Crypto debit cards can be useful and continue to grow in popularity. As more individuals join the crypto market, infrastructure providers are seeking to make it easier for them to join.

Europe is among the regions where crypto debit cards are becoming more common. This guide lists the top nine crypto debit cards in Europe, along with everything you need to know about each.

BeInCrypto evaluated the top crypto debit cards in Europe over six months. Criteria included the service fees, the card’s user-friendliness, and multiple other features. Here are our reasons for choosing each crypto debit card with care:

Wirex Card

- Wirex Card offers free ATM withdrawals of up to £200 monthly.

- It supports BTC, ETH, SHIB, and 50+ coins and tokens.

- Users can convert crypto to fiat instantly within the app.

- The card allows you to hold multiple currencies in your account without extra fees.

- You can earn up to 8% cashback on in-store and online purchases.

- It supports contactless payments for quick and secure transactions.

YouHodler Card

- YouHodler Card allows you to use your crypto as collateral for instant loans.

- The card is available physically for worldwide use.

- There are no monthly or annual maintenance fees.

- The card provides high spending and withdrawal limits.

Uphold Card

- It has a high daily spending limit of £10,000.

- The card offers low ATM withdrawal fees (£2.50 domestic, £3.50 foreign).

- You can access and spend multiple asset types, including metals and fiat.

- The card integrates seamlessly with the Uphold app.

- It offers competitive fees on transactions and conversions.

Bybit Card

- It has competitive fees for trading and transactions.

- The card includes advanced security measures, including multi-signature wallets.

- It can be used globally with low foreign transaction fees.

- It supports instant transfers between Bybit accounts.

- The card supports a variety of fiat and cryptocurrencies.

Binance Card

- Binance Card allows users to earn up to 8% cashback on purchases.

- The card can be used worldwide with low foreign transaction fees.

- It supports BNB, BUSD, USDT, BTC, and more.

- Users can convert crypto to fiat instantly for payments.

- There are no monthly or annual fees for card maintenance.

Nexo Card

- Nexo Card offers flexible cashback, earning up to 2% in NEXO tokens or 0.5% in BTC.

- There are no monthly, annual, or foreign transaction fees.

- Users can use crypto as collateral for instant loans.

- The card has high transaction and withdrawal limits.

- The card offers multi-factor authentication and cold storage for security.

SpectroCoin Card

- SpectroCoin Card has low transaction fees, with no fees for purchases within EEA and low fees for non-EEA transactions.

- The card offers chargeback fee protection.

- It is available as both physical and virtual cards.

- Expedited shipping options are available.

- The card has low fees for ATM withdrawals.

Crypto.com Card

- Crypto.com Card offers up to 8% cashback on purchases.

- It supports ADA, BTC, ETH, and many more.

- Users get free ATM withdrawals up to a monthly limit, with low fees beyond that.

- Additional rewards are available for staking CRO tokens.

To learn more about BeInCrypto’s Verification Methodology, navigate to our website.

- What are crypto debit cards?

- Top 8 crypto debit cards in Europe

- 1. Wirex Card

- 2. Coinbase Card

- 3. Uphold Card

- 4. Bybit Card

- 5. Binance Card

- 6. Nexo Card

- 7. SpectroCoin Card

- 8. Crypto.com Card

- How do crypto debit cards work?

- Crypto debit cards compared

- What are the benefits of using crypto debit cards?

- What security features do European debit cards offer to protect against fraud?

- How to choose the right card for you

- Frequently asked questions

What are crypto debit cards?

Crypto debit cards allow individuals to use their crypto assets to purchase online and in-person products and services. Crypto cardholders can use this physical card for transactions or ATM withdrawals, just like traditional debit and credit cards. They can preload their debit cards with cryptocurrency, and then the crypto debit card automatically exchanges only the needed amount of fiat at the time of the purchase.

Over the last few years, cryptocurrency has become more mainstream, and that has led to an increase in the number of crypto debit cards available in Europe. Some of these services offer perks such as cashback rewards, interest rates, and other useful insights on their mobile apps. The debit cards offer support for multiple cryptocurrencies, including bitcoin (BTC), ethereum (ETH), and litecoin (LTC).

Top 8 crypto debit cards in Europe

As a cryptocurrency investor and holder, you want to use and access your digital assets as easily as possible. Luckily, as a European resident, you have plenty of crypto debit card options. The top six crypto debit cards in Europe are listed below.

1. Wirex Card

Wirex cards are debit cards. It functions similarly to a traditional debit or credit card, except that it only spends cryptocurrency. The Wirex card is not associated with a bank account. It is connected to your Wirex wallet and can be used anywhere Visa Cards are accepted.

To top up, it costs Crypto account: 3.24%, Fiat/stable account: 1.99%. Limits to transfer out are: 10K USD per transaction, 50K USD per day.

- Uses cold-storage and multi-sig

- Can use worldwide

- U.S. accounts FDIC insured

- High Cryptoback up to 8%

- Different features for different countries

- Rewards paid in "X-Points"

1. On the Dashboard, scroll down and choose “Order cards”.

2. In the Order new card window, select Get the card.

3. Review your personal details and the billing address.

4. Select delivery options.

5. Click Place order. You will see the success message.

2. Coinbase Card

The Coinbase Card is a Visa debit card that is accepted anywhere Visa is accepted. It works offline, online, and globally. You can use the card to make everyday purchases at your favorite stores or to withdraw cash from your Coinbase account at ATMs. The Coinbase Card can be used to spend funs from any of your Coinbase balances.

– There are no transaction fees for spending with the Coinbase Card.

– You can spend U.S. Dollars (USD), USDC, or any supported crypto on Coinbase using your Coinbase Card and there will be no transaction fees.

– Coinbase does include a spread in the price to buy or sell cryptocurrencies.

– 1.5% for ATM transactions.

- Connects to your Coinbase account

- Physical and virtual

- Cashback rewards

- Accepted anywhere Visa is accepted

- Spending limit

- One card per user

1. Sign up to Coinbase Card using the link below

2. Go to your Pay tab

3. Select Apply now under Coinbase Card

4. Follow the prompts to sign up.

3. Uphold Card

Uphold cards are debit cards. Meaning that the crypto you spend comes directly from you account with Uphold. They also offer both physical and virtual cards, which you can track your transactions through the app. The flagship Uphold card is supported by Mastercard, and is supported wherever Mastercard is accepted.

There is no annual fee and no foreign transaction fees with the Uphold card. However, there is a spending limit of £10,000 GBP and 50 transactions per day. IN the U.K. there are also ATM withdrawal fees, £2.50 GBP domestic and £3.50 foreign.

- No foreign transaction or annual fees

- An app to monitor transactions

- Cashback rewards, booosted with XRP

- Apple & Google Pay

- Only available in U.K.

- Card shipping fee of £9.95

1. Go to the Uphold website by clicking the link in the description.

2. Create a free account.

3. Activate your card within the wallet.

4. Bybit Card

The Bybit card is a Mastercard supported debit card. This means that you will be able to spend crypto from your Bybit account. When you use the card to make a payment, the funds are automatically deducted from your funding account.

The Bybit card has a foreign exchange fee of 0.5%. There is also a conversion fee of 0.9% with a minimum conversion of 10 EUR/GBP. When it comes to annual, inactivity, or cancellation fees, there are none. There is however an ATM fee of 2% after the first 100 EUR/GBP, which resets each month.

Additionally, the maximum limits on the card are 5,000 (EUR/GBP) daily, 50,000 monthly, and 250,000 annually. There is a max limit of ATM withdrawals 10 to 2,500 times depending on the time frame, and 2,000 to 75,000 (EUR/GBP) depending on the time frame.

- Up to 10% cashback

- Associated card app to manage your transactions

- Accepted in over 90 million merchants worldwide

- Loyalty rewards

- Not available in some geographic regions

- ATM withdrawal and spending limit may not suit some users

1. Go to the Bybit website and select “Finance.”

2. Select “Card,” then “Apply Now.”

3. Submit KYC information and give phone number and email address to confirm information.

4. After your account passes review, you can use your virtual card or order a physical one.

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk.

5. Binance Card

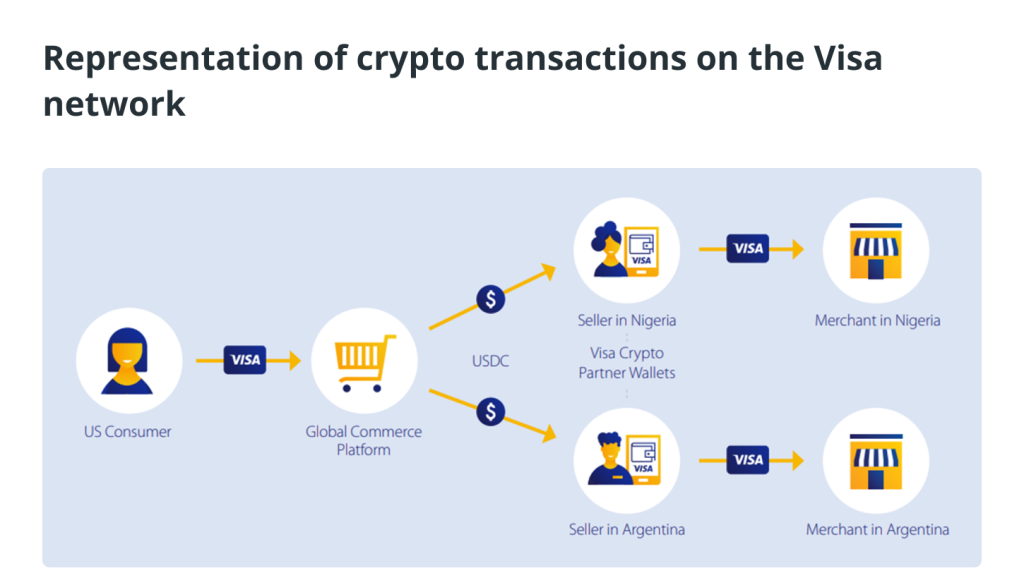

The Binance Debit Card is a cryptocurrency debit card that allows you to easily convert your crypto assets into fiat currency. Because the Binance Card is issued by Visa, it can be used anywhere Visa is accepted. It also functions similarly to a traditional debit card, allowing you to make purchases and withdraw cash from ATMs.

– Amount per contactless transaction: 50 EUR (across Europe).

– Accumulated amount of contactless payments: 150 EUR. When you reach the accumulated contactless payment limit, you need to make a Chip & Pin transaction to reset it, and you will be able to use contactless payment again.

– Transaction fees up to 0.9%.

- Up to 8% cashback

- Virtual and physical

- Card for refugees

- Low ATM and virtual card spending limit

- Not available in U.S.

1. Follow the link below and click on Get Started

2. Create an account on Binance. To order a Binance Card, you must complete Identity Verification and live in a region where Binance Card is available.

3. Return to Binance card page and follow the instructions.

6. Nexo Card

Nexo gives you fiat you can spend and in return, you provide crypto as security for repayment. All this is done in the background whenever you make a purchase with your card. Rates start from 0% APR and never exceed 13.9% APR.

– No monthly, annual, or inactivity fees.

– No FX fees for up to €20,000 per month.

– Up to €10,000 in monthly ATM withdrawals.

– Up to 10 free withdrawals per month.

- Physical and virtual

- Cashback rewards

- Accepted wherever Mastercard is accepted

- Only available for EEA residents

- Only works on credit

1. Open the Nexo app using the link below, create an account on Nexo and go to the Card tab.

2. Swipe left and tap on the Order Nexo Card button.

3. Follow the on-screen instructions and wait up to 2 weeks for your card to arrive. Your virtual card will be ready instantly.

7. SpectroCoin Card

The SpectroCoin card functions similarly to any other debit card. Instead of a bank account, you can use funds from your wallet. After you’ve funded your card, you can use it anywhere Mastercard is accepted.

-For purchases made within EEA countries, in EUR, SpectroCoin does not charge a transaction fee

-0.5% for transactions not in EUR and 1% for internet transactions not in EUR

-Using an ATM to get cash costs 1%-2%.

- Mobile-app

- More than 40 cryptocurrencies accepted

- No monthly fee

- Not available in U.S.

- No cashback

- High fees

1. Get the Spectrocoin.com.

2. Open an account

3. Provide taxpayer identification information.

4. Set a pin.

5. Order virtual or physical card.

8. Crypto.com Card

In the Crypto.com App, you can top up your card with your fiat wallet, crypto wallet, or credit/debit card. Cryptocurrency cannot be loaded onto the Crypto.com Visa Card. The card is a prepaid card, not a traditional debit card.

-$4.95 inactivity fee per month after 12 months

-3% foreign transaction fee on all non-USD purchases and ATM withdrawals

-2% ATM withdrawal fee on amounts above the monthly free ATM limit

-$25,000 max balance on all cards

-Free ATM monthly limit $200-$1,000

-ATM withdrawal limit $500-$1,000 daily, $5,000-$10,000 monthly

-Purchase limit $10,000-$25,000 daily, $15,000-$25,000 monthly

- Various benefits like Spotify, Netflix, AirBnB, etc.

- Connected to your Crypto.com

- Inheritance service

- Have to stake CRO to get card

- Reward restrictions

1. You need to lockup CRO tokens for a period of 180 days to apply for a Crypto.com Visa Card.

2. Sign up for a Crypto.com App account and complete KYC verification.

3. Purchase CRO tokens and deposit them into your Crypto Wallet in the App (the amount of CRO depends on the card tier you’re applying for).

4. Go to the ‘Card’ tab in the App, select your desired Crypto.com Visa Card.

5. Tap the ‘Lockup CRO’ button, and follow the on-screen instructions.

How do crypto debit cards work?

You can use a cryptocurrency debit card to make purchases just like a traditional debit card. A crypto debit card acts like a prepaid card and can be loaded with crypto to make in-store or online purchases from merchants who don’t otherwise accept cryptocurrency.

Many crypto debit cards are supported by traditional credit card companies. This allows users to make purchases anywhere the major credit card company’s cards are accepted. This is the case for most crypto debit cards.

To request a crypto debit card in Europe, you will need to open an account with one of the companies that offer a cryptocurrency debit card. Before using your card, you must verify your identity and deposit crypto in your account.

There are different conditions based on what card you have and what crypto you choose. Every crypto debit card offers a list of cryptocurrencies. Obviously, the most commonly supported cryptos include bitcoin and ethereum.

The majority of these crypto debit cards work with a software cryptocurrency wallet and an app that allows you to load crypto or fiat onto the card. You can manage your card and account through that app. The app also offers a virtual card that can be used for online purchases.

Once the card is loaded, you can use it at ATMs, merchant stores, and other locations, just like a regular debit card. The best part is that you don’t have to wait for your physical card to arrive. After signing up for an account, you can use your virtual card immediately.

Many crypto cards offer a flat rate for rewards and cashback for your purchases in specific categories, just like regular rewards cards.

Crypto debit cards compared

| Features | Type | Fees | Cashback | Issuance fee | Supported crypto |

| Nexo Card | Physical and virtual | -Rates start at 0%, up to 13.9% -No inactivity, annual, or monthly fees -No foreign exchange fees for up to €20,000 per month | Up to 2% | Free | BTC, ETH, XRP, and 14+ assets |

| Coinbase Card | Physical and virtual | -No transaction fees -1.5% fee for ATM transactions | Up to 4% | £4.95 | Any coins or tokens supported by Coinbase |

| Binance Card | Physical and virtual | -Transaction fees up to 0.9% -ATM withdrawal fee 2% (per withdrawal) for non-EUR, and outside of Europe -Foreign transaction fee 2% per transaction for non-EUR, outside Europe | Up to 8% | -First issuance free -Re-issuance €25 | BNB, BUSD, USDT, BTC, SXP, ETH, EUR, ADA, DOT, XRP, AVAX, SHIB, LAZIO, PORTO, SANTOS |

| SpectroCoin Card | Physical and virtual | -No transaction for purchases made within EEA countries, in EUR, -0.5% for transactions not in EUR 1% for internet transactions not in EUR -Using an ATM to get cash costs 1%-2%. -Chargeback €25 | No | -Free -Re-issuance €15 -€60 expedited shipping | Any coins or tokens supported by the SpectroCoin wallet |

| Wirex Card | Physical and virtual | -Free ATM withdrawal up to £200 monthly after which a small fee of 2% is applied (EEA/ UK, international/ domestic) | Up to 8% | Free | BTC, ETH, SHIB, and 50+ coins and tokens |

| Crypto.com Card | Physical and virtual | -$4.95 inactivity fee per month after 12 months -3% foreign transaction fee on all non-USD purchases and ATM withdrawals -2% ATM withdrawal fee on amounts above the monthly free ATM limit | Up to 8% | -$4.99 for the first physical Midnight Blue card | ADA, BTC, CHZ, DAI, DOGE, ENJ, EOS, ETH, LINK, LTC, MANA, MATIC, USDP, TAUD, TCAD, TGBP, TUSD, UNI, USDC, USDT, VET, XLM & ZIL |

| Uphold Card | Physical and virtual | -Spending limit of £10,000 GBP and 50 transactions per day -ATM withdrawal fees (UK), £2.50 GBP domestic and £3.50 foreign | Up to 4% | -Card shipping fee of £9.95 | 250+ coins and tokens |

What are the benefits of using crypto debit cards?

Nowadays, cryptocurrency is used by an increasing number of people from all over the world. As seen in the figure below, crypto adoption is increasing at a similar rate as the internet. Since digital assets are part of our daily lives, more people are becoming interested in how they can use them as payment.

Because most businesses don’t accept cryptocurrency payments (yet!), a crypto debit card will indirectly help you pay with crypto for goods and services. Here are the main benefits of using a crypto debit card in Europe:

- Cashback reward: You can earn cashback rewards by simply paying with your crypto debit card. Each cryptocurrency card provider may offer different benefits, and some may offer 3% or higher rewards for each transaction.

- Access to different currencies with only one card: Many cryptocurrency debit cards allow you to access your fiat currencies as well as crypto assets.

- Convenient for everyday expenses: If you want to use your crypto for everyday expenses like groceries or gas, crypto debit cards are a great solution

Crypto vs. traditional debit cards

The benefits of crypto debit cards can not be overstated. They are the bridge from traditional finance to web3. Crypto debit cards allow you to use your crypto for real-world use cases. They also have some benefits over traditional debit cards.

Contrary to popular belief, transactions made with traditional debit cards aren’t settled until days later. This means that crypto debit cards give you faster payment finality.

In addition, crypto debit cards are a great solution for the unbanked. According to the most recent data from the World Bank, about 1.7 billion people do not have access to financial institutions. You do not have to sign up for a bank account to use them. You can also use them to withdraw money from ATMs nearly anywhere major card providers are accepted, in your local currency.

What security features do European debit cards offer to protect against fraud?

European debit cards incorporate several advanced security features to ensure the safety of transactions and protect users against fraud, including those using traditional cards and innovative financial products like crypto credit cards. These measures are designed to safeguard your financial information and provide peace of mind while using conventional and crypto credit cards, including those from top European crypto exchanges.

- Protect your PIN: Keep your PIN confidential and never share it with anyone. This fundamental step helps prevent unauthorized access to your account.

- Check your bank statements regularly: Regularly reviewing your bank statements lets you quickly identify and report suspicious transactions.

- EMV chip technology: European debit cards are equipped with EMV chips, which provide stronger security than traditional magnetic stripe cards, making it harder for fraudsters to clone a card.

- Two-Factor Authentication (2FA): Many banks and Bitcoin debit cards offer 2FA for online transactions, which requires a second verification form and adds an extra layer of security.

- Real-time alerts: Banks often provide real-time alerts for transactions made with your debit card, enabling you to monitor activity and quickly respond to any fraudulent charges.

By leveraging these security features, users can enjoy greater protection against fraud using traditional debit cards and innovative financial products like crypto credit cards.

How to choose the right card for you

If you believe that the asset class will become more prominent in day-to-day usage and have a hefty amount of crypto, then a crypto debit may be for you. It can be a convenient way of using crypto for your expenses.

Furthermore, if you use crypto a lot, then you might be more interested in receiving more cashback for your purchases. In this case, you’ll have to explore all the different tiers for cashback rewards for each card. It’s also worth mentioning that each card may have different transaction fees.

Join the BeInCrypto Telegram group if you want more information on crypto debit cards (or anything else web3-related!) Many of our members will be happy to help and answer your questions in more detail.

Frequently asked questions

Yes, specific regulations in Europe affect the use of crypto debit cards. The European Union’s Fifth Anti-Money Laundering Directive (5AMLD) mandates stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures for crypto-related services. Additionally, crypto debit card providers must comply with the General Data Protection Regulation (GDPR) to ensure data privacy and protection.

There are many crypto debit cards available today. Contrary to popular belief, you can spend your cryptocurrency for many everyday purchases. Some cryptocurrency debit cards can be spent in the same fashion as traditional debit cards.

Yes, specific regulations in Europe affect the use of crypto debit cards. The European Union’s Fifth Anti-Money Laundering Directive (5AMLD) mandates stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures for crypto-related services. Additionally, crypto debit card providers must comply with the General Data Protection Regulation (GDPR) to ensure data privacy and protection.

Cryptocurrency debit cards are issued in collaboration with major credit card services. They can be used online or in-store anywhere major credit cards are accepted. Cardholders can also withdraw cash from any ATM that the credit service supports.

In most cases, if your crypto card is supported by Visa, you can withdraw from any ATM baring the VISA logo. In other cases, there are many cryptocurrency ATMs that support cards. Some ATMs even allow you to purchase cryptocurrency at the ATM.

Since Mar. 2021, Crypto.com cards have been available in Europe. Cardholders can use the Crypto.com Visa cards for online and in-store purchases. Crypto debit cards are issued in collaboration with major credit card services. They can be used online or in-store, anywhere that major credit cards are accepted.

There are many crypto debit cards in Europe that allow users to use their crypto just like a bank account. Some of the most popular debit cards for crypto purchases are Crypto.com, Coinbase card, Binance, and Wirex.

Each crypto debit card presents different features and benefits that are based on specific tiers of the card. Most of these benefits are based on the amount of crypto you own and hold in your crypto wallet.

To set up a crypto debit card, you need to select one of the available services and sign up for an account. You will have to verify your identity and then order your physical card. To start using the card, you will have to fund it with crypto.

Having a crypto debit card empowers cryptocurrency holders to actively spend their crypto for everyday purchases. Similar to the way we use fiat currencies, crypto-assets can be used to pay for your groceries. When paying with a crypto debit card, the card is converting crypto automatically to the exact amount needed into fiat currencies for payment.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.