The state of the crypto market in late 2023 is up for debate. While for some, the bull market has begun as of late October 2023, more apprehensive observers are considering the price rise as an extended relief rally. Most likely, the reality is somewhere in the middle, with the price rise signaling growing momentum months before the bull finally kicks off. And that is why we are here — to highlight the must-have cryptos in your portfolio before the market really heats up.

But first, before we even get to the cryptos, discussing the fundamental, technical, and social factors, let us keep the top exchanges handy. Here are the top crypto exchanges that would fit right in.

Best exchanges to buy crypto with a credit card within a minute

Coinbase

Best for beginnersWirex

Best for low transaction fees

YouHodler

Best for beginnersMethodology

Our process for selecting the platforms to select the top cryptocurrencies was exhaustive. BeInCrypto utilized primary and secondary research including articles, journals, market reports, press releases, and other product-related literature to inform our understanding.

The practical testing process was conducted over a period of six months. During this period, many factors that were taken into account to ensure we select and recommend only the most appropriate platforms. Some of these factors included pricing or fee schedule, security, liquidity, compliance, features and products, and user-experience.

Platforms that exercised strong account controls and platform security received top marks. Compliance goes hand in hand with security. Diversity and abundance of products and creative features were also a prerequisite. User experience can be quantified as balanced layouts, smooth operation, and ease of use.

Exchanges

• Coinbase: A publicly traded company in the U.S. that releases regular financial reports, holds multiple licenses in states and other countries, and has a brokerage and an exchange.

• Paybis: Is an instant exchange that offers a level of security buy allowing customers to purchase crypto in a non-custodial manner.

• YouHodler:YouHodler is an exchange that operates both a lending and borrowing facility with crypto as collateral, and offers loans in fiat.

• OKX: A global exchange that serves over 100 countries, publishes a proof of reserves and offers an Expiry and Safety fund for platform security.

• Binance: The largest exchange by trading volume and assets under management, which allows it to have deeply liquid markets.

• Bybit: An exchange that tailors its platform for traders, offering spot and derivatives trading, trading bots, OTC, margin trading, and leveraged tokens.

• Kraken: One of the oldest Bitcoin exchanges in existence, also offers altcoins, and is tailored for traders, having an advanced trading interface and allowing for multiple order types.

This methodology was peer reviewed and fact-checked for accuracy. The aforementioned platforms reflect the top options for purchasing the top must-have cryptocurrencies. To learn more about BeInCrypto’s verification methodology, navigate here.

Must-have crypto assets to buy before the bull run

For starters, no indicator can precisely point out the next 100x coin. However, based on the current market conditions, accumulating the right crypto assets is a good start. Here are the ones we are most optimistic about.

1. Bitcoin

It isn’t a surprise that Bitcoin (BTC) takes the top stop. And before we tell why it makes the list, let us keep the platforms handy that allow you to buy BTC and even do more.

Top platforms to buy BTC and do more with your holdings

Check these platforms out that allow you to seamlessly get hold of some bitcoins before the bull run shoots the prices up.

And if simply holding BTC is so yesterday, there were resources with lucrative staking and earning opportunities, all focussed on BTC? Let’s check out the options:

YouHodler

Best for BTC-powered crypto loansCoinbase

Best for BTC stakingOKX

Best for BTC-led savings programWhy does it make it to the list?

From Blackrock announcing BTC-specific exposure for its clients to Bitcoin ETFs consistently making the news, the fundamentals of the OG crypto look promising. Also, as of Nov 3, 2023, bitcoin whales, which have been dormant for the past six years, have suddenly sprung into action, moving close to $230 million between addresses.

Plus, with the Bitcoin halving event knocking on doors and experts standing by the 6-month prior accumulation cycles, BTC might just be the first asset to focus on before the bull run starts.

Fundamental factors

Bitcoin’s funding rates have been positive for a while now, showcasing the optimism of long-term investors.

Another underrated fundamental insight has to be the exchange whale ratio. A drop in value shows that despite price surges, the whales aren’t moving BTC to cryptocurrency exchanges.

Technical analysis

Looking closely at the BTC’s weekly chart reveals the red line (20-week moving average) crossing above the orange line (50-week moving average), forming a golden crossover. Something similar happened around April 2020, which marked the onset of a bull phase.

Social indicators

Tracking social engagement on LunarCrush shows that bitcoin’s engagement has risen over the past six months. While this could be due to the upcoming halving event, the engagement surge has also been followed by price surges.

Other insights

With pro-BTC firms like MicroStrategy making huge purchases and retail investor interest surging courtesy of increasing open interest, BTC seems like the first must-have crypto to secure in your portfolio before the bull run ensues.

2. Ethereum

Now that we have shifted our attention to the second-largest cryptocurrency by market capitalization, it makes sense to first list the platforms that can help you do more with your Ether holdings.

Top platforms to buy ETH and do more with your holdings

In case you are bullish about ETH, especially in the months to come, we come bearing good news. Here are three platforms on which you can buy ETH. And once you have Ether, you can even use these platforms to trade, hold, stake, and do all kinds of profitable stuff with your holdings:

Binance

Best for competitive feesOKX

Best for ETH staking and copy tradingYouHodler

Best for high APY on ETH stakingWhy does it make it to the list?

After BTC, ETH is easily the most talked about cryptocurrency. And while people might argue that layer-2 platforms and related altcoins have lowered the efficacy of Ethereum as a value chain, co-founder Vitalik Buterin noted on Oct. 31, 2023, that Ethereum’s tech stack is currently more than enough to host several applications — not everything needs to be put on a rollup.

Some projects that are currently independent layer-1s are seeking to come closer to the Ethereum ecosystem and possibly become layer-2s. These projects will likely want a step-by-step transition. Transitioning all at once now would cause a decrease in usability, as the technology is not yet ready to put everything on a rollup.

Vitalik Buterin: Vitalik.ca

Fundamental factors

A closer look at Ethereum’s fund market premium shows strong buying pressure. This has been on the way up since the end of 2022, but the prices have caught up only from June 2023 onwards.

A steady decrease in the new supply post the proof-of-stake transition is another reason for the price-specific optimism.

Technical analysis

Like BTC, the 20-week moving crossing over the 50-week moving average can push the prices of ETH to new highs. While that happened briefly, the red line now seems to be moving closer to the orange line, pushing for another instance of golden crossover.

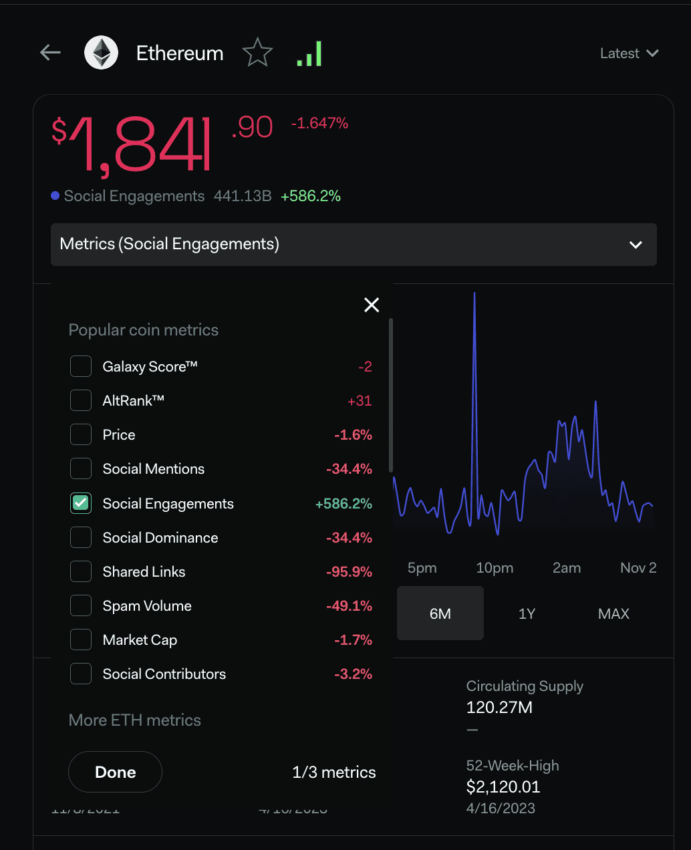

Social indicators

Over the past six months, Ethereum’s social engagement is up over 500%, making it one of the more talked about cryptos around.

Other insights

The PoS transition and then the Shapella upgrade made ETH far more promising, more so due to the increase in energy-specific sustainability quotient. Plus, with Ethereum still being the decentralized finance (DeFi) leader in terms of TVL, the bull market is likely to be a good catalyst for ETH’s price rise. Plus, Ethereum is the second biggest crypto player in terms of market capitalization, leading the blockchain crusade with smart contracts, DeFi resources, DApps, and more — a reason significant enough to consider buying prior to the next bull run.

3. Arbitrum (ARB)

Before we discuss why ARB is a bull-run-worthy cryptocurrency, let us stack a few platforms that would help you maximize the profitability of your supposed ARB holdings.

Top platforms to buy ARB and do more with your holdings

Waiting for the bull run to take form might be too late to buy ARB at this throwaway price! Check these platforms out to buy the tokens quickly and without fuss.

And did you know that ARB tokens can be traded innovatively? Or, you can even save them in savings accounts, with the following platforms:

YouHodler

Best for ARB multi HODL

Coinbase

Best for seamless ARB transactions

OKX

Best for ARB saving and trading

Why does it make it to the list?

Layer-2s are undoubtedly capturing some of Ethereum’s limelight, all while lending support to the network. Arbitrum is one of the newest players in that layer-2 space. Driving the price surge and the optimism is the whale optimism, with almost 20 million ARB tokens gobbled up between October 23 and November 2, 2023.

Fundamental factors

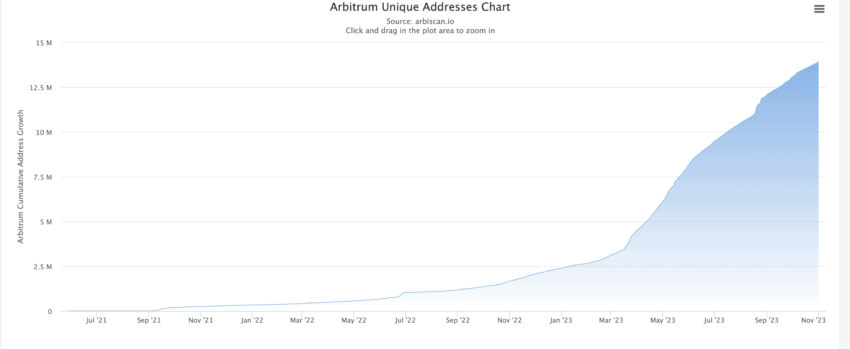

Despite being a relatively new chain, Arbitrum’s unique addresses have surged since its launch.

Technical analysis

As Arbitrum is new, it isn’t prudent to only check the weekly info. However, if we pull the daily chart, the 20-day moving average (red line) is crossing above the 50-day moving average (orange line), indicating bullish momentum.

The volume pillars look strong and green, hinting at possible accumulation.

Social indicators

Over the past three months, Arbitrum’s social engagement volume has risen by over 47%. This metric, coupled with a growth in unique addresses, hints at overall bullishness.

Other insights

Arbitrum seems to be holding onto its crucial support level of $1. Note that after Polygon, Arbitrum is the leading layer-2 project by market capitalization, which furthers its credibility.

4. Ripple (XRP)

Well, Ripple (XRP) deserves all the attention it has been getting. But to make the most of your bull run holdings, you first need to zero in on the right platforms.

Top platforms to buy XRP and do more with your holdings

In case you want to grab some XRP tokens before the bull run starts, the first thing you need is access to a credible exchange/platform. We have a few listed for you.

Additionally, if you are interested in maximizing your XRP’s trading and staking potential after buying you can also consider these platforms:

Bybit

Best for XRP trading and stakingYouHodler

Best for XRP-backed trading and loansCoinbase

Best for XRP staking and rewardsAdditionally, if you want to use your XRP holdings to earn passive income, you might consider fixed or flexible plans available with CEXs like Binance or Kraken.

Why does it make the list?

Ripple’s courtroom win over the SEC in July 2023 has contributed to the XRP coin’s continued momentum.

Did you know? Uphold, a U.S.-based cryptocurrency bank and one of Ripple’s largest partners, holds customer-specific XRP tokens worth $1.25 billion.

Fundamental factors

One of the key fundamental movers has to be Santiment’s tweet mentioning a surge in wallet addresses holding at least 10K XRP.

Technical analysis

A closer look at the price analysis hints at the formation of a golden crossover — a red line crossing above the orange line. This pattern, if it continues, can push the prices higher over the next few months. However, the last high of 95 cents seems like a crucial resistance level.

Social indicators

Between since August 2023, Ripple’s social engagement levels have gone through the roof. With banking giants considering Ripple for CBDCs and international payments, there’s been no shortage of social activity.

Other insights

Ripple’s scalability and price-related optimism have also been voiced by its co-founder, Arthur Britto. Plus, the focus for long-term buyers has to be $0.685, which aligns with the 0.5 fib retracement level.

5. Chainlink (LINK)

Before we start counting the reasons why Chainlink (LINK) makes it to the list, let us keep a few trading and staking platforms handy, just so you know where to look when the time or rather the bull comes!

Top platforms to buy LINK and do more with your holdings

If LINK is one of your favorite cryptocurrencies, the following platforms can help you buy, sans any trouble.

And why simply buy and hold LINK tokens when you can trade them better and stake them for higher gains? Interested already! Time to check the platforms out:

Binance

Best for competitive trading fees

OKX

Best for LINK savings and NFTs

Coinbase

Best for LINK trades and security

Why does it make it to the list?

With the world focusing on real-world assets, AI, and other innovative technologies, even existing blockchain networks will be dependent on real-world data. This use-case makes Chainlink increasingly relevant.

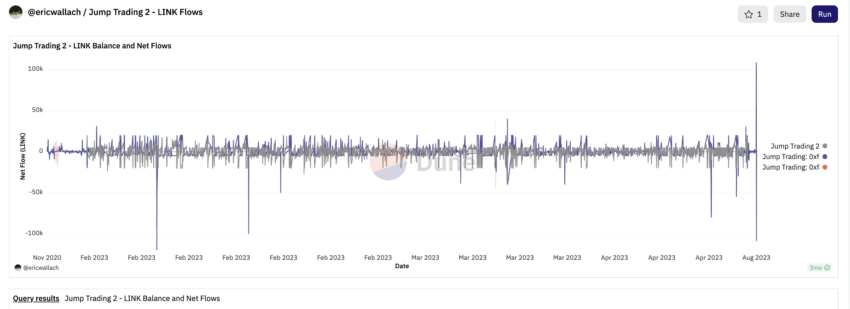

Fundamental factors

Fundamentally, the negative net flow – out of exchanges — is an optimistic sign for Chainlink.

Another reason LINK may be a must-have crypto for your portfolio before the bull run is the percentage of addresses that look to be in the space for the long haul. Currently, the percentage stands at 69.54.

“Chainlink’s principled approach to secure systems design is the reason why it is rightly credited for helping unlock DeFi’s full potential.”

Sergey Nazarov. Co-Founder of Chainlink: Twitter (X)

Technical analysis

The price of LINK surged from the low of $5.70 to over $12 within 45 days. However, things get really interesting when we pull out the weekly chart. In May 2019, the 20-period moving average moved above the 50-period moving average, pushing the prices to a whole new level. Something similar is cooking with the red line almost crossing above the orange line.

This might be a potent long-term signal, especially with the volume pillars showing decent developments.

Social indicators

Since August 2023, Chainlink’s social engagements have pushed beyond the 170% mark, demonstrating the network is a popular pick within the crypto community.

Other insights

In late October 2023, Chainlink (LINK) broke out of a maudlin sideways pattern that lasted over 500 days. However, it is still far from its $50+ all-time-high level, giving ample reasons to consider LINK a must-have crypto in your portfolio right before the bull run.

6. Uniswap (UNI)

Before we analyze the bull-run potential of Uniswap, let us track a few top platforms that can make holding UNI tokens more profitable than ever.

Top platforms to buy UNI and do more with your holdings

Yes, you can expect the value of UNI tokens to appreciate during the bull run! And to buy them before could be a good call.

Or, you can be more proactive and rely on the following platforms to get higher trading and staking returns, once you have some UNI tokens to show for!

Coinbase

Best for UNI-specific activities

Bybit

Best for UNI staking and automated trading

YouHodler

Best for high UNI staking rates and savings

Binance still happens to be the volume driver, the second position is held by the UNI/USD trading pair. Once bought, you can store your UNI tokens in the Coinbase Wallet or move the same to other wallets for staking.

Why does it make it to the list?

DeFi, despite its popularity in 2021, had a beaten-down 2022. With new use cases like interoperability, decentralized credit scoring, and more, DeFi might again become a talking point in the next bull run. As a DEX and a DeFi protocol, Uniswap (UNI), spread across 10 chains, might be at the epicenter of this rewarding quake.

Fundamental factors

Unlike other DeFi protocols like Lido, Compound Finance, and more, Uniswap has a presence across 10 chains. Plus, over 72% of Uniswap addresses are long-term holders, a fundamental metric that instills a level of confidence.

Another positive on-chain metric has to be the drop in the exchange reserves, hinting at a drop in the selling pressure.

Technical analysis

Uniswap, on the weekly chart, isn’t looking particularly bullish as of Nov. 3, 2023, courtesy of the recently concluded bearish RSI divergence. However, the price seems to be holding onto the red line or the 20-week moving average, and a weekly close above the same can induce strength.

Social indicators

Over the past month, Uniswap’s social engagement levels have been over 100%. While some might consider it as negative publicity, courtesy of the swap fees controversy, this DeFi market leader has been in the news.

Other insights

With Uniswap embracing an Android wallet and almost 75% of holders being out of money or nursing unrealized losses, it is a matter of time before a breakout happens at the counter.

7. Injective (INJ)

INJ featuring on the list might read surprising but we have our reasons. And before we discuss those, let us keep a few top INJ platforms handy.

Top platforms to buy INJ and do more with your holdings

Unsure if your favorite crypto exchange has INJ listed. Check these platforms out, where you can buy INJ without even breaking a sweat. Furthermore, these platforms can also help you maximize INJ-specific yields, in case you want to do more with the tokens in hand.

Binance

Best for competitive INJ trading

Coinbase

Best for learning and staking INJ

YouHodler

Best for high INJ staking APY

Why does INJ make the list?

With web3, interoperability, and DeFi expected to dominate the next bull run, the focus shifts to projects like Injective (INJ). As a smart contracts platform with automation at its core, Injective may be a must-have crypto for your portfolio with the bull run in sight.

Fundamental factors

One promising element for injective is the 42% one-year+ wallet strength. This means 42% of addresses have held INJ for over a year.

Plus, the active user count looks to be on the way up.

Technical analysis

Per the technical chart, the 20-day moving average seems to have crossed above the 50-day moving average, kickstarting a price surge. Over the past few days (as of Nov. 3, 2023), volume pillars have also been rising.

Social indicators

Between October and November 2023, injective has gained a significant amount of good press, resulting in a 250% surge in social engagements.

Other insights

With a recent price ramping integration with the Kava Network — a layer-1 chain — injective has the legs to become a game-changing crypto for your portfolio.

Honorable mentions

While the above seven cryptos are some bullish picks, we are also optimistic about polygon (MATIC), optimism (OP), and several other tokens. It is worth noting that proper portfolio management with a focus on rebalancing and diversification is needed as these cryptos might not surge at once. Depending on the nature of the asset and your goals, you might want to book short-term gains or focus on long-term investments.

It is also advisable to have stablecoins in your wallet, as this can help you quickly accumulate these coins without having to rely on third-party payments. Notably, stablecoins won’t appreciate, but having them covers you for market volatility, especially when fiat prices are considered.

Selecting the cryptocurrencies: The process in place

Despite the continued price rise and the crypto market holding into the 1 trillion USD mark for dear life, it’s likely the market needs a few more months to get off its feet and start flying.

Bitcoin (BTC), the most dominant crypto, is already up over 100% from its November 2022 value of under $17,000.

Yet, many other crypto assets are still much closer to their all-time lows as opposed to the all-time highs, validating the fact that the bull market is still a distance away. And that is exactly what we have considered while choosing this list.

We have discounted the recent price surges and followed a data-driven approach comprising five broad market indicators to choose the must-have crypto assets that can be in your portfolio for the next bull run.

These indicators include:

- Historical precedence and similarities in price moves to the 2021 bull run.

- Fundamental factors with a focus on lowering the NVT (Network Value to Transactions) ratio for the concerned crypto assets, large whale and institutional transactions, and more.

- Technical analysis — focusing on volume analysis over a given period followed by identification of long-term tools like Fibonacci levels, long-term RSI levels, and potential or ongoing crossovers.

- Social metrics like growing social volume and engagement.

- Unique selling points, market position, and problem-solving capabilities.

In addition to these indicators, macroeconomic factors and geopolitical scenarios should also be considered. However, those are timed metrics and can only be evaluated at a given instant.

How do I build a diversified cryptocurrency portfolio?

A good start would be to include the mentioned cryptos to create a diversified cryptocurrency portfolio. If you have positions across several exchanges, you can also use a one-stop cryptocurrency portfolio tracker like Delta.

With Delta, you can track a wide range of assets, initiate deep performance analysis, sync the app with exchanges, and even get hold of tax-optimized reports. Delta also includes support for airdrops and ICOs.

Here is why Delta Investment is the right tracker for you:

- Comprehensive crypto support

- Detailed portfolio insights

- Multi-exchange integrations

Besides Delta, you can also consider Coinsats, Crypto Pro, or CoinLedger — all invaluable tools to help you effectively manage your portfolio.

Here is what makes Coinstats a good enough tracker:

- End-to-end portfolio management

- Custom alerts

- Access to Coinstats Earn

How do I prepare for the next crypto bull run?

Bull-run investments aren’t easy to find in the crypto space — the volatile market can be difficult to predict. While you can add these must-have crypto assets to your portfolio before the next bull run, it is always advisable to invest responsibly, focus on diversification, and even rely on portfolio rebalancing, depending on the macroeconomic and geopolitical factors. Regardless of the assets you choose, portfolio management and tracking are imperative.

Frequently asked questions

What is the significance of a bull run in the cryptocurrency market?

How do I manage risks while investing in cryptocurrencies?

Should I focus on long-term investments or short-term gains in the crypto market?

What are the potential risks associated with investing in altcoins?

How often should I rebalance my cryptocurrency portfolio?

What crypto should I have in my portfolio?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.