Swiss City St. Gallen will issue a $113 million three-year digital bond using the SIX Digital Exchange (SDX). The bond can be settled using Switzerland’s wholesale central bank digital currency (CBDC) or tokenized euros.

Swiss city St. Gallen joins the Canton of Zurich, the City of Basel, and Lugano in issuing tokenized bonds in an effort that is part of Switzerland’s CBDC trial.

SDX Targets Bonds for Smaller Firms

With a maturation period of three years, St. Gallen’s digital bonds can be settled using the Swiss Franc CBDC or tokenized euros. Like the bonds the other three regions issued, St. Gallen’s will be part of a trial to test CBDC transactions between institutions. The principal managers for the bond issuance are Kantonalbank, UBS, and J. Safra Sarasin.

A bond is a debt a company or government issues to borrow money from the investing public. Most bonds have maturation windows of three months and thirty years, after which the institution generally repays the money. Certain bond vehicles have a coupon, an interest payment that the lender can recoup regularly before the bond matures.

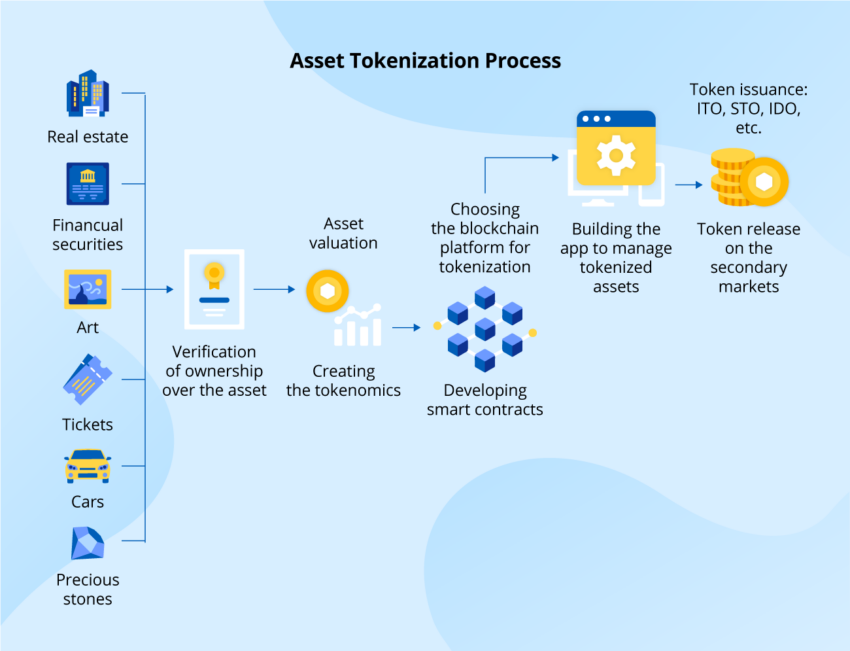

Tokenized bonds are simply bonds that issuers can settle on blockchain infrastructure. A company such as SDX converts the bond into an ownership certificate that a blockchain can understand. This company can then manage its issuance and settlement using distributed ledger technology, which is a non-trivial task, according to researchers at the Universitat Politècnica de València in Spain.

“Designing a tokenized platform involves several critical factors, including scalability, security, and user experience. Scalability is vital as the platform should be able to handle a vast number of transactions without experiencing performance issues. High-performance computing infrastructure, such as cloud computing services and efficient consensus algorithms such as proof-of-stake or sharding are crucial in achieving this,” said Angel A. Juan et al.

Read more: What is Tokenization on Blockchain?

SDX, the digital arm of the SIX stock exchange, has issued bonds for major institutions, including SIX, UBS, and the four Swiss regions. It is also targeting smaller companies interested in issuing digital bonds.

Global Regulators Welcome Tokenization

European regulators have been at the forefront of legalizing real-world asset real-world asset (RWA) tokenization. Switzerland’s Financial Market Supervisory Authority gave the SIX stock exchange a license to launch SDX in 2021. The regulator was among the first globally to issue two licenses, allowing SIX to operate a stock exchange and a blockchain-based depository institution.

Last year, Goldman Sachs helped Germany’s Siemens AG launch a $65 million tokenized bond on a public blockchain. The bond issuance complied with Germany’s Electronics Securities Act.

Regulators in the Middle East are also making waves. The financial watchdog of the Abu Dhabi Global Markets region drafted legislation allowing Bridgewater and Deus X Capital to set up an institutional blockchain business. The $250 million platform offers institutional crypto staking with delegated assets.

Read more: What Is Crypto Staking? A Guide to Earning Passive Income

Southeast Asian governments have also made significant strides. The Monetary Authority of Singapore gave the local branch of Switzerland’s Sygnum Bank a crypto brokerage license shortly before Hong Kong’s Securities and Futures Commission hinted that it was working on tokenization regulations. BeInCrypto has contacted the Swiss city of St. Gallen for comment but has not heard back at press time.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.