1inch exchange is one of the many decentralized exchanges (DEXs) that make the DeFi ecosystem far more accessible to the average cryptocurrency trader. When using DEXs, traders don’t have to rely on a third party to keep custody of their funds or question the security of the service. What’s more, 1inch expands on the possibilities offered by other DEXs and offers the cheapest route for your trade.

In this guide:

- Evolution of 1inch exchange

- What is 1inch exchange?

- How does 1inch work?

- How to use 1inch exchange

- Comparison with competitors

- Roadmap and development history

- What is 1INCH token?

- What is Chi Gastoken (CHI)?

- Should you buy 1INCH?

- How to buy 1INCH

- How to stake 1INCH

- Is 1inch exchange the future of DeFi?

- Frequently asked questions

Evolution of 1inch exchange

1inch was founded in March 2019 by two Russian developers, Sergej Kunz and Anton Bukov. But even before that, Kunz was hosting live streams on YouTube in which he would audit Ethereum smart contracts security. The two developers also attended some international hackathons, which brought them sponsorship from MarkerDAO, Set Protocol, and Kyber Network.

The two developers were experimenting with arbitrage bots and created the first 1inch Exchange blueprint before attending the ETHNewYork convention. They created the 1inch Exchange MPV during the event, which aggregated liquidity from DEXs, including Bancor, Kyber, and Uniswap.

What is 1inch exchange?

1inch exchange is a revolutionary decentralized exchange platform, which incorporates two different functions:

- DEX platform

- DEX aggregator

The 1inch DEX platform allows you to buy and sell cryptocurrencies, and in many ways, it is similar to Uniswap DEX.

What sets the 1inch exchange apart from other DEXs is its DEX aggregator feature. This feature searches for the best prices from a bunch of decentralized exchanges for its customers and tries to ensure the best possible rates for exchanging cryptocurrency.

The 1inch DEX aggregator checks several rerouting options for each specific trade. It can also split funds into smaller amounts and exchange them on different DEX, thus ensuring the lowest prices.

The 1inch exchange uses arbitrage bots to split and trade orders on multiple DEXs, to find the best market price. While this operation could also be done manually, 1inch can do it within one transaction and at a very fast pace. Slippage is not a negligible concern for DEX users, especially when trading large orders on illiquid markets. Splitting orders over multiple DEXs also decreases the slippage fees, which means better trades for customers.

1inch is a platform that gives DEX users the best choice and prices for their swaps. As with all DEXs, there is no need to complete the KYC process or have an account to use the platform.

1inch connects to multiple DEXs and DeFi platforms, including Uniswap, SushiSwap, Compound, Yearn.finance, and Bancor.

The main features of the 1inch Exchange are:

- Liquidity Protocol

- Aggregation Protocol

- Limit Order Protocol

- Multi-chain integration

- Low trading fees

Liquidity Protocol

The first focus of the 1inch protocol was to aggregate liquidity from other DEXs. However, the team also developed a liquidity protocol that would attract native liquidity to 1inch.

The liquidity protocol stands at the core of the 1inch Exchange and its Mooniswap AMM. Anybody can deposit assets in a 1inch liquidity pool. But 1inch failed to attract LPs from other AMMs, despite launching its liquidity protocol using a liquidity mining program.

Aggregation Protocol

In Mar. 2021, 1inch announced its v3 aggregation protocols and upgraded smart contracts. As of this upgrade, the 1inch DEX aggregator became faster and more efficient.

1inch V3 connects to more DEXs via Ethereum, Binance Smart Chain, and the other chains. Traders can easily access liquidity from the main DEXs on different chains.

Limit Order Protocol

Most traders are staying away from DEXs because of their lack of advanced trading tools such as limit orders. But 1inch Exchange is one of the most innovative DEXs, which features a limit order protocol.

Traders can place stop-loss orders, trailing-stop orders, and auctions. The 1inch limit order protocol does not charge any fees.

Multi-chain integration

Most DeFi applications exist on the Ethereum network. However, the expensive Ethereum transaction fees keep many investors away from the ecosystem. That’s why 1inch Exchange integrated several other blockchains, including Binance Smart Chain (BSC), Gnosis Chain, Avalanche — as well as popular Ethereum layer-2 solutions (Polygon, Optimism, and Arbitrum).

For instance, 1inch’s BSC deployment offers the same functionality as its Ethereum counterpart. Instead of routing to Uniswap or Sushi, 1inch’s BSC route to PancakeSwap and Venus Protocol.

Low trading fees

1inch does not charge any service trading fees, regardless of the size of your trade. However, traders will still have to pay the trading fees that incur from trading on the other exchanges. Often, trading fees are the same, if not even lower, as when you’re using Uniswap or Curve directly.

How does 1inch work?

Users of 1inch Exchange can initiate their DEX transaction, and then 1inch splits the order amongst different DEX to provide the best possible price. Users can also edit the slippage percentage and gas fees for processing the transaction. This will influence the processing time for the transaction.

The core principle of 1inch is to find the best and most cost-effective route to exchange cryptocurrency. Generally, exchanging crypto isn’t a simple swap between two assets, and the exchange must execute multiple trades before it obtains the desired asset.

This is especially true if the crypto you are looking to exchange isn’t one of the most popular assets. For instance, if you would like to exchange wBTC to LINK, the route could be wBTC to ETH to LINK, if there is no exchange that offers a liquidity pool that provides those two specific assets.

While most DEXs offer this kind of routing, 1inch does it across different exchanges in its pursuit to find the best possible rates.

The main aspects of using 1inch Exchange are:

- User-friendly interface

- No extra transaction fees: The users only pay for transaction fees on the blockchain, but the 1inch exchange doesn’t charge any fees.

- Low swapping fees: Users can choose between different exchanges, and can actively choose the best prices and gas fees.

- LP tokens can be used for yield farming.

- It’s a secure platform.

- Favorable crypto rates: Users can easily find the best available rates for cryptocurrency exchanges through the 1inch Pathfinder feature.

- Increase liquidity: As a DEX aggregator, 1inch is connected to over 50 DEXs, which hold a significant amount of liquidity.

How to use 1inch exchange

Anyone can use 1inch Exchange. You need to connect your wallet to the platform. The application supports some of the most popular cryptocurrency wallets, including MetaMask, Coinbase Wallet, and other wallets supported by WalletConnect.

The exchange also supports some of the most popular blockchain networks, including Ethereum, Binance Smart Chain, Gnosis Chain, Avalanche, as well as popular Ethereum layer-2 solutions (Polygon, Optimism, and Arbitrum).

For all 1inch swaps, users are in control of most aspects of their trade, including:

- Gas price: It can be set to low, medium, high, and instant.

- Slippage tolerance: The minimum slippage amount is 0.1%.

- Partial fill: Can choose to fill their order partially, to avoid transactions from being reverted and losing their gas fees.

- Compatibility mode: This option can be useful for tokens that charge internal commissions.

- Use legacy transaction type.

- Liquidity sources: 1inch users can choose to use or avoid specific from the liquidity sources available.

- Custom tokens: Users can add tokens to this list using their smart contract address.

There is also an option to place limit orders on the 1inch exchange.

Comparison with competitors

While DEXs are the safest way for crypto investors to trade their coins, the platforms may face some issues when dealing with large trades. Moreover, some of the smaller DEXs, with limited liquidity, may become unattractive for traders, as they can’t perform token swaps of large amounts and also face sharp price fluctuations.

But DEX aggregators have the power to change that and benefit all the actors involved in the DeFi scene, solving issues related to low liquidity or high commissions fees.

The world of decentralized finance is gaining more DEX aggregators to support the best possible trades for investors.

Because the DEXs are still in their infancy — most of them arriving in 2020 or 2021 — there aren’t many DEX aggregators available for crypto traders. While 1inch is the largest DEX aggregator, others also exist. The main 1inch competitors are:

However, there isn’t one DEX aggregator to work across all smart chain blockchain networks. Apart from the 0x DEX aggregator, which is the main competitor for 1inch, the other 1inch DEX aggregator competitors are small projects that only work on one of two networks but have big development plans for the future.

Most of 1inch’s competitors lag behind

The main difference between 0x and 1inch is that 0x charges service fees, unlike the 1inch protocol. Launched by 0x Labs, 0x API provide DeFi traders and developers with an easy way to purchase and sell assets across all liquidity sources. It’s worth noting that the two protocols offer highly competitive prices when handling larger trades.

SwapZone is a non-custodial, instant cryptocurrency exchange aggregator. It provides thousands of cryptocurrency pairs and information to help you choose the best. Users can convert cryptocurrency immediately, without registration and with low fees, by selecting one of the exchanges that offer the trading pair.

Orion is a DEX aggregator operating on the Ethereum and Binance Smart Chain networks. It also features a Bridge between the two networks. Orion protocol also features a governance token (ORN), which can also be staked.

SwapMatic is a protocol that helps users find the best crypto prices across Ethereum, Polygon, and Binance Smart Chain. The protocol has its own token (SWAM), which can be staked or deposited as liquidity on the protocol to generate more yield.

Roadmap and development history

The MVP of 1inch protocol launched during the ETHNYC Hackathon and, initially, sourced its liquidity from Uniswap, Bancor, and Kyber. Since the launch, the exchange has received around $190 million through its seed, Series A, and Series B funding rounds.

The aggregator launched its own AMM (automated market maker), called MooniSwap, in Aug. 2020. Mooniswap was designed to stop front-running and be a next-generation AMM. The DEX introduced five-minute price delays, forcing arbitrageurs to trade at lower profit prices. This mechanism theoretically lowers impermanent losses for liquidity providers and generates more profit.

A few months later, in Nov. 2020, the 1inch V2 was released. This upgrade was primarily about updating the 1inch Aggregation Protocol and replacing the outdated routing algorithm with Pathfinder. It is a new API that finds the best swap route faster than ever before. Pathfinder can split swaps among multiple liquidity sources, and can even use different market depths within a single liquidity source for a single Swap. It also takes gas consumption into consideration.

In Dec. 2020, the 1INCH token launched along with the 1inch DAO. Holders can stake this token on the 1inch exchange, and also use it for governance.

On Jun. 10, 2021, the 1inch Limit Order Protocol went live. This upgrade replaces the legacy solution forked from 0x and provides a more gas efficient protocol.

What is 1INCH token?

1inch exchange introduced the 1INCH token on Dec. 25, 2020. The token serves as a governance token and utility token for 1inch’s AMM, and DEX. Similar to the Uniswap token launch, the 1INCH token was airdropped to the liquidity providers of the exchange.

All addresses that traded on the platform prior to Sep. 15, 2020, or made at least four trades with a total of at least $20, received the token. The protocol gave away 90 million 1INCH tokens. According to the blockchain data, one user received more than 9.7 million 1INCH tokens, which were valued at around $76.7 million, when 1INCH token surged to $7.87 in May 2021.

These tokens are used on the 1inch DAO (decentralized autonomous organization) to vote on the platform’s future developments.

1INCH token has the following main use cases:

- Utility: The token can be used on the 1inch Liquidity Protocol as a connector to help achieve efficient token swap routing.

- Governance: The token is needed for all governance voted on the 1inch Network.

- Multi-chain: The token is available on the Ethereum and the BSC networks through a bridge.

1INCH tokenomics

There is a maximum supply of 1,500,000,000 1INCH tokens. Out of the total supply, 6% of the 1INCH tokens were distributed during the first airdrop. The remaining tokens are planned to be fully released until Dec. 24, 2024.

Token distribution:

- Community incentives 30%

- Backers1 18%

- Network growth fund 14.5% (to issue grants and incentivise developers)

- Backers2 12.2%

- Core contributors 22.5%

- Small backers 2.3%

1INCH price and price predictions

As of Mar. 2022, out of the total supply of 1.5 billion tokens, only 415.760.024 1INCH token are circulating. The 1INCH token trades at around $1.50 and the all-time high was reached on May 8, 2021, at $7.87 for a 1INCH token.

According to WalletInvestor, 1INCH is on a downwards trend, and the market is extremely bearish. By the end of 2022, the price of 1INCH token could be around an average value of $0.42, and the maximum price could be $1.89. If the trend continues, 1INCH token could plummet to around $0.0179 by the end of 2025.

What is Chi Gastoken (CHI)?

In Jun. 2021, the Chi Gastoken was introduced. It is a gas token and a key feature of the 1inch network.

The Chi token allows users to reduce Ethereum gas costs, and it works as a tokenized gas. Traders can buy Chi tokens when gas prices are low and then use them later when gas fees might increase.

The price of the Chi token is tied to the Ethereum network’s gas price. This allows users to benefit from reduced gas fees during times of high network congestion. Traders can therefore save money during peak trading hours. Read more about the Chi token on the 1inch blog.

Should you buy 1INCH?

We strongly recommend that you do your own research before deciding to invest in any cryptocurrency project. Before you can understand the prospects of long-term profits, it’s recommended that you understand the technology that stands behind the 1INCH token.

After researching the project, you might find it easier to invest in 1INCH token. Trading ERC-20 tokens is a good experience with the 1inch protocol, but it incurs much higher gas fees than other networks.

How to buy 1INCH

If you already have a private cryptocurrency wallet, then you can trade your crypto for 1INCH tokens on any of the DEXs on Ethereum. If, however, you don’t have funds in a private crypto wallet, you might need to use a centralized exchange, such as Binance, to buy 1INCH token, before entering the DeFi ecosystem.

Don’t worry. You can buy 1INCH tokens in only a few simple steps on Binance.

Step 1. Create an account on a crypto exchange

If this is your first time buying cryptocurrency, you will need to create an account on your chosen crypto exchange.

Setting up an account on Binance is easy and only requires a few clicks. Click on Register and enter all the information needed.

Step 2. Verify your account

Before you can purchase cryptocurrency with your credit or debit card, you will need to verify your identity. This is the case with most centralized crypto exchanges that allow direct crypto purchases with fiat.

To get verified, you will have to provide your ID and tax information, as well as proof of your home address.

Step 4. Buy 1INCH token

After your account gets verified, go to Buy Crypto and select Credit/Debit Card. You can select your fiat currency and the desired crypto. In this case, we will choose 1INCH since the token is available for direct purchase.

Enter all the details, click on Continue. You will have to activate Fiat Service, which allows the Binance service provider to access your information.

After your Fiat service is activated (it only takes a couple of seconds), you will see all the details of your transaction. You can also input the details of your credit or debit card here if you haven’t already.

Click on Continue when you’re ready.

Here you will see the exact price per 1INCH token, the transaction fees and the total amount you’re going to pay. If you’re happy with all the details, click on Confirm before the quote expires, and you will finalize the transaction.

It should only take a few moments to see the tokens in your account. You will also receive an email confirmation of your purchase.

If you want to see what the market looks like, go to Market (from the top menu) and search for 1INCH token. Then click on Trade.

You will see the market screen, where you can set market orders to trade 1INCH tokens. The trading pairs available on Binance are 1INCH/BTC, 1INCH/USDT, and 1INCH/BUSD.

When you scroll down, you will see this window, where you can set your buy/sell orders.

To see your funds, you can always go to Wallet > Fiat and Spot, and you will see all the coins in your Binance account.

Congrats on your purchase! You can keep the tokens in your account or send them to a different wallet for long-term storage.

How to stake 1INCH

1INCH token holders can participate in 1inch’s DAO governance and 1inch Network Treasury management by staking their tokens on the 1inch protocol. Stakers have the ability to vote on key protocol parameters and make changes to the 1inch Aggregation or Liquidity protocols.

There are many wallets supported by the 1inch app, including its very own 1inch wallet. In this tutorial, we will use MetaMask to stake 1INCH tokens, but you can use any wallet from the list of supported wallets.

Step 1. Send 1INCH token to your private wallet

Before staking 1INCH tokens, you will need to have them in your private wallet.

That’s why you will have to send them from your Binance account, or what centralized exchange account you used to buy 1INCH into a private wallet. If you don’t have a private wallet, please follow this tutorial about how to use MetaMask wallet.

After you have your MetaMask wallet ready, you will need to go to your Binance account or any other exchange that you used to buy the tokens. We will refer to Binance, since we used it to buy the 1INCH tokens.

Go to your Wallet > Fiat and Spot and look for 1INCH token. You will have the option to Withdraw your funds.

Click on Withdraw.

In the next window, you can input the details for your 1INCH token withdrawal, including the address of your crypto wallet and the amount of 1INCH token to withdraw.

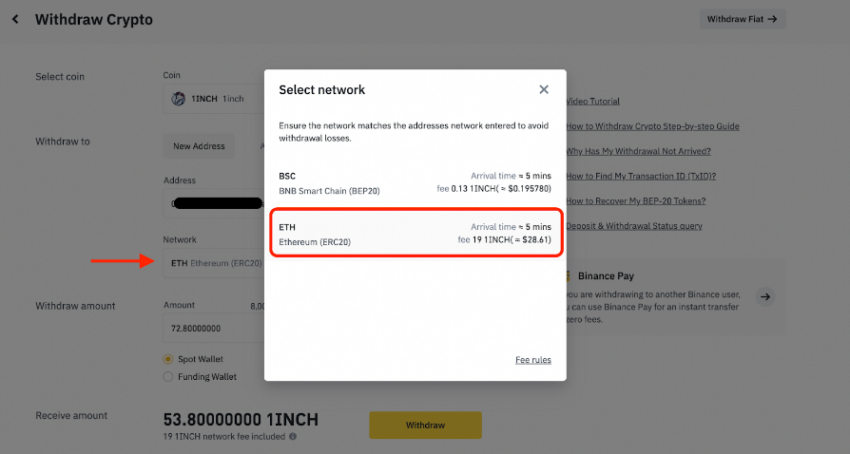

It’s important to select the Ethereum (ERC20) network for withdrawal. Then you can select the number of 1INCH tokens to withdraw.

Note that this is a blockchain transaction, and the Ethereum network has significant fees. Binance will clearly state the network fees and the amount that you will receive. You can click on the network to see the exact gas fee estimated in USD. In this case, the gas fee is 19 1INCH tokens (≈ $28.61), and the arrival time is estimated to be around five minutes.

The withdrawal address is the address of your Ethereum wallet, since 1INCH is an ERC-20 token. You can simply copy it from your MetaMask wallet. You can find it here:

After you’ve input all the details, you can click on Withdraw and wait for the funds to arrive in your wallet. You will also receive an email confirmation from Binance.

Step 2. Connect wallet to 1inch app

The 1inch app supports many of the popular cryptocurrency wallets, including its own 1INCH wallet.

Since we already have a MetaMask wallet, we will use it to connect to the 1inch app. To connect with your MetaMask wallet to the 1inch staking platform, choose Web3 option under wallets.

Step 3. Stake 1INCH tokens on the 1inch app

After you’ve connected your wallet to the 1inch app, you will see the option to stake your tokens. Simply choose what amount to stake and click on Give permission to stake 1INCH.

Note that there are no more staking rewards available, but staking grants you voting rights within the 1inch DAO.

You will have to sign the transaction from your wallet. Each of these actions incurs a network fee. In this case, the network fee was around $11. After you confirm the transaction from your wallet, click on “Stake token.”

Note that your staked tokens will show up as st1INCH in your wallet and on the block explorer. You might need to add the token address manually to your wallet to see the tokens.

The token contract address for st1INCH is 0xa0446d8804611944f1b527ecd37d7dcbe442caba.

You can also find all the details on the 1inch blog.

Is 1inch exchange the future of DeFi?

Most DeFi supporters believe that 1inch Exchange may play a huge role in future developments of the DeFi space, especially on the Ethereum network. While newbie DeFi users might find decentralized exchanges more expensive than centralized ones like Binance, they provide true ownership of your assets, and that’s a very powerful thing.

Unfortunately, centralized exchanges are still subject to downtime or certain limitations, especially during high price volatility times. This is driving demand for DEXs. Aggregators like 1inch Exchange can help fill the gap and help crypto traders to find the best available prices.

Frequently asked questions

What is 1INCH used for?

What is 1INCH worth?

Is 1INCH a good investment?

Is 1inch legit?

What is 1inch coin?

What is unique about 1inch?

Is 1inch a good exchange?

Can you use 1inch Exchange in the U.S.?

Is 1inch related to Uniswap?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.