The Fantom platform specializes in DeFi services and came to the fore in 2018 as a layer-1 project. Laden with several execution chains, a novel consensus mechanism, and the inputs of Andre Cronje — the DeFi godfather — Fantom quickly made a name for itself in the crypto market. This FTM price prediction piece will analyze the long-term future of this platform — and its native token, FTM, in 2024 and beyond.

Want to get FTM price prediction weekly? Join BeInCrypto Trading Community on Telegram: read FTM price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

- Fantom price prediction and fundamental analysis

- FTM price prediction and the DeFi presence

- The Fantom tokenomics model

- FTM price forecast and key metrics

- Fantom price prediction and technical analysis

- Fantom (FTM) price prediction 2023

- Fantom (FTM) price prediction 2024

- Fantom (FTM) price prediction 2025

- Fantom (FTM) price prediction 2030

- Fantom (FTM’s) long-term price prediction up to 2035

- Is the FTM price prediction theory reliable?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Fantom Price Prediction tool.

Fantom price prediction and fundamental analysis

Fantom isn’t your regular blockchain-powered protocol. Instead, it follows the DAG (Directed Acyclic Graph) form of Distributed Ledger Technology. And this allows Fantom to scale its DeFi services better and further.

Per the website, Fantom is a high-speed, high-throughput smart contract ecosystem meant for DApps and digital assets. And here is how scaling-capable it is, courtesy of the DAG DLT.

And while there is a lot more to the Fantom ecosystem than what meets the eye, here are some of the fundamental insights that can help you make an informed investment decision:

- As an ecosystem, Fantom can host fast payment systems, sensitive healthcare data, and even Central Bank Digital Currencies.

- Fantom boasts “Lachesis,” an innovative consensus mechanism focusing on combining speed, security, and scalability over everything else.

- It makes a strong case as an enterprise-grade decentralized project that even governments can use to build their products and services.

- FTM, the native crypto of Fantom, is open to staking. Therefore, at its core, Fantom is still PoS but with a far more secure algorithm driving it.

- Andre Cronje, one of the most reputed developers in the DeFi space, was a leading technical advisor to the Fantom ecosystem.

Did you know? Fantom is one of the first ecosystems to implement the novel Lachesis consensus algorithm. Lachesis offers near-instant finality for transactions.

Andre chose to leave the DeFi space in early 2022, but his recent comeback has played a major role in pushing the price of FTM through the roof. Further, Opera, Fantom’s mainnet, launched a year after Fantom Foundation surfaced.

All these fundamental insights make us optimistic regarding the FTM price forecast, both in the short-term and long term.

FTM price prediction and the DeFi presence

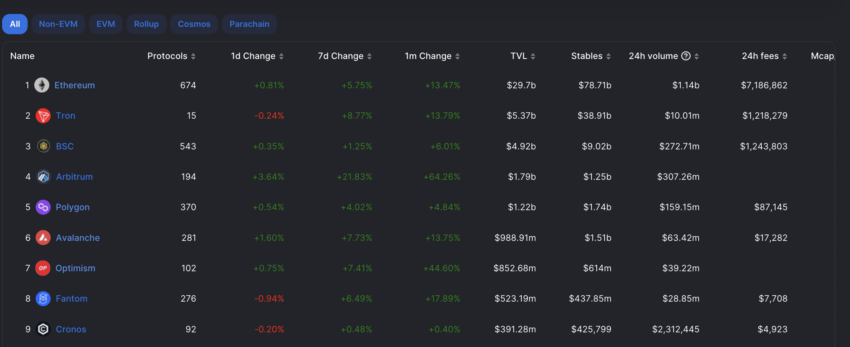

Fantom ranked 8th in terms of DeFi TVL back in February 2023. Data from DeFillama suggested that at that time, Fantom already had 276 DeFi protocols built on top of it, close to Avalanche’s 281. This growth in popularity does make us optimistic regarding the future Fantom (FTM) price predictions.

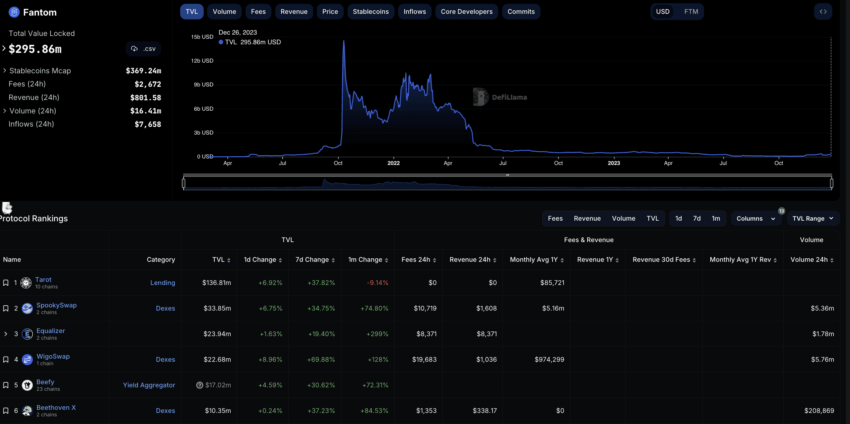

It is December 2023 now, and things have changed rather significantly. Fantom has slipped to the 18th place with a sizable drop in DeFi TVL. And the number of protocols has dropped to 271. A conservative DeFi presence could be the reason why FTM didn’t surge beyond expectations in 2023.

If you zoom into Fantom’s DeFi presence, an interesting trend surfaces.

DEXs built atop Fantom, like SpookySwap, Beethoven X, and even Equalizer Exchange, have been very exuberant over the past 30 days. Equalizer is even up 299% as we speak.

“Getting increasingly bullish on $FTM In the Modular vs Monolithic era, Solana is currently leading the monolithic category, but Fantom 2.0 Sonic upgrade will put $FTM in the game.”

Ignas, DeFi Researcher: X

The growth of Fantom as a DeFi giant is inspiring. This makes us look at the future Fantom price forecast with more optimism.

The Fantom tokenomics model

As FTM can be used on top of Ethereum and Binance Chain, there are ERC-20 and BEP-2 versions of FTM. However, only native FTM can be used on its Opera mainnet.

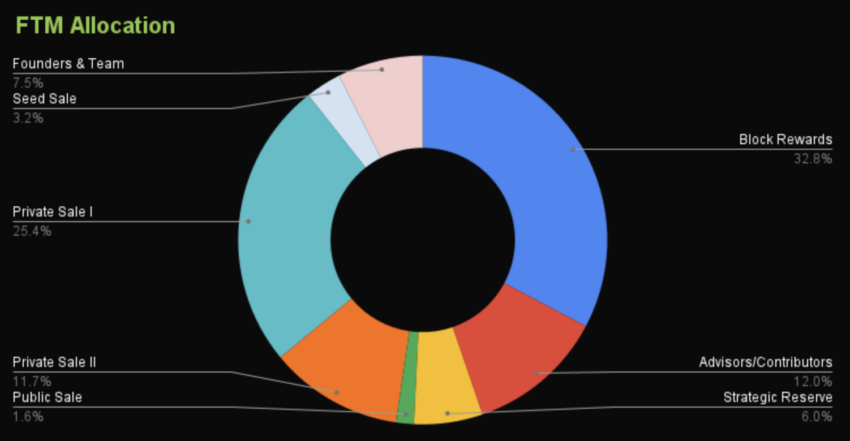

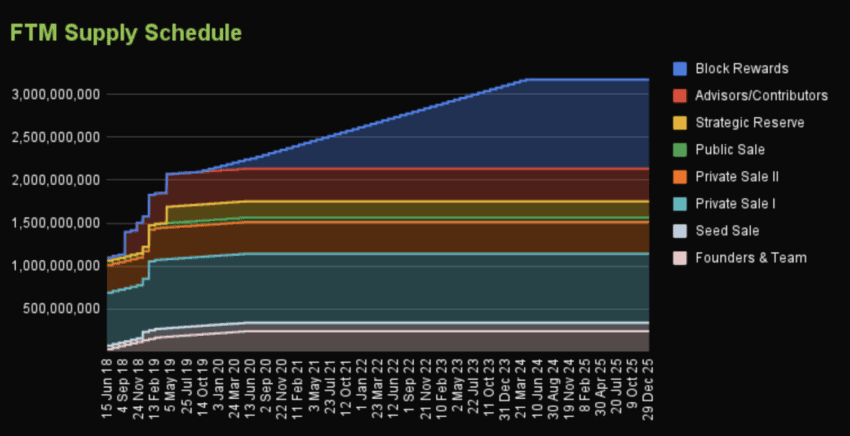

With a total supply of 3.175 billion FTM coins, Fantom has a chance of turning deflationary over time. At present, over 2.8 billion of the total supply comprises the circulating supply. The tokenomics model shows a 32.8% reservation for the staking (Block) rewards.

Keeping the current circulating supply and the vesting schedule in mind, we expect all FTM coins to become liquid by 2025. This can lead to a small price correction followed by a decent surge, provided the adoption continues to grow.

FTM price forecast and key metrics

Fantom’s unique address chart, as of February 2023, touched newer peaks since November 2022. Post the FTX crisis, faith in DeFi projects skyrocketed. However, the address count soon flattened out, leading to a price consolidation.

Things seem to have changed by late 2023, especially when unique addresses are concerned. Additionally, unique addresses have picked up pace, which might be optimistic for the price action.

Another interesting bit of data has to be regarding the nature of FTM holdings. Even though whales control close to 75% of the supply, most of the held assets belong to the holders, which can be a good sign for long-term price action.

The price volatility metric also paints an interesting picture. Barring the recent peak, every bottom made by the volatility chart saw a price peak at FTM’s counter. We can now see a new bottom being formed, per the February 2023 chart. Once the bottom was in and the volatility chart saw an up-move, the price of FTM moved up — per the historical data.

The December 2023 chart reveals that the peaking volatility also helped the prices. However, a dip in the volatility metric can be good for the price of FTM in the mid-to-short-term.

Overall, most indicators are counting on positive price action for Fantom. However, it will first need to reach the trading price of $0.6 before it starts seeing some more action.

Fantom price prediction and technical analysis

Our early 2023 analysis

Per our early 2023 analysis, FTM found it hard to breach the $0.55 mark. And that was back in February 2023. Here is how the chart read:

The daily price chart suggests a five-wave “Motive” phase in progress. It would be interesting to see where the fifth wave surfaces. After that; we can expect some correction at Fantom’s counter.

The fib levels put the next resistance at $0.55 and $0.66, respectively, with the current price of FTM at $0.54. The only deterrent here is the bearish divergence at the RSI, with FTM’s price making a higher low, whereas the RSI makes a lower low.

The moving averages paint a different, positive picture here. Do notice the 100-day moving average line has now crossed above the 200-day moving average line. Also, the green line, or the 50-day moving average, already trades above the other higher period moving averages. Therefore, the mentioned resistance levels might be attainable.

As for the pattern, the rising wedge is quite obvious as part of Fantom’s short-term technical analysis. Note that the rising wedge is bearish, and if the price of FTM drops below the $0.36 mark, the bullish signs might be invalidated.

Our December 2023 analysis

A clear short-term correction might be on the cards, courtesy of the bearish divergence exhibited by the RSI indicator. Breaches under $0.50 could trigger a more rapid sell-off. However, a rise above $0.57 could invalidate the bearish trend.

Long-term pattern identification

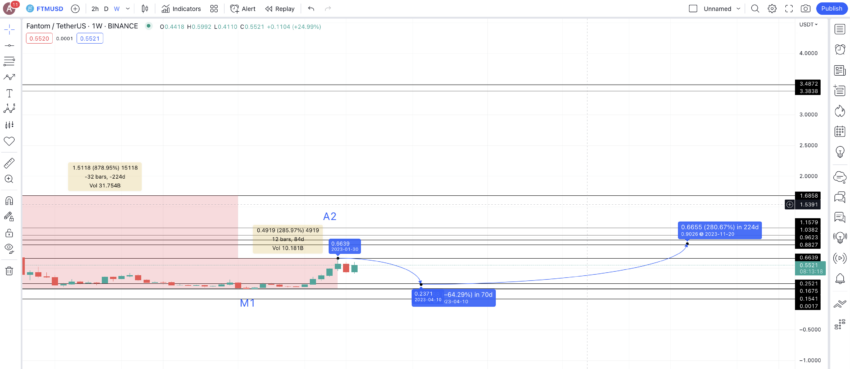

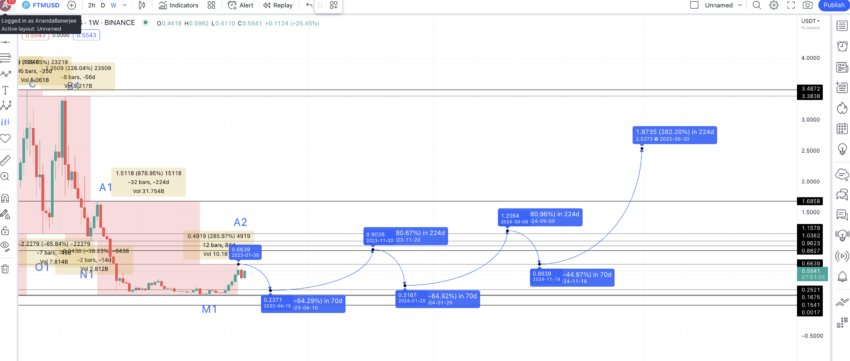

Here is the weekly chart where we can locate a clear pattern. The price of FTM makes a couple of higher highs to form a peak. Once the peak is shown, there are two lower highs before FTM again starts moving in a range, concluding the pattern.

You can now see the price moving up again — similarly from M to A — projected by the left side of the pattern.

Here are all the crucial chart points relevant to our pattern of discussion. Notice that a new peak is being formed. We can mark it A2, which might help us trace the future price forecast levels relevant to FTM.

Price changes

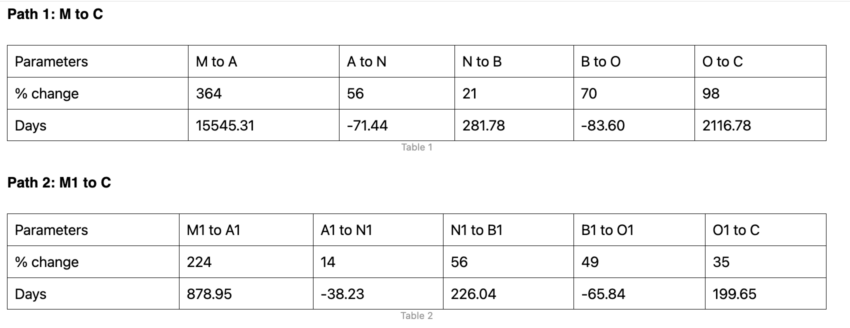

Now, let us locate the price percentage changes and distance between each point on the chart. We shall prepare two tables for two paths: M to C and M1 to C. Plus, we will keep the M1 to A2 difference handy to cross-check our calculations. So, let us get started.

The data from the tables provided allows us to determine the average prospective movements for FTM from low to high and high to low, using negative and non-negative column values.

It’s important to note that the M to A percentage change is not included in this average calculation, as it might represent an anomaly more characteristic of a beginners’ price surge. The average low-to-high increase is calculated to be 1140.64%, with a timeframe ranging from 21 to 224 days, based on data from Tables 1 and 2.

For high-to-low decreases, the average is -64.78%, with the timeframe varying from 14 to 70 days, depending on the distances between the high and low points. This information will be used to plot future FTM price prediction levels.

Fantom (FTM) price prediction 2023

We predicted a maximum price rise of almost 90 cents for FTM in 2023. However, it still managed to touch base with our first high expectation of $0.66. Here is how we approached the 2023 Fantom price prediction.

Our last low on the mentioned chart is M1. Keeping the recent crypto market condition in mind, we can expect the peak to be anywhere between 199.65% (the lowest price hike percentage from the tables above) and the average hike of 1140.64%.

Notice that A2, or the expected high, as per the chart, is at a high of 285.97% — a level that aligns with our expectations and the third lowest growth level of 281.78% (from the table above). Hence, the first high of 2023 could surface or has already surfaced at $0.66. Remember that we already have this FTM price level as our next resistance level.

The next low from A2 could take support at $0.24, which coincides with the average drop expectation of -64.78% (nearly). From this level, considering the bullishness in the Fantom fundamentals and the on-chain metrics, we can expect the next high to be at a peak percentage of 281.78%, keeping the previous low-to-high move into account (M1 to A2).

Hence, the FTM price prediction high for 2023 could surface at $0.9026. Depending on the current condition of the crypto market, this level could surface by the end of 2023.

Yet, the trading volume at FTM’s counter should keep seeing steady growth for FTM to reach this close to the anticipated $1 mark.

Projected ROI from the current level: 63.50%

Fantom (FTM) price prediction 2024

Outlook: Bullish

From the 2023 high, we again expect the price of FTM to drop over the next 70 days by something close to the average price drop percentage of -64.78%. This puts the minimum price of FTM in 2024 at $0.32.

From this level, we can expect the price action to follow the same growth path of 281.78% in 224 days, staying in sync with the previous price levels.

Hence, the maximum average price of FTM in 2024 could surface somewhere close to $1.20.

Projected ROI from the current level: 129%

Fantom (FTM) price prediction 2025

Outlook: Bullish

The next drop and take support at an important support level of $0.6639 — the first high in 2023. This drop percentage also aligns with the minimum price percentage of -38.23% (from Table 2).

Therefore, the next high or the maximum price of FTM in 2025 could surface at $2.54, keeping the 280+% price growth in mind.

Projected ROI from the current level: 368%

Fantom (FTM) price prediction 2030

Outlook: Very bullish

The next low, that is, the minimum price of FTM in 2025, could take support at $1.68 — a level that coincides with the high A1. This translates into a dip of 33.64%. The next high from this level can show up in 224 days or by mid-2026. This puts the maximum price of FTM at $6.43. This would help the FTM price forecast reach a new all-time high.

Now that we have the 2026 high in sight, we can use it and the 2025 low to plot the levels till 2030. If we keep the same growth path for FTM in mind, it might be able to reach $41 by the end of 2030. However, the actual FTM price prediction level for 2030 would depend on the extent of adoption, existing trading volume, and even the popularity of DeFi service providers.

Projected ROI from the current level: 7464%

Fantom (FTM’s) long-term price prediction up to 2035

Outlook: Very bullish

You can easily convert your FTM to USD here

Technical analysis till 2030 helps us locate the crucial Fantom (FTM) price predictions till $41. However, if you plan on holding FTM through 2035, here is a table with the future FTM price forecast levels for your reference:

| Year | | Maximum price of FTM | | Minimum price of FTM |

| 2023 | $0.66 | $0.17 |

| 2024 | $1.20 | $0.32 |

| 2025 | $2.54 | $1.68 |

| 2026 | $6.43 | $5.01 |

| 2027 | $8.03 | $4.98 |

| 2028 | $13.25 | $10.33 |

| 2029 | $19.87 | $15.50 |

| 2030 | $41.10 | $25.48 |

| 2031 | $49.32 | $38.47 |

| 2032 | $61.65 | $48.10 |

| 2033 | $92.47 | $72.12 |

| 2034 | $120.22 | $93.77 |

| 2035 | $180.32 | $111.80 |

Is the FTM price prediction theory reliable?

This FTM price prediction theory takes technical analysis, tokenomics, DeFi exposure, and even the on-chain metrics into consideration. Plus, with the entire supply becoming liquid by 2025, the price surge for 2025 looks all the more possible. This contributes to the practicality and overall reliability of this Fantom price prediction model.

Frequently asked questions

Is the FTM coin a good investment?

Will Fantom’s price go up?

How much will Fantom cost in 2030?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.