In 2023, Cardano (ADA) came pretty close to surpassing our year-specific price prediction level. We are in 2024, and with the bulls knocking at the doors, waiting to barge in, the focus of the entire market shifts the expected price of ADA in 2024, 2025, and beyond. This updated Cardano price prediction takes a closer and more detailed look at the future of the Cardano blockchain going further into 2024 and the price of ADA — from an investment perspective.

Over the next few sections, you will find how we successfully predicted the highest price of ADA in 2023 and why we expect the 2024 high to be around the $1.22 mark. Plus, we will show (not tell) why we believe the price of ADA can breach the $5 mark by 2030.

Best crypto exchanges to buy & trade ADA

Best for interest rates

Best for spot trading

Best for altcoins trading

YouHodler’s combination of high liquidity, a wide range of ADA pairs, attractive joining bonuses, and competitive staking rates makes it a compelling choice for those looking to trade or invest in ADA. Here are some of the specific reasons why YouHodler was listed:

Crypto loans using ADA as collateral: YouHodler allows you to use ADA as collateral for instant loans in fiat, crypto, or stablecoins, with Loan-to-Value (LTV) ratios as high as 90%.

ADA savings accounts: You can deposit ADA in savings accounts on YouHodler and earn an Annual Percentage Yield (APY) of up to 5.65%, paid weekly without any fees. The interest compounds, and there’s no lock-in period for your funds.

Multi HODL feature: This unique offering lets you capitalize on ADA’s volatility, offering the opportunity to multiply your holdings in both bull and bear markets.

Turbocharge loans: It offers a “chain of loans” feature to potentially increase your ADA holdings.

Wallet and exchange services: YouHodler provides a wallet app where you can store ADA and also trade it against various fiat and cryptocurrencies. The platform supports a wide range of cryptocurrencies and fiat currencies, making it versatile for diverse trading strategies.

Besides the mentioned features, YouHodler promises high trading liquidity. Plus, YouHodler offers a welcome bonus worth $50 to new customers. Additionally, there is also a $50 worth referral program in place.

Bybit is a prominent crypto trading platform that offers a range of advanced trading features, making it a suitable choice for buying and trading Cardano (ADA). Here are some of the key Cardano-specific traits and functionalities of Bybit:

Trading options: Bybit is well-equipped for both spot and derivatives trading. It offers a wide range of trading tools and features, including support for over 180 contracts, access to USDT and USDC perpetual contracts, inverse perpetual and futures contracts, and USDC options.

Leveraged tokens: The platform offers leveraged tokens, which are ideal for users who prefer not to stress over going long or short with assets. These tokens come with built-in leverage and are akin to crypto Contracts for Difference (CFDs), though Bybit does not directly support CFDs.

Quick buy feature: Bybit enables quick crypto purchases through a one-click buying option, allowing users to easily exchange fiat for various cryptocurrencies, including ADA.

Copy trading: This feature allows users to copy the trading strategies of successful traders on Bybit, which can be particularly useful for less experienced traders or those looking to leverage the expertise of others.

Bybit Card: Bybit offers a MasterCard debit card, allowing users to make payments directly using any crypto in their Bybit funding account.

Besides the following traits, Bybit’s ADA/USDT pair also enjoys high liquidity, making order execution rapid. Bybit’s ADA/USDC pair also enjoys high liquidity. Bybit also offers attractive bonuses to the new users — up to $50. Plus, you, as an ADA trader, can earn up to 420 USDT via referals.

Binance also boasts tons of ADA-specific features, with its ADA/USDT pair enjoying 14.36% of the global ADA trading volume. Other ADA pairs like ADA/ETH, ADA/FDUSD, ADA/BTC, and more are equally popular. Here are some of the other features that make Binance good enough to be listed as one of the top ADA trading platforms:

Binance offers ADA staking with an APY of up to 6.1%, with weekly payouts and the flexibility to unstake at any time without a designated unstaking period. Plus, it supports Cardano network upgrades and hard forks, ensuring that ADA traders on their platform are not affected during these updates.

Binance stands out for its deep liquidity, ensuring efficient order filling without significant price slippage. It starts with a low spot trading fee of 0.1%, one of the lowest in the industry, which can be further reduced for BNB token holders.

Additionally, Binance offers $30 as the welcome bonus to new users followed by $5 as verification bonus.

All of the platforms recommended by BeInCrypto in this piece have been thoroughly tried and tested by our teams over a period exceeding six months. During our review processes we assessed YouHodler, Binance and Bybit against a number of key criteria, checking for usability and how each platform appeals to a diverse range of traders and investors. All platforms were found to have secure infrastructure and solid customer services offerings, making them all well-rounded offerings suitable for the buying and trading of ADA.

Learn more about BeInCrypto’s methodology verification here.

- Cardano (ADA’s) long-term price prediction until the year 2035

- Cardano price forecast and the impact of historical elements

- Cardano price prediction and technical analysis

- Cardano (ADA) price prediction 2023 (almost successful)

- Cardano (ADA) price prediction 2024

- Cardano (ADA) price prediction 2025

- Cardano (ADA) price prediction 2026

- Cardano (ADA) price prediction 2027

- Cardano (ADA) price prediction 2028

- Cardano (ADA) price prediction 2029

- Cardano (ADA) price prediction 2030

- ADA price forecast and related case studies

- Cardano fundamentals and the impact on ADA price prediction

- ADA price prediction and the role of tokenomics

- Cardano price forecast and on-chain metrics

- Is the Cardano price prediction model accurate?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Cardano Price Prediction tool.

Cardano (ADA’s) long-term price prediction until the year 2035

You can easily convert your ADA to USD here

Outlook: Very bullish

Yes, Cardano’s price action has been crazy, like a PEPE or a WIF. Yet, in the long run, the market is optimistic about ADA.

“Cardano’s been slow and steady for a while. It is not crypto like a memecoin, where you can expect a flip. A lot of the investors holding Cardano (ADA) are long on the crypto. They are Buy-and-Hold investors by definition.”

Crypto Jon, Crypto Analyst: YouTube

If you wish to hold ADA longer — even through 2035 — here is a table that can help you trace the expected price projections for the same:

| Year | Maximum price of ADA | Minimum price of ADA |

| 2024 | $1.22 | $0.41 |

| 2025 | $2.24 | $0.712 |

| 2026 | $2.14 | $1.32 |

| 2027 | $2.57 | $2.00 |

| 2028 | $3.85 | $3.01 |

| 2029 | $4.23 | $3.30 |

| 2030 | $5.26 | $4.10 |

| 2031 | $7.89 | $6.15 |

| 2032 | $10.65 | $8.30 |

| 2033 | $15.97 | $9.90 |

| 2034 | $18.37 | $14.33 |

| 2035 | $22.04 | $17.19 |

Now that the prices are revealed let us take a closer look at the detailed technical pointers in play.

Cardano price forecast and the impact of historical elements

Cardano (ADA) has experienced significant fluctuations since its inception. Launched in late 2017, ADA saw rapid growth, reaching an all-time high of $1.33 in January 2018 during the crypto boom. However, the subsequent market crash saw its price plummet to as low as $0.03 by early 2019. Despite these fluctuations, ADA began a steady recovery, particularly in 2020 and 2021, fueled by continuous development and updates from the Cardano team. Notable price movements include its peak of around $3.10 in September 2021, driven by the broader crypto bull run and significant upgrades like the Alonzo hard fork, which introduced smart contracts to the network. These advancements highlighted Cardano’s potential and attracted significant investor interest.

Impact of Major Events

The broader cryptocurrency market, particularly Bitcoin’s halving cycles, has a considerable impact on Cardano’s price. Bitcoin halving events, which reduce the block reward for mining Bitcoin by half, have historically led to bullish phases due to reduced new Bitcoin supply, indirectly benefiting other cryptocurrencies like Cardano.

For instance, the 2020 Bitcoin halving contributed to the 2021 crypto bull run, during which ADA reached new highs.

Additionally, Cardano’s internal developments significantly influence its price. The Shelley upgrade in 2020, which introduced staking, and the Goguen phase in 2021, which enabled smart contracts, were pivotal in ADA’s price surges.

These upgrades enhanced Cardano’s functionality, making it more attractive to investors and developers. Regulatory developments and shifts in market sentiment also play crucial roles in ADA’s price dynamics. For example, positive regulatory news often boosts prices, while uncertainty or negative news can lead to declines.

Keeping these factors in mind, let us take a closer look at the technical elements:

Cardano price prediction and technical analysis

Let us now circle back to the short-term technical analysis from the past — April 2023.

Notice how ADA traded inside the ascending channel pattern — with the prices alarmingly close to the lower trendline. If breached, ADA could try and find some support at $0.377. However, over time, this level was breached, pushing ADA all the way up to 65 cents.

Let us now identify if the current price of ADA is giving out any optimistic short-term signal or not:

The 24-hour chart price chart shows that ADA broke out of a channel pattern, as marked by the arrow. At present, the upper channel trendline is acting as a support, and if breached, at say, $0.56, ADA might correct further. The 20-EMA line works as a secondary support at $0.52, under which ADA might even head to the sub-50-cent levels. Even the volume levels look a tad jaded in the short term.

Pattern identification

The weekly chart reveals a peak-like formation towards the extreme left of the chart. Before the peak, there is a smaller high, and post the peak, ADA makes a smaller high before going tepid and range-bound for close to 2.5 years.

Post that, ADA makes two higher highs before peaking at over $3. After that, there are two discernible lower highs. Also, notice how the current weekly RSI is making a higher high as opposed to the lower high made by the price of ADA. This form of bullish divergence means that ADA might again start forming a series of higher highs.

We can now locate every crucial high and low point on the chart to help you identify the average high-to-low and low-to-high moves.

Price moves and changes

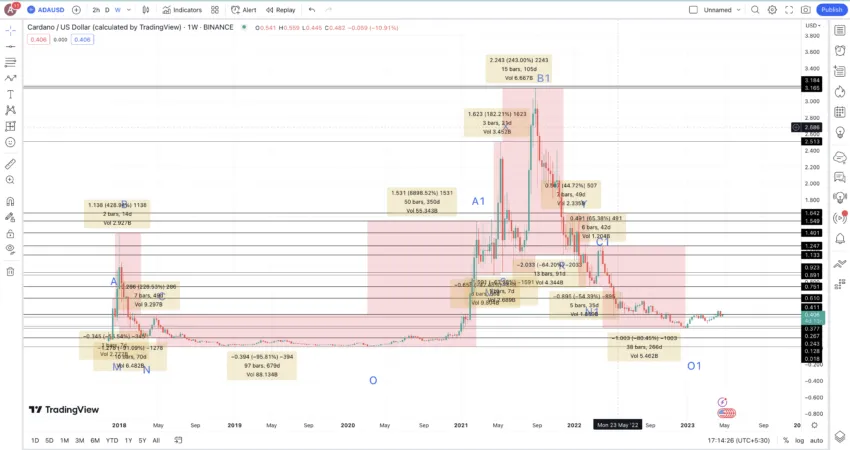

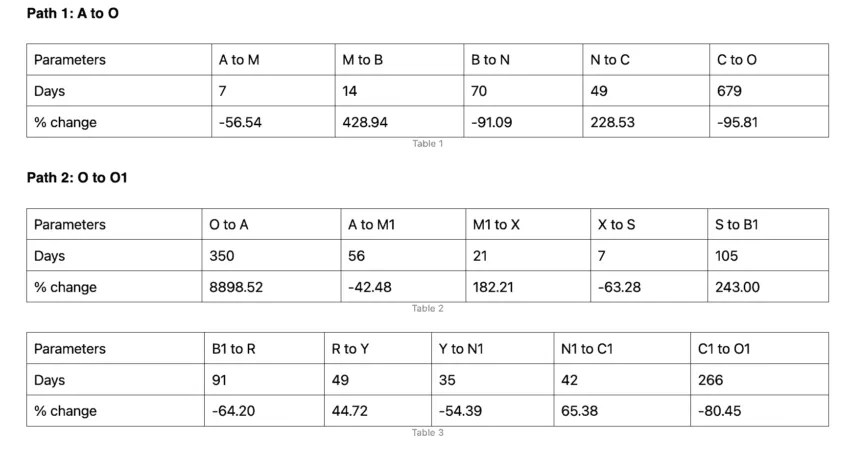

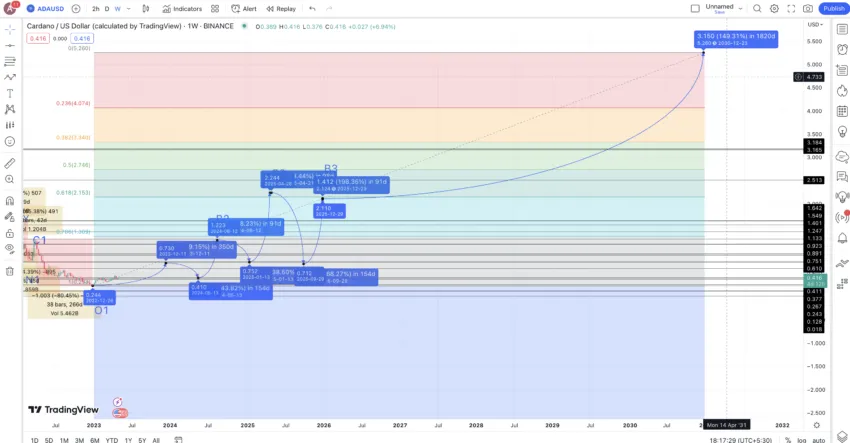

Now that we have marked all the crucial points before, after, and between the peaks, it is time to locate the price percentage changes and distances between them. For that, we will focus on two paths: A to O and O to O1.

Now that we have data for all the chart points, let us use the negative and non-negative values to locate the averages.

The sum and average of all the negative values return a percentage drop (high-to-low) of 68.53%. The time taken for the same can be 151 days (average of the negative days).

Optimism surrounding ADA:

Calculations

The sum and average of all the non-negative values return a percentage hike (low-to-high) of 198.79%. We purposefully kept the O to A values of 8898.52% out to keep the calculations within permissible limits. The time taken for the same can be 90 days (average of the non-negative days).

Note: The high-to-low and the low-to-high moves can vary from the calculated average depending on the crypto market conditions, support levels, and even the resistance levels.

Now, let us use the calculations to identify the Cardano price prediction levels for the years to come.

Cardano (ADA) price prediction 2023 (almost successful)

Outlook: Bullish

Here is how we projected the price of ADA to go in 2023. Read along for the initial analysis.

The last point we have on the weekly price chart is O1. Considering the average low-to-high move of 198.79%, we can expect the next high to surface at $0.729. Also, we have taken the max distance or timeframe of 350 days, considering how slowly the price of ADA moves up.

This also confirms the fact that the price of ADA in 2023 might not drop lower than $0.244 — the level of O1.

Update: In 2023, ADA reached a high of $0.675, which was in line with our maximum price prediction of $0.729.

Cardano (ADA) price prediction 2024

Outlook: Bullish

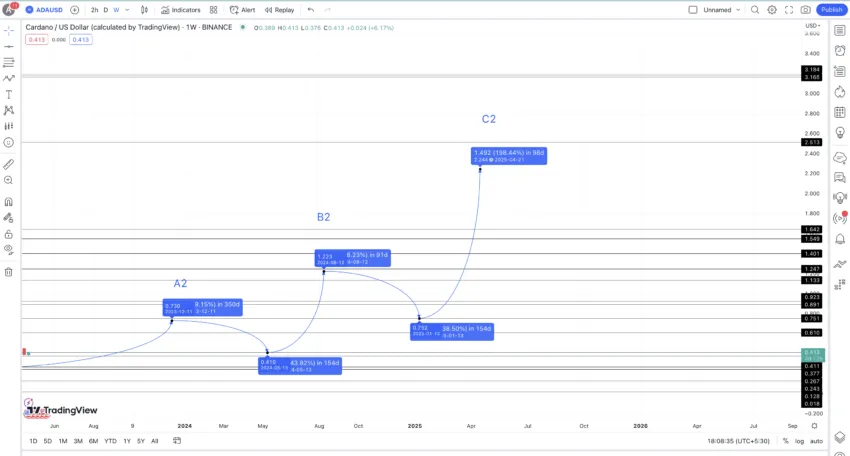

Now that we have A1 — the highest Cardano price forecast level for 2023 (which was nearly fulfilled) — we can use the high-to-low percentage average of 68.53% to chart the low in 2024 in close to 151 days. However, there are some strong support levels close to $0.41, which might be the lowest the price of ADA can drop in the subsequent 151 days from A2.

The next high from this low could again go as high as 198.79% and, in 90 days, settle at $1.22. This could be the Cardano price prediction for 2024.

Projected ROI from the current level: 159%

Cardano (ADA) price prediction 2025

Outlook: Moderately Bullish

The next low from this high of $1.22 or B2 could again be closer to the support level of $0.752 — translating into an average price drop of 38.50%. As this low is still higher than the 2023 high of $0.675, we can expect the price of ADA to be in an uptrend, even in 2025.

Also, using the average price hike of 198.79%, we can plot the 2025 high for ADA, which could settle at $2.24.

Projected ROI from the current level: 376%

Cardano (ADA) price prediction 2026

Outlook: Neutral

Let us now assume that the high in 2025 for ADA is termed C2. From this level, the average drop of 68.53% might be possible due to increased selling pressure applied by the recently turned-in-the-money holders. Therefore, over the next 150 days, the next drop can see the average price of ADA surface at $0.712.

This can, therefore, be the lowest price in 2025, beating the first low of $0.752. The low of $0.712 makes sense if followed by the average price hike of 198.79%. This value puts the next high — towards the onset of 2026 — at $2.14. If we mark this high as B3, we can again see a lower high formation in play for ADA — like the previous patterns.

This expectation aligns with the slow-yet-steady price action of Cardano.

Projected ROI from the current level: 355%

Cardano (ADA) price prediction 2027

Outlook: Moderately Bullish

When compared to 2026, where the prices are expected to dip in comparison to 2025, 2027 can see ADA rise anywhere between 10% to 44% — the lowest percentage hike per the tables above. Assuming a 20% hike, which is more than adequate per Cardano’s reputation, the 2027 price prediction high surface at $2.57.

Assuming that the market conditions remain neutral, the lowest price for 2027 should not drop below $2.

Projected ROI from the current level: 445%

Cardano (ADA) price prediction 2028

Outlook: Bullish

In 2028, the ADA bulls might take center stage with steady gains of over 44%. As mentioned, 44% is the lowest price surge for ADA across any interval. Under standard market conditions, this price surge is expected.

Pairing the 2026-2030 price chart, looking at the extrapolated points, and keeping the historical price surge into consideration, the Cardano price prediction for 2028 would be close to the $3.90 mark.

Projected ROI from the current level: 719%

Cardano (ADA) price prediction 2029

Outlook: Moderately Bullish

After a year with almost a 50% spike in prices, the most practical pathway for ADA would be anywhere between 10% and 50%. Assuming 10% to the most practical positioning, the ADA price prediction for 2029 should hold somewhere around the $4.23 mark.

The low for 2029, per the Fibonacci indicator, shouldn’t drop under $3.30, unless the market conditions go seriously awry.

Projected ROI from the current level: 800%

Cardano (ADA) price prediction 2030

Outlook: Bullish

With the 2023 low and 2026 high, we can extrapolate the Cardano price prediction path to locate the prices till 2030. Following the same growth path till 2026, we can expect the price of ADA to settle at $5.26 by 2030.

Projected ROI from the current level: 1019%

ADA price forecast and related case studies

It is important to know how previous technological advancements specific to Cardano’s future outlook have impacted the prices. Here are some case studies to take note of:

Case Study 1: Alonzo Hard Fork and ADA Price Surge In September 2021, the implementation of the Alonzo hard fork introduced smart contract functionality to Cardano. This significant upgrade enabled developers to build and deploy decentralized applications (dApps) on the Cardano network, enhancing its overall utility. The anticipation and successful deployment of Alonzo led to a notable increase in ADA’s price. Leading up to the upgrade, ADA’s price climbed from about $1.20 in July 2021 to an all-time high of approximately $3.10 in early September 2021. This demonstrates the positive impact that major technological advancements can have on Cardano’s price.

Case Study 2: Shelley Upgrade and Staking Implementation The Shelley upgrade in July 2020 marked Cardano’s transition to a fully decentralized network by introducing staking. This allowed ADA holders to participate in securing the blockchain and earn rewards through staking. The launch of Shelley attracted significant attention, leading to an increase in ADA’s price from around $0.08 in early July 2020 to about $0.18 by the end of the year. This highlights the beneficial effects of network enhancements and staking opportunities on Cardano’s market performance.

Expert Opinions

Charles Hoskinson, Founder of Cardano Charles Hoskinson has frequently highlighted Cardano’s meticulous and scientifically rigorous development process. In an interview with the Financial Times in April 2024, Hoskinson stated, “Cardano’s strong position within the blockchain ecosystem reflects its innovative strategies in scalability, governance, and community engagement. The upcoming upgrades like Ouroboros Genesis will further reinforce our path towards a fully decentralized network.”

Besides that, independent analysts have also expressed optimism about Cardano’s future outlook. According to their analysis, ADA is expected to benefit from the network’s continuous upgrades and increasing adoption.

Now that the technical analysis is out of the way let us focus on the fundamentals.

Cardano fundamentals and the impact on ADA price prediction

Founded by Charles Hoskinson, Cardano is easily one of the more technologically-equipped blockchains around. Here is a quick refresher to how powerful and feature-loaded the Cardano network actually is:

- Cardano comes with a layered architecture, making transaction handling more flexible.

- The blockchain comes with a more energy-efficient version of the Proof-of-Stake consensus — the Ouroboros.

- You can stake ADA to secure the network or even use it to take part in on-chain governance.

- The Cardano blockchain is developer-focused, offering ample DApp and smart contract development resources.

- The Cardano ecosystem is interoperability-focused and boasts periodic technical upgrades.

And that’s just scratching the surface when the functionality of Cardano and its native ADA tokens are concerned.

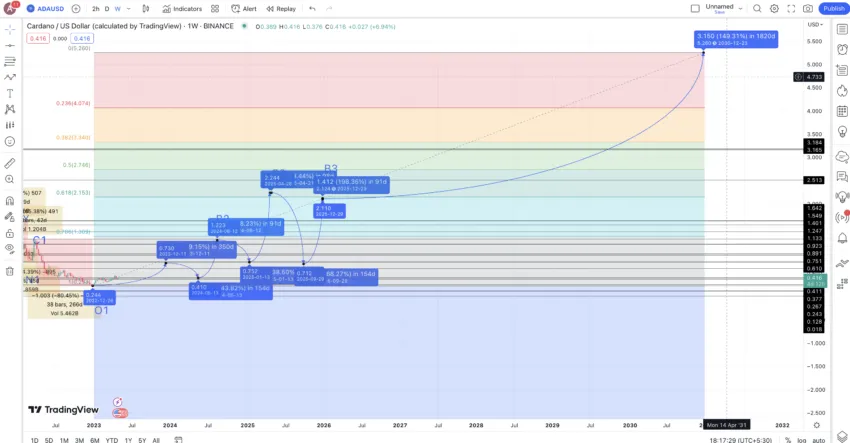

Cardano is also steadily evolving into a breeding ground for NFTs with marketplaces like Jungle, jpg.store, Pun City, and more setting shops. Per data from Crypto Slam at press time, total NFT Txns corresponding to the Cardano ecosystem have surged almost 68% over the past 7 days. And the majority of the transaction volume has been pushed in by the buyers.

If you look at the 7-day chart, there has been a clear uptick in the number of buyers and sellers flipping NFTs across the Cardano network.

Did you know? Apart from NFTs, Cardano also has a pretty evolving DeFi presence. It was ranked 17 in terms of TVL in early April, with the Minswap DEX having a 29% dominance.

As of December 18, 2023, the ranking has changed to 12, and the Total Value Locked has surged almost three times.

Upgrades and roadmap that might impact ADA price forecast

Cardano’s roadmap is marked by significant technological upgrades aimed at enhancing its scalability, security, and functionality. One of the key upcoming upgrades is the Hydra protocol, a layer-2 scaling solution designed to increase the network’s throughput to millions of transactions per second. This improvement is crucial for handling large-scale applications and could positively impact Cardano’s price by attracting more developers and users to the ecosystem.

Another critical upgrade is the Plutus platform, which enhances Cardano’s smart contract capabilities. Plutus allows developers to write complex smart contracts and deploy decentralized applications (dApps) more efficiently. The ongoing enhancements to Plutus are expected to make Cardano a more attractive platform for dApp developers, potentially increasing its adoption and market value.

Competitive Analysis

Cardano stands out among major blockchains like Ethereum and Solana due to its unique approach and technological advancements. Unlike Ethereum, which uses a Proof-of-Work (PoW) consensus mechanism, Cardano employs Ouroboros, a Proof-of-Stake (PoS) protocol that is more energy-efficient and scalable. This gives Cardano an edge in terms of sustainability and transaction costs.

Compared to Solana, which also aims for high throughput, Cardano’s methodical and peer-reviewed development process ensures a robust and secure network. While Solana has faced several network outages, Cardano’s rigorous testing and formal verification methods enhance its reliability. Additionally, Cardano’s focus on interoperability and its layered architecture enables seamless integration with other blockchains and legacy systems, further boosting its appeal.

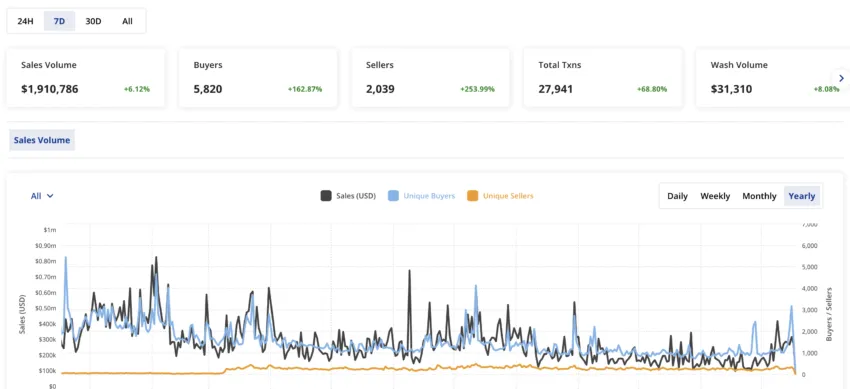

ADA price prediction and the role of tokenomics

As far as ADA tokenomics is concerned, Cardano has a maximum supply of 45 billion. Do note that almost 31.1 billion ADA tokens were initially allocated. Here is what the ratio looked like:

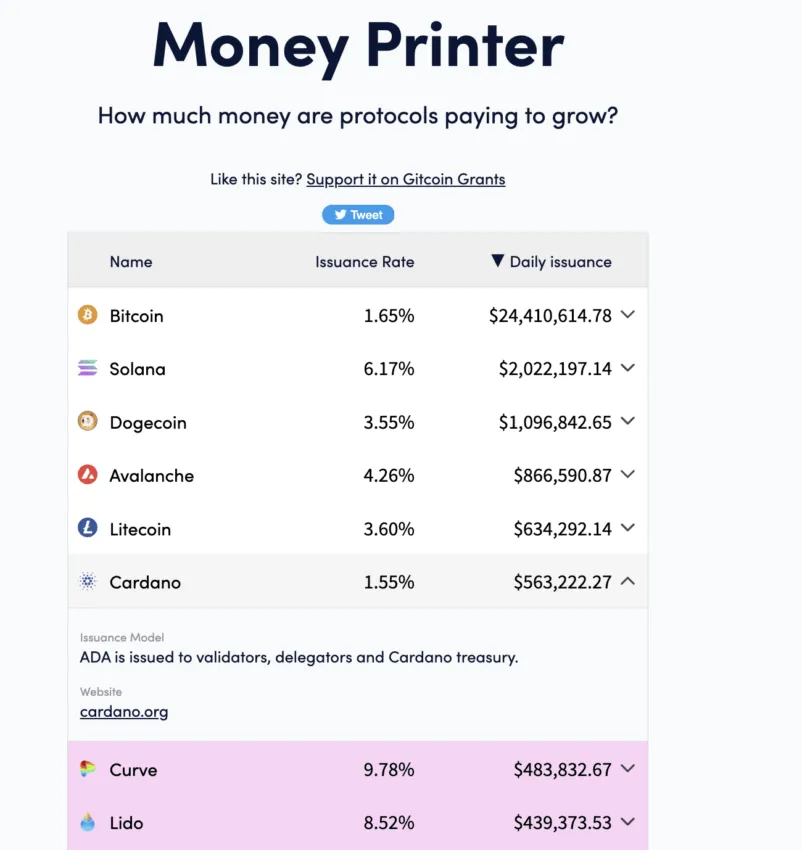

Per calculations, the entire Cardano supply might take close to 2050 to become liquid. Until then, we will have to deal with a standard inflation or issuance rate. Do note that the inflation rate might start dropping as and when the circulating supply starts approaching the supply cap. But that would still take some time. In early April, the Cardano network had an inflation rate of 1.55% — which is lower than that of BTC.

However, the same has gone up to 1.68%, per the latest Money Printer data. The increase in inflation might work as a deterrent to the price surge expectations. It also shows demand for ADA tokens hasn’t been that high.

The steady inflation rate might be a good sign for the market capitalization of Cardano. Plus, if the demand increases significantly, scarcity might creep in even with the 1.55% inflation rate. Fingers crossed!

Cardano price forecast and on-chain metrics

A good sign for the Cardano blockchain is that the daily fees and the developer count (core devs) have remained steady over the past 180 days before surging again in early December 2023.

As the supply side fees also involve fees paid to the staking pool operators, the DeFi presence seems to be picking up for the Cardano network towards the end of 2023, with the fees slowly surging and making the network more desirable.

A surge in the supply side fees — the revenue generated by the validators, delegators, and staking pool operators — might help increase prices.

The price surge after every volatility bottom is evident if you look at the volatility chart. Right now, we might be staring at a series of quick bottoms in regard to volatility — a development that might push the prices higher in the mid-term. However, this was early April, and as of now, the volatility metric is high, hinting at a quick correction in the short term.

Let us move to the technical analysis to understand how the ADA Coin price prediction might hold in the short and long term.

Is the Cardano price prediction model accurate?

This Cardano price prediction model takes technical analysis seriously. A wide range of tracking points helps us fetch the most accurate and relative projections. However, the ADA coin price prediction levels might change depending on the changing market cap of Cardano. Other factors like the number of active developers, upgrades like the Vasil Fork, and more might also come into play. Therefore, it is advisable to keep tracking every ADA price prediction level alongside Cardano’s network-specific growth and the broader crypto market.

Frequently asked questions

What will Cardano be worth in 2025?

Will Cardano reach $100?

Will Cardano reach $20?

How high will Cardano go in five years?

Is Cardano a safe long-term investment?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.