Founded by Anatoly Yakovenko, Solana is a fast-growing network and ecosystem with the potential to compete with the likes of Ethereum. Since its launch in March 2020, it has only grown in value, though it is still early in the project’s lifespan. Here, we look at the Solana price prediction model, primed to work till 2035.

We use token analysis, fundamental elements, and other factors to determine where the price might go. But first, let’s take a look at what Solana is.

This article may be outdated, we suggest you visit our new Solana Price Prediction tool.

- What is Solana (SOL)?

- Tokenomics

- Solana price prediction and fundamental analysis

- Solana (SOL) technical analysis

- Solana price prediction 2023: What did we learn from the historical data?

- Solana price prediction and the associated patterns

- Solana (SOL) price prediction 2024

- Solana (SOL) price prediction 2025

- Solana (SOL) price prediction 2030

- Solana (SOL) price prediction until 2035

- Why is Solana unique?

- Frequently asked questions

What is Solana (SOL)?

Solana is a decentralized open-source blockchain project. Its primary focus lies in the creation of decentralized applications (DApps). Currently, the Solana network boasts more than 400 projects, which span the decentralized finance (DeFi), non-fungible token (NFT), and Web3 sectors.

Solana provides great scalability because it uses a proof-of-stake (PoS) and proof-of-history (PoH) consensus mechanism. Due to this hybrid mechanism, it processes a block at very fast transaction speeds of 50,000 tps (transactions per second). In addition to this, it has transaction costs of less than $0.01.

The PoH consensus runs parallel to the PoS consensus. It is a sequence of computations that makes it possible to verify the time passed between two events by using cryptography. Due to its secure cryptographic function, the input cannot predict the output. Rather, it has to be executed fully to arrive at the output.

Solana keeps growing:

It is possible to both create and trade non-fungible tokens (NFTs) in the Solana ecosystem at very low transaction fees. One such project was ”The Degenerate Ape Academy,” which was launched in August 2020 and sold 10,000 units in a matter of minutes.

Did you know? The Solana network possesses more than 4400 nodes. This makes it more decentralized when compared to other similar blockchains. However, there is a relatively high cost of between $3000–$40000 to become a validator node.

The network has seen considerable growth in 2021 since numerous well-known projects, such as ChainLink (LINK), Terra (LUNA), and Serum (SRM), have boarded the platform. However, it got embroiled in the FTX contagion, after which the price dived.

Tokenomics

The native token for the Solana platform is SOL. It has a circulating supply of 436,747,472 tokens as of February 7, 2024, and a total supply of 568,874675 SOL.

Holders can stake tokens to validate transactions due to the use of PoS in the consensus mechanism. In addition, holders have governance rights, receive periodic rewards, and pay gas fees with SOL, giving it numerous use cases. However, despite the multiple token-related use cases, Solana has faced several criticisms related to frequent network outages.

Solana price prediction and fundamental analysis

Identifying potential price moves is possible simply by looking at the on-chain metrics. Let us look at a few for Solana.

Solana’s network fees peaked in December 2023 and have steadily increased since. This shows people are using the network, and the price spikes aren’t simply sentiment-driven. A further increase in the network fees can push the prices closer to the $120 level.

Let us now look at how the traders are behaving. The trading volume has been steady, but those monumental surges haven’t been in 2024. A breach past the price line can push the prices higher.

Another metric has to be Solana’s DeFi presence. Over the past 30 days, the TVL figures have surged, amounting to $2.675 billion. But that isn’t why we are optimistic about Solana’s price action. The current TVL is still far off from Solana’s DeFi presence in 2022, at close to $10 billion. This shows potential for the network.

“Solana liquid staking will continue to grow in TVL and userbase.”

Miles Deutscher, Crypto Analyst: X

The active addresses (wallets) have also peaked over the past 30 days. However, the numbers are still way lower than the figures registered in April 2021.

All the existing metrics project an optimistic trend for Solana (SOL) going into the future.

Solana (SOL) technical analysis

Before we delve deeper into the weekly charts and broader strokes related to the price action, here is a short-term analysis we did in 2023.

Solana (SOL) price analysis: August 2023

Our short-term Solana price prediction was successful. Here is what it comprised:

SOL’s price has been falling since reaching an all-time high of $259 on Nov. 6, 2021. But that was in the past. Over the past year, SOL has dipped by close to 40%, ditching its year-on-year high of $46.60 to trade at $23.61 currently. It is noteworthy that the prices went as low as $9 at one point in time. SOL prices have recovered since.

The recent high made by SOL coincides with the 0.5 Fib retracement level of $32.17. Strong support is at the 0.618 Fib level, aligning with the $27.58 price level. Do note that on the daily chart, SOL’s price has followed this support level for some time now. If it breaks, SOL might even head toward $21.05.

The RSI is making a lower low, standing perilously close to breaching the 50 level. A drop in RSI might suggest weakening momentum and a further price drop.

Even the Parabolic SAR indicator hints at a weakening trend, with the bearish parabola forming above the price candles. But our bullish predictions prevailed, and the price merrily breached $32 and even $100 in days to come.

Solana price prediction 2023: What did we learn from the historical data?

Here is how we charted SOL’s price action for 2023 based on insights from the past.

The first upward movement for SOL transpired between April and August 2020. The token increased by 2,320% in 144 days. The second upward movement transpired between December 2020–May 2021. The token increased by 5,950% in 146 days. This was the steepest increase so far.

The third and final upward movement transpired between July–November 2021. This led to the current all-time high of $267. While the token only increased by 1,060%, the move continued for 110 days.

The previous two increases ended after the RSI crossed below 70 (red icon). Therefore, the third one may have ended since the RSI crossed below 70 in November 2021.

In this case, the price of Solana would continue correcting for the majority of 2023. Regardless of the reasons, the correction has been pretty alarming for traders. Do note that this happened with SOL embroiled in the FTX fiasco.

Solana price prediction and the associated patterns

Now, if we shift our attention to 2023, it is evident that the correction is a mirror formation or, rather, a foldback pattern similar to SOL’s broader price action. The following chart reveals that the bearish price movements helped the foldback pattern stay true to our expectations. Based on this, we can expect a price rise in future days.

Also, if we look at the corresponding RSI patterns, the correction for each phase stopped, and the prices surged every time the RSI dropped deep in the oversold region — under 30. The red arrows mark these points. Therefore, for SOL’s price to increase from here, we might need to see the RSI return to the oversold zone.

And we would need a solid bullish RSI divergence instead of the price action for a sustained uptrend. However, per the historical data and previous price surges, we might see SOL’s price picking up pace towards the end of 2023.

And congratulations if you were on the right side of this price surge, which actually happened.

If you look at the daily chart above, a rising price followed by a bullish SAR and increased volume can push the prices towards $36.75 and then $42.43 — levels coinciding with the 0.382 and 0.236 of the Fib retracement indicator.

Solana (SOL) price prediction 2024

Outlook: Bullish

Before we try to predict what price points Solana will touch upon in 2024, it is important to look at the weekly chart to discover a set pattern.

Calculations

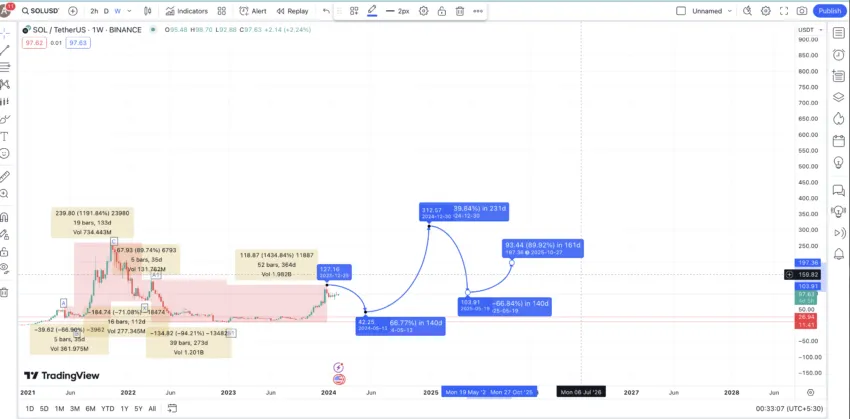

One pattern is clearly visible. A high followed by a higher high, in A to C. Notably, the latest price rise also hints at the continuation of the said pattern, establishing a clear path for SOL. Let us first chart the patterns and find the price changes and time taken between each level.

| A to B | -66.90% in 35 days |

| B to C | 1191.84% in 133 days |

| C to X | -71.08% in 112 days |

| X to A1 | 89.74% in 35 days |

| A1 to B1 | -94.21% in 273 days |

Considering these values, the average price surge for SOL would be 640% in 84 days (approximately).

Also, the average price correction would be approximately -77.40 % in 140 days.

Now that we have B1, the next high could be at 640% from B1, at almost $62, which SOL reached. Our 2023 prediction, based on the weekly data, came out to be successful. This also shows that C2 is already in, at 1434.84% from B1 and in 364 days. If we include this in our analysis, the average price surge for SOL would be approximately 905.47% in 177 days.

Now, if we take the lowest price drop percentage — 66.90% — the drop for SOL in 2024 could be $42.25. This is the minimum price expectation if something goes wrong. If this level is reached, we can expect a surge of 640% for SOL in days to come, considering the positive on-chain metrics.

This puts the 2024 high at $312.57 towards the year’s end. However, this has to be the most optimistic price prediction. The actual price could be between the low and high, at an average of approximately $178.

Projected ROI from the current level: 220%

Solana (SOL) price prediction 2025

Outlook: Bearish

Provided the price of SOL reaches $312.57, we can expect a dip of 66.90% — the smallest percentage drop from the table above. This way, the minimum price of SOL in 2025 could be $103.64. The price surge from this level could be limited to 89.74%, the lowest surge per the table above, courtesy of rapid selling and Ethereum’s growing popularity.

A lesser surge also aligns with our weekly pattern where A1 was formed lower than C, the current all-time high of SOL. Therefore, the SOL price prediction high for 2025 could surface at $197.36.

Projected ROI from the current level: 102%

Solana (SOL) price prediction 2030

Outlook: Bullish

If SOL reaches $197.36 by 2025, the next low might follow the average dip of 77.40%. This way, the 2026 low could surface at $44.20. By this time, new buyers could flock to SOL’s counter, priming the low prices for a massive 640% uptick, which isn’t out of the question for a coin like Solana.

Therefore, the 2026 high could surface close to $327, making a new all-time high.

Based on the 2026 low and 2026 high, we can extrapolate the path of SOL till 2030. Per the extrapolation, the price of SOL could reach $1751.08 by 2030.

Projected ROI from the current level: 1692%

Solana (SOL) price prediction until 2035

Based on the price levels SOL is expected to touch until 2030, we can extrapolate the available points and chart the path till 2035. Here is the table that explores the Solana price prediction levels till 2035.

Also, here are some metrics leading to this data-packed table:

Observations

- The price fluctuates significantly yearly, indicating high volatility common in the cryptocurrency market.

- A notable spike in 2030 suggests a significant event or development that could lead to increased adoption or demand for Solana.

Assumptions for prediction

- Volatility: We’ll assume that the volatility continues, with significant fluctuations in maximum and minimum prices each year.

- Growth trend: Despite volatility, there is an overall growth trend leading up to 2030, which suggests increasing adoption or technological advancements that favor Solana.

- Post-2030 adjustment: After the spike in 2030, there might be a period of correction or stabilization, as is common after significant price increases.

Based on these observations and assumptions, here’s a possible prediction pattern:

- 2027-2029: Continue the trend of volatility with gradual increases in both the maximum and minimum prices, reflecting growing adoption and the impact of broader market cycles.

- Post-2030: After the 2030 peak, we might see a more significant correction or stabilization period, followed by a slower growth rate as the market adjusts to the new valuations.

Filling in the predictions

- 2027: Following the pattern, we might expect a recovery and increase from 2026, setting the stage for the 2030 peak.

- 2028-2029: Building up to the 2030 peak, these years could show substantial growth but with continued volatility.

- 2031-2035: After the 2030 peak, a correction might occur in 2031, followed by gradual growth or stabilization in the subsequent years.

| Year | Maximum price of Solana | Minimum price of Solana |

| 2024 | $312.57 | $42.25 |

| 2025 | $197.36 | $103.64 |

| 2026 | $327 | $44.20 |

| 2027 | $683.02 | $478.11 |

| 2028 | $1039.04 | $701.35 |

| 2029 | $1395.06 | $906.79 |

| 2030 | $1751.08 | $1094.43 |

| 2031 | $1488.42 | $1050.65 |

| 2032 | $1532.20 | $881.01 |

| 2033 | $1313.31 | $722.32 |

| 2034 | $1094.43 | $574.57 |

| 2035 | $875.54 | $437.77 |

Why is Solana unique?

SOL differs from other platforms specializing in DApp creation because it combines a proof-of-stake with a proof-of-history concept. This gives it a great degree of scalability and very low transaction costs. The low transaction costs have been especially helpful in the NFT sector since gas fees have consistently provided problems in the ETH blockchain. Also, the Solana price prediction shows how aggressive and lukewarm the price movements can be compared to the broader market.

Frequently asked questions

How much will Solana be worth in 2024?

What is the future of Solana?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.