Mirror Protocol is one of Terraform Labs’ newest products. Its goal is to allow crypto users to interact with the financial system through innovative means. Using smart contracts, crypto users can purchase synthetic assets that mirror the price of real-life assets, such as stocks and precious metals.

What are the odds of Mirror Protocol becoming the top DeFi project? Is the protocol something that you can use to your advantage? Let’s find out in our following, expansive guide.

In this guide:

What is Mirror Protocol?

Mirror Protocol allows its users to trade and create synthetic assets. It helps unify the worlds of traditional assets with blockchain technology. It’s a protocol that can prove enticing to regular users seeking an alternative to the traditional banking system.

Mirror Protocol is a DeFi protocol that uses the Terra blockchain to create synthetic assets known as Mirrored Assets or mAssets.

Mirror uses the CosmWasm smart contract programming language. mAssets replicate the price behavior of digital and traditional financial assets. The trade is done without intermediaries. And the underlying assets don’t need to be purchased directly.

mAssets can be easily and quickly transferred across the Terra, Ethereum, and Binance Smartchain networks. Terra stablecoins are, in fact, exchanged for mAssets. mAssets can then be deposited into Collateralized Debt Positions (or CDPs). To stabilize the mAsset value, the protocol uses CDPs.

How Mirror Protocol originated

Terraform Labs is responsible for launching Mirror Protocol in early 2020. Terraform Labs company is based in South Korea and also created the Terra network. Do Kwon is the CEO and co-founder of Terraform Labs and Mirror Protocol.

Terraform Labs introduced Mirror Protocol in Dec. 2020 to create price-stable derivative assets on Terra Network. Mirror Protocol aims toward complete decentralization. MIR holders conduct governance of the protocol.

Participants in the network benefit from MIR tokens’ distribution. Their roles in the protocol determine the distribution model. The project’s main objective is to make it easy to access financial markets and to facilitate liquidity that can be used to create synthetic assets.

Mirror’s native token is MIR. It was first issued to Terra liquidity providers via Uniswap and Terraswap between Nov. 11 and Dec. 4, 2020. Mirror’s genesis event began a four-year-long issuance of MIR tokens to Terra and Mirror users. Mirror was the fifteenth-largest DeFi protocol, according to TVL, by May 2021. It had $118 billion in collateral locked in the protocol.

The team behind Mirror Protocol

Do Kwon and Daniel Shin founded Terra in Jan. 2018. They conceived the project as a way to promote the adoption of cryptocurrency and blockchain technology by focusing on usability and price stability. Kwon assumed the role of CEO at Terraform Labs, the company behind Terra and Mirror Protocol.

Do Kwon was born in South Korea to a family of medical equipment distributors. He often speaks of his commitment to cryptocurrency’s global goals.

Anyfi was Kwon’s first company back in 2016. It received grants of $1 million from South Korean government officials and angel investors. Kwon first learned about cryptocurrency by experimenting with the use of blockchain technology.

Starting Terraform Labs

Daniel Shin is a co-founder of the company Ticket Monster. In the Korean tech scene, Shin is widely appreciated. In 2010, he began his e-commerce website. It quickly grew to be one of the largest internet companies in the country. Shin expressed his desire to invest in the new generation of Korean tech companies. This is how Kown and Shin struck a partnership.

Mirror is only one part of the constellation of apps that surround the Terra galaxy. They now call themselves Terranauts. Furthermore, they say that their goal is to continue expanding. They wish to use decentralized blockchain technology to improve all areas of finance.

How does Mirror Protocol work?

Mirror functions as a synthetics-trading tool alternative. The ultimate goal, according to Do Kwon, is to create a genuine alternative to the classic financial system.

Mirror Protocol allows users to trade tokens that mirror important financial assets, without having any of the financial assets, such as stocks or precious metals. The system of tokenization of real-life assets reduces the barrier to entry for traders around the world. Mirror Protocol makes it possible for anyone anywhere to trade tokenized assets around the globe. This level of ease involved in traditional trading was unheard of only a few years ago.

Buying synthetic stock using the Mirror Protocol

But how does it work, exactly? Let’s take one of tech’s biggest companies, Apple, as an example. On the NASDAQ market, the trade of Apple stock occurs daily. Purchasing stock is equivalent to purchasing shares in the company. With Mirror, we can create a new asset based on the Apple stock. We simply go to the website and find the stock labeled mAAPL. AAPL is the name of the stock traded on NASDAQ.

The website will require that you stake funds into the protocol to generate mAssets of mAAPL. This results in what is referred to as overcollaterization on the Mirror Protocol. This process helps protect against sharp price volatility. It essentially means that there is enough provision of collateral in the case of default. Finally, the created mAsset reflects the actual price of the asset it mimics. It is, essentially, a method to use the crypto market while investing in the classic stock market.

As a result, when purchasing the mAAPL you will pay a higher price. This represents the overcollaterization. Furthermore, the price of the actual stock is subject to price change. It can be worth $100 when you purchase it and $80 or $120 in the following weeks.

How do you profit from Mirror Protocol?

Once you have minted the asset, in our case mAAPL, there are a number of ways to earn profit:

- Provide the assets as liquidity and earn a segment of the exchange fees.

- Sell their assets and profit from the price fluctuation of their stock. If they purchase the same stock cheaper, they are able to unlock their collateral and make a profit on the difference.

- Stake or yield farm the mAAPL and earn MIR.

Naturally, you can also buy mAAPL from someone who has minted the token. The Mirrored Assets are tradable on the protocol. This is, overall, the best strategy for investing in a company. These tokens are tradable. Also, the tokens are transferable to other chains or tradable off-chain.

Roles within Mirror Protocol

The concept of decentralization is at the heart of Terra’s ecosystem. Mirror Protocol, like their other products, encourages governance participation. In keeping with this spirit, users can hold different roles within the ecosystem. There are incentives for each role. And each contributes to the daily operations of the protocol.

Crypto users have five roles within the Mirror Protocol: trader, minter, liquidity provider, staker, and farmer. There is also an auxiliary role, oracle feeder. Each protocol participant contributes differently. Let’s take a look at the characteristics of each of these.

Minter

Essentially, a minter creates synthetic assets. Once created, the asset can be traded in a variety of ways. The minter may choose to keep their asset or short it for profit. They are different from traders in that their strategy for earning profit may be more complex. This is one of the reasons why they accept to pay higher collateral for minting.

A minter is an individual who enters into a collateralized loan position (CDP), to receive newly minted tokens from an mAsset. CDPs may accept collateral in the form UST, mAssets, or whitelisted collateral. They must also maintain a collateral ratio that is higher than the mAsset minimum multiplied with a premium rate. Governance determines this rate.

The shorter is a similar role with a few distinctions. The same CDP is taken shorter. However, they sell the tokens immediately to get new-minted sLP coins. If Terraswap prices are higher than the oracle price, sLP tokens can be staked for MIR reward. Shorters, therefore effectively take a short against the price direction of the reflected asset.

As long as the CDP’s minimum collateral ratio is not exceeded, excess collateral can be withdrawn. Minters have the option to adjust the collateral ratio of CDP by depositing or burning more collateral.

Traders

Traders are the ones that take advantage of the price fluctuation of stocks that the mAssets mirror. They can show their support and trust in a company’s stock by trading assets that have already been minted on the protocol. The traders use UST stablecoin through the Terraswap network.

This is the most straightforward way to use Mirror Protocol to your advantage as a user. Engaging with the platform as a trader allows you to utilize the protocol in the same way that you would use any other stock-trading app.

Liquidity providers

The liquidity provider adds the same amount of mAsset and stablecoin to the Terraswap pool. This increases market liquidity for the entire market. In this way, newly minted LP tokens are rewarded to the liquidity provider. This represents their stake in the pool. They also receive rewards from pool trading fees.

Stakers

A staker is a user who stakes LP tokens, sLP tokens (with staking contract), or MIR tokens (with Gov contract) to earn staking rewards as MIR tokens. While staking token holders of LP tokens and sLP tokens are eligible for rewards from inflation-related MIR tokens, stakers of MIR tokens can earn staking rewards through CDP withdrawal fees.

Users who have staked MIR tokens are eligible to vote and participate in governance. The amount of stake MIR will determine how much voting power they receive. The governance token helps approve various items for inclusion in the protocol. For example, whitelisting of mAssets occurs. Furthermore, voting determines changes to protocol parameters. Users can unstake MIR Tokens at any stage. Votes, however, count towards future elections solely.

Farmers

Crypto farming is possible on the Mirror Protocol. Users receive MIR, the native token of the protocol, as an incentive. In exchange, they must stake LP tokens minted when providing liquidity for mAssets and MIR. Yield is calculated on a yearly basis. MIR’s issuance will happen over the course of four years. This could, technically, make MIR more valuable over time.

Features of Mirror Protocol

There are a number of features that make Mirror Protocol highly interesting. The key aspect is, of course, its mirroring of regular stocks. Besides this, the protocol provides incentives for users that can adopt various strategies.

Also, the Mirror Protocol has three token types: the MIR token, the LP token, and the mAsset token. The LP tokens are used by liquidity providers to add liquidity to pools. The mAsset is a blockchain asset that acts like a mirror of real-world assets by reflecting the exchange prices. And, MIR encourages users to stake LP tokens and for governance.

ATQ Capital manages Mirror Protocol’s wallet, the Mirror Wallet. It is used to buy crypto and ETFs with crypto. Users have unlimited access to financial markets. Mirror Wallet is a simple wallet that allows users to connect with the protocol, and it provides a variety of synthetic investment options.

Besides this, the Mirror Protocol website includes four essential features. These correspond to the roles we previously outlined.

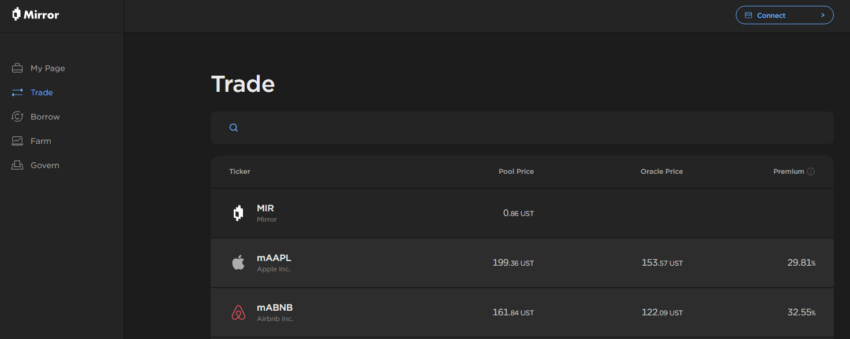

Trade

This tab allows users to trade MIR and minted stock. Information about the asset’s estimated pool and oracle prices is provided. When purchasing, for example, mAAPL users are shown the Oracle price, the total liquidity, and the tax fees. The Terra blockchain facilitates trades.

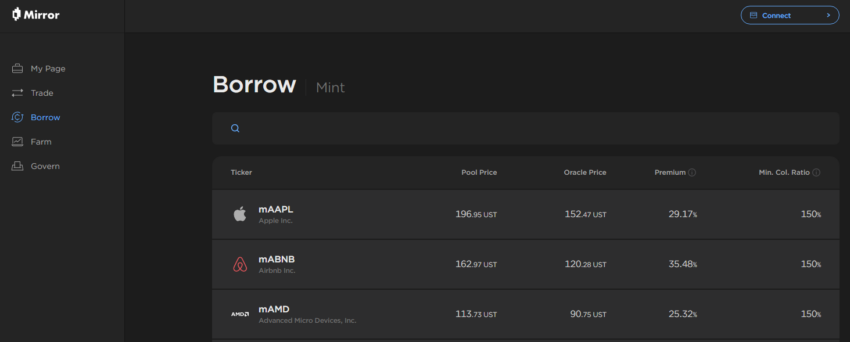

Borrow

This tab shows borrowing conditions. For example, a user must pay, at least, 150% collateral for mAAPL stock. The transactions include fees also. Users must repay their loan under the conditions stipulated before the purchase.

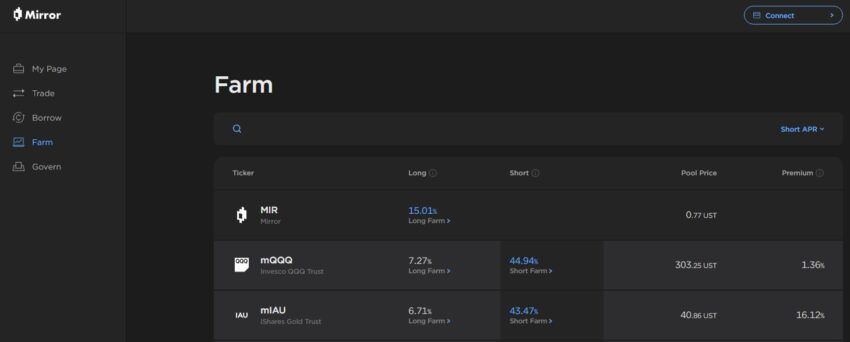

Farm

On the Farm tab, users are provided the available list of staking pools. Users can earn MIR rewards through both long and short positions. The difference between the Terraswap and Oracle prices is the Premium. When choosing a Long Farm position, users provide an equal value of the asset and UST. When choosing a Short Farm position, users must lock collateral assets in the protocol and then mint mAssets. At any point, users can unstake LP tokens.

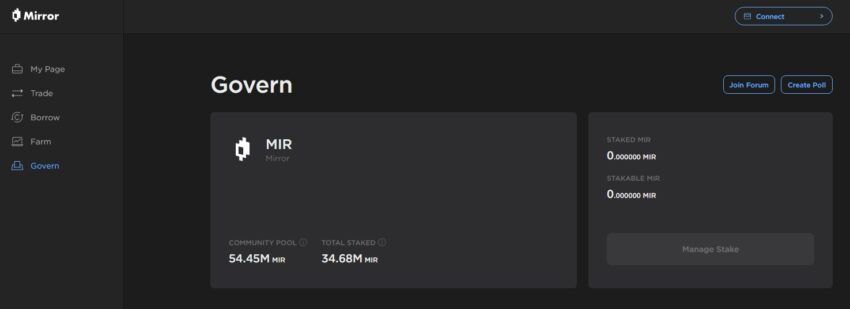

Govern

Voting on various proposals is done using MIR tokens. This ensures the decentralization of the network. Collateral values and whitelisting assets are issues discussed on the Govern tab.

What gives Mirror Protocol value?

Mirror Protocol’s value comes from its technical capabilities, and the technology behind it. This makes it possible for anyone to create synthetic assets, without having to own the underlying assets. To maintain the assets’ value, the system uses smart contract collateralization. It is worth remembering that the various roles of users provide incentives that exist outside the scope of the native token.

How to use Mirror Protocol

Using Mirror Protocol is a relatively straightforward process. Users must first access the website and connect to the Terra blockchain using their crypto wallet. They then have the option to mint, and trade synthetic assets. They can also farm, borrow, or take part in the governance process. On the dashboard (My Page), users see all the active transactions.

The MIR token

The MIR is the native token of the Mirror Protocol. It facilitates all transactions on the protocol and functions on the Terra blockchain. It serves within the reward system to stakers and is the token that measures voting power of its holders in the decentralized governance of protocol.

To ensure its revaluation, the MIR token is essential within the protocol. Therefore, developers decided to limit its existence to a maximum number of 370 million tokens. These are distributed across four years. Accelerated distribution occurs as the deadline nears. This means that, as with bitcoin, rewards will be fewer as time passes. The rarity factor could help increase the value of MIR.

Tokenomics

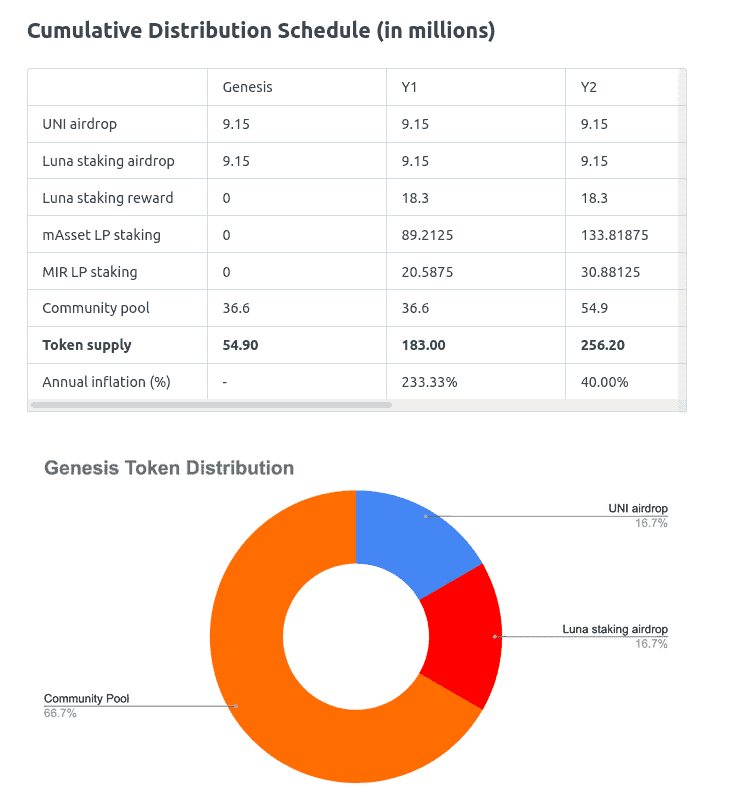

The total token supply is 370 million MIR tokens. The total supply distribution occurs over four years.

Mirror Protocol has a restricted supply of MIR coin. The finite supply acts to prevent inflation and devaluation of MIR tokens.

MIR price and price prediction

At the time of writing, one unit of MIR costs around $0.4. It has decreased nearly 40% over previous days. This is due, in no small part, to the current bear market. This has affected almost all cryptocurrencies. Its all-time high price was $2.40.

Forecasts for MIR are, generally, positive. Crypto experts say that the Mirror Protocol price could reach $2.35 by the end of 2022, equaling its greatest value. The same analysts predict a value of $3.35 in 2023. By 2026, at this rate, it could have surpassed $10.28.

How to buy MIR token

The MIR token is available on many of the largest crypto exchange services. Users can purchase it from Binance U.S, Coinbase, Uniswap, Kucoin, etc.

Will Mirror Protocol change crypto finances?

Mirroring of stocks through synthetic assets is an interesting prospect for the crypto world. As has been stated before, this makes Mirror a crypto-rival to Robinhood. It will allow crypto users to endorse and invest in stocks. But, it does this in an innovative way that involves blockchain technology.

Is there a risk? Certainly, mirrored assets can only be minted on the Terra blockchain. But this is not necessarily a terrible thing. Terraform Labs’ products are very popular at the moment. LUNA, their native coin, has received widespread coverage. Besides, the assets are transferable to Ethereum and sold off-chain as well.

There are also numerous ways to profit from the Mirror Protocol. Trading, minting, or providing liquidity, for the existing trading pairs, are all rewarded. The protocol does require greater technical knowledge.

Frequently asked questions

What is the Mirror Protocol?

Is Mirror Protocol a good investment?

Can you mine the Mirror Protocol (MIR)?

What Oracle does Mirror Protocol use?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.