like the adoption of digital assets by major countries or institutions can result in price spikes. The below chart shows the growth of Bitcoin over the years and the impact of various major events, including El Salvador’s Bitcoin adoption and the impact of various halving events.

Even with such widespread media coverage during a Bitcoin halving event, anyone looking to invest around this time should educate themselves on the best Bitcoin halving investment strategies.

Impact of macro/crypto summer on the market

Each crypto summer impacts the market differently. Here are some of the most important effects of crypto summer on the market.

Institutional involvement

One major impact of macro summer in the past is greater institutional involvement. During a crypto summer, crypto assets usually experience increased interest and investment from large investors. Institutional investors and professional traders, such as hedge funds, large corporations, and financial institutions, tend to push the prices upwards when they get involved in the digital asset market.

Numbers go up!

During a crypto summer, crypto prices go up. At the end of the day, that’s what 99% of the people in crypto are here for. While a handful of people want to make the world a better place using decentralized technologies, the vast majority want to get rich with crypto. And that’s what crypto summers are for!

Stay safe during crypto summer

Crypto summer is more than a market rally. It’s a phase of increased growth, innovation, and optimism in crypto. While crypto and macro summers are an exciting period, it’s important to carry out due diligence before investing in order to stay safe and avoid any mistakes.

Incorporating various investment strategies and tools into your decision-making can make a whole lot of difference. Most importantly, understanding the intricacies of crypto market cycles can help investors navigate the digital asset market with success.

Frequently asked questions

What is macro summer?

What causes macro/crypto summer?

How long does macro/crypto summer typically last?

What are the signs of an upcoming crypto summer?

How can investors benefit from macro/crypto summer?

What risks are associated with macro/crypto summer?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.